Your gateway to Depth of Market, powered by Finalto

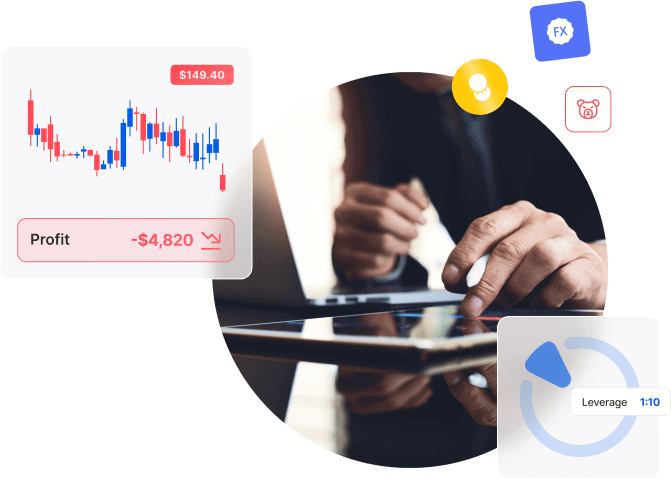

Welcome to a revolutionary trading experience with Depth of Market (DoM), a powerful tool that provides unparalleled insights into the financial markets. At Markets.com, we empower traders like you with the ability to grasp the true supply and demand dynamics, enabling well-informed decisions and enhanced risk management. Let's explore how Depth of Market impacts crucial factors like bid-ask prices, spreads, and slippage, and how it sets us apart from platforms lacking transparency.

Understanding Depth of Market - impact on trading

Depth of Market goes beyond surface-level data, giving you a clear X-ray vision into the markets. It reveals the complete order book, displaying pending buy and sell orders at various price levels. Here's how it affects your profitability:

Bid-Ask Price

With market depth, you can assess the bid and ask prices of assets, helping you make informed decisions and optimize your entry and exit points for a better trading experience.

Spread

Understanding market depth allows you to observe how spreads fluctuate and helps you identify the best times to execute trades with minimized transaction costs.

Slippage

Market depth enables you to avoid potential slippage by revealing the order book's liquidity, improving your risk management techniques and potentially avoid unexpected losses.

Transparent trading - contrasting platforms with DoM

Not all exchanges or trading platforms offer the advantage of DoM. Without it, traders are left in the dark, lacking critical information about the true market conditions. Choose Markets.com with Depth of Market to avoid:

Limited visibility

Platforms lacking Depth of Market conceal vital buy and sell orders, making it challenging to assess the market's true liquidity and pricing.

Uncertain pricing

Without access to bid-ask prices and order book data, traders may not be aware of the actual liquidity available in the market, leading to uncertain pricing.

Hidden spread costs

In the absence of transparent spreads, traders may unknowingly incur higher transaction costs, impacting the overall trading fees.

Slippage surprises

Without access to real-time order book data, traders risk encountering unexpected slippage during high volatility periods.

World-leading Prime of Prime liquidity provider

Backed by Finalto Group, a world-leading Prime of Prime liquidity provider across multiple asset classes, Markets.com offers its clients with unparalleled top-notch trading conditions fueled by top-tier financial institutions.

