Sunday Sep 27 2020 04:48

8 min

It’s a big week for financial markets, as the first US Presidential Debate kicks off on Tuesday. Donald Trump has spent a long time attacking ‘Sleepy Joe’s’ mental prowess, but has he accidentally set the bar too low for his opponent, or will Biden’s verbal blunders see him put on a poor show?

After the two candidates have argued about the economy we’ll get another update on the labour market when the nonfarm payrolls report is published on Friday.

Headline risks surrounding the US Presidential Election will shoot higher this week as President Donald Trump and Democratic nominee Joe Biden get ready for the first Presidential Debate on September 29th. Topics are liable to change in response to the latest new events, but at the time of writing the debate commission had announced the following itinerary:

It’s a list of huge controversies, but even with such important topics, can the debates do much to swing the opinion of such a highly-polarized electorate?

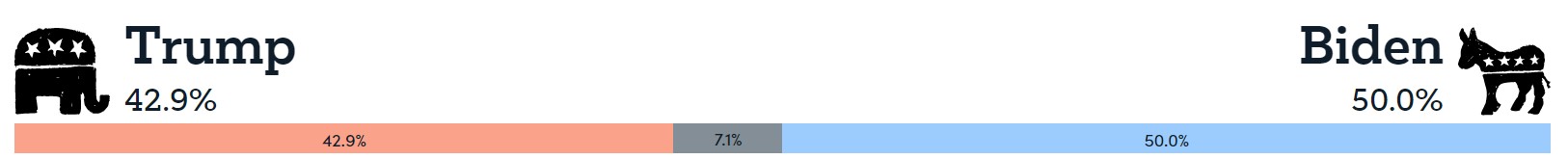

Biden leads Trump by 7.1% in the national polls according to our election poll tracker. Much has been made of his age and his verbal blunders and there’s a risk he’ll find himself flattened by Trump’s aggressive debating style.

However, thanks to months of the President attacking ‘Sleepy Joe’s’ mental capacity, some Republicans fear that Trump has actually set the bar incredibly low for Biden.

A few days after Trump and Biden have argued over the state of the economy, we’ll get another look at the health of the labour market. Payrolls growth slightly undershot forecasts in August, coming in at 1.371 million against expectations for 1.4 million.

Of the more-than 22 million Americans who lost their jobs towards the start of the pandemic, 11.5 million of them are still out of work. There’s still a long way to go until the labour market has recovered and some analysts are expecting the pace of job creation to have softened again.

Other data in focus next week includes Germany and Eurozone flash inflation reports and the China Caixin Manufacturing PMI. Thursday will be a busy day for US data, with core PCE, personal income, personal spending, initial and continuing jobless claims and the ISM Manufacturing PMI all in the docket.

Finalised quarterly growth figures from the US and UK and finalised manufacturing PMIs from Eurozone member states and the UK could garner some interest if the figures differ notably from initial readings.

Tuesday sees the latest earnings reports from McCormick & Co before the New York open and Micron Technology after the close.

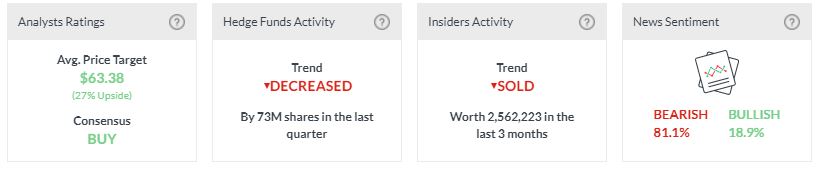

McCormick has fallen -12% from its September 1st peak, but remains 65% above its March lows. Both hedge funds and company insiders have been selling the stock recently, which is trading -9% below its average price target on Wall Street.

Micron Technology, on the other hand, has a 27% upside, although it has also experienced heavy selling in the past quarter.

On Thursday PepsiCo and Constellation Brands both report before the opening bell. After the March recovery PepsiCo has struggled to hold above opening levels and is currently down over -4% on the year. You can download the latest research on the stock by Thompson Reuters in the platform.

Constellation Brands is virtually flat for the year. Analysts see a 9% upside for the stock.

Read the full schedule of financial market analysis and training.

| 17.00 UTC | 28-Sep | Blonde Markets |

| 17.00 UTC | 29-Sep | Webinar: Money Management and Trading Psychology |

| 11.00 UTC | 30-Sep | Midweek Lunch Wrap |

| 17.00 UTC | 01-Oct | Election2020 Weekly |

Watch out for the biggest events on the economic calendar this week. A full economic and corporate events calendar is available in the platform.

| 23.50 UTC | 28-Sep | Bank of Japan Summary of Opinions |

| Pre-Market | 29-Sep | McCormick & Co – Q3 2020 |

| 12.00 UTC | 29-Sep | German Flash Inflation |

| 14.00 UTC | 29-Sep | US CB Consumer Confidence |

| 23.50 UTC | 29-Sep | Japan Preliminary Industrial Production / Retail Sales |

| After-Market | 29-Sep | Micron Technology – Q4 2020 |

| 01.45 UTC | 30-Sep | China Caixin Manufacturing PMI |

| 06.00 UTC | 30-Sep | UK Finalised Quarterly GDP |

| 09.00 UTC | 30-Sep | Eurozone Flash Inflation Data |

| 12.30 UTC | 30-Sep | US Finalised Quarterly GDP |

| 14.30 UTC | 30-Sep | US EIA Crude Oil Inventories |

| 07.15 – 08.00 UTC | 01-Oct | Eurozone Final Manufacturing PMIs |

| 08.30 UTC | 01-Oct | UK Final Manufacturing PMI |

| Pre-Market | 01-Oct | PepsiCo – Q3 2020 |

| Pre-Market | 01-Oct | Constellation Brands – Q2 2021 |

| 12.30 UTC | 01-Oct | US Core PCE, Personal Income, Personal Spending, Jobless Claims |

| 14.00 UTC | 01-Oct | US ISM Manufacturing PMI |

| 14.30 UTC | 01-Oct | US EIA Natural Gas Storage |

| 01.30 UTC | 02-Oct | Australia Retail Sales |

| 12.30 UTC | 02-Oct | US Nonfarm Payrolls Report |

| 14.00 UTC | 02-Oct | Finalised University of Michigan Sentiment |