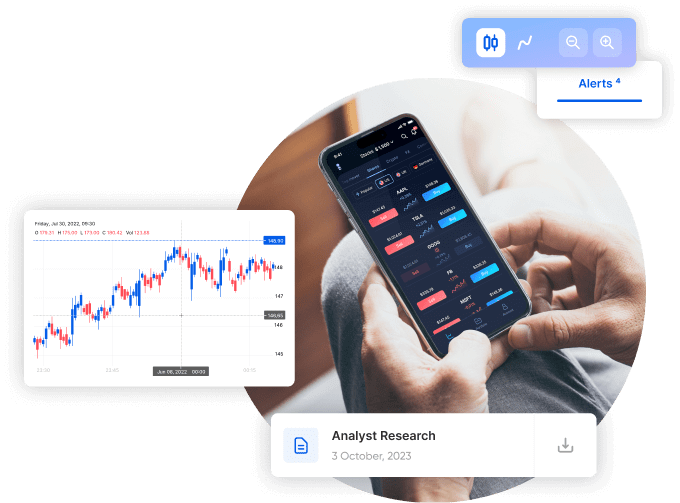

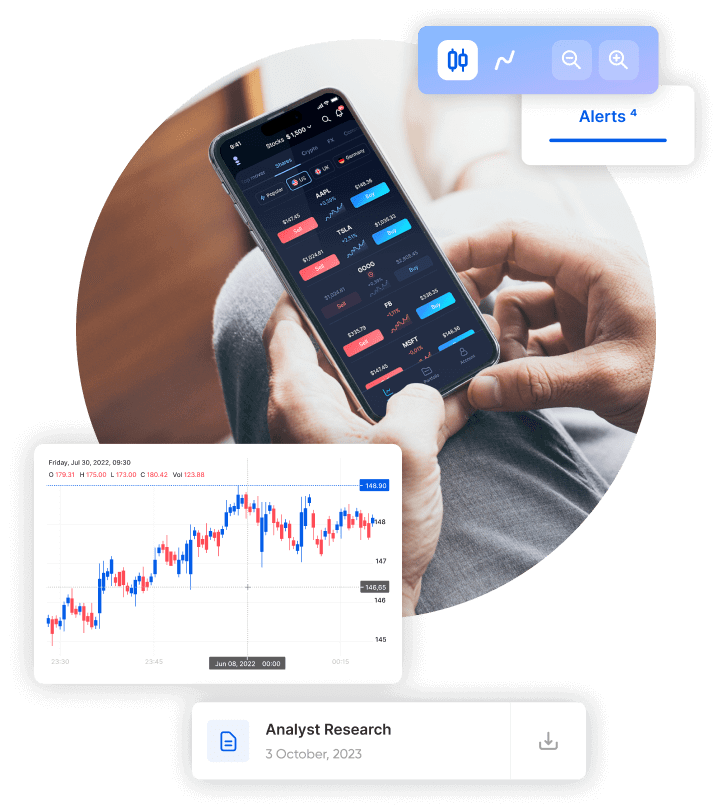

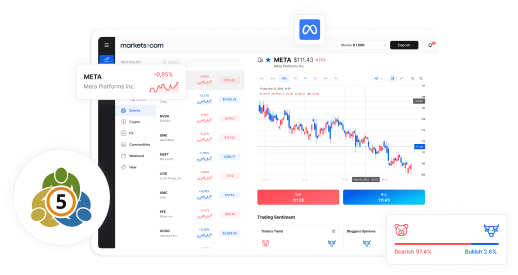

Unveiling DoM with Markets.com - MT5

DoM is a tool of choice for pro traders/institutions. Experience the real-time bid and ask prices of the markets to ensure you get the best prices and enjoy tighter spreads with lower costs.

Contact us to unlock DoM access!

Trading carries a considerable risk of capital loss.

Please trade wisely.

How do I open DoM?

4. Apply for DoM

Reach out to our Customer Support team to apply for our Depth of Market feature.

5. Download and trade

Download MT5, and embark on your trading journey with enhanced market insight!

Download MT5Trading carries a considerable risk of capital loss. Please trade wisely.

Trading CFDs carries a considerable risk of capital loss.

Master your strategy

Maximizing the benefits of DoM with Markets.com

Deep liquidity access

Benefit from access to deep liquidity provided by Tier 1 banks, ECNs, and non-bank liquidity pools, ensuring tight spreads and lightning-fast trade execution.

Lower transaction costs

Transparent spreads enable cost-efficient trades, reducing the impact on your overall trading fees.

Enhanced trading precision

Gain real-time visibility into order book data, allowing you to see the actual supply and demand levels. Make informed decisions based on transparent market conditions.

Smoother execution

Anticipate price movements with Depth of Market, leading to reduced slippage and smoother trade execution.

Better risk management

Informed decision-making enables you to implement effective risk management strategies.

Seize unseen opportunities

Explore the Depth of Market now!

Trading carries a considerable risk of capital loss.

Please trade wisely.