Friday Aug 21 2020 15:43

3 min

Every quarter hedge funds with over $100 million under management have to submit documents to the US Securities and Exchange Commission. This gives traders invaluable insight into what the world’s top money managers have been buying and selling in the past quarter.

Ray Dalio’s Bridgewater Associates, the largest hedge fund in the world, recently filed its latest update. Here are five investments the fund dumped in second quarter.

The three largest holdings that Bridgewater exited in the second quarter are all ETFs:

Dalio also closed a $28.6 million stake in Royal Bank of Canada, and a $25.1 million stake in Toronto-Dominion Bank.

Bridgewater put nearly half a billion dollars into gold during the second-quarter, increasing holdings in the iShares Gold Trust ETF and the SPDR Gold Trust ETF. At almost a billion dollars, the SPDR Gold Trust is the firm’s second-largest holding.

Gold rallied 13% in the second quarter, and hedge funds who held onto or increased their positions will have benefited further thanks to the surge above $2,000 in Q3.

Dalio isn’t the only fund manager to pile into gold in the second quarter. Mason Capital Partners, Sandell Asset Management and Caxton Associates all took up positions on SPDR Gold Trust as well.

Even Warren Buffett, who famously dislikes gold as an investment has joined the party, taking a stake worth $563 million in Barrick Gold – the world’s biggest gold miner.

Gold is a popular inflation hedge because it is priced in dollars – as inflation erodes the value of the dollar, gold prices rise.

On top of gold, hedge fund managers including George Soros, Dan Sundheim, and Daniel Loeb have been snapping up tech stocks.

Zoom and PayPal saw strong demand thanks to the increased need for their services as more people across the world are forced to work and shop from home. Zoom’s stock price has leapt 327% this year, with users find new applications for the service, such as streaming weddings, as well as the usual business calls.

Soros doubled his stake in Amazon, while Sundheim increased his holdings of Microsoft 74%.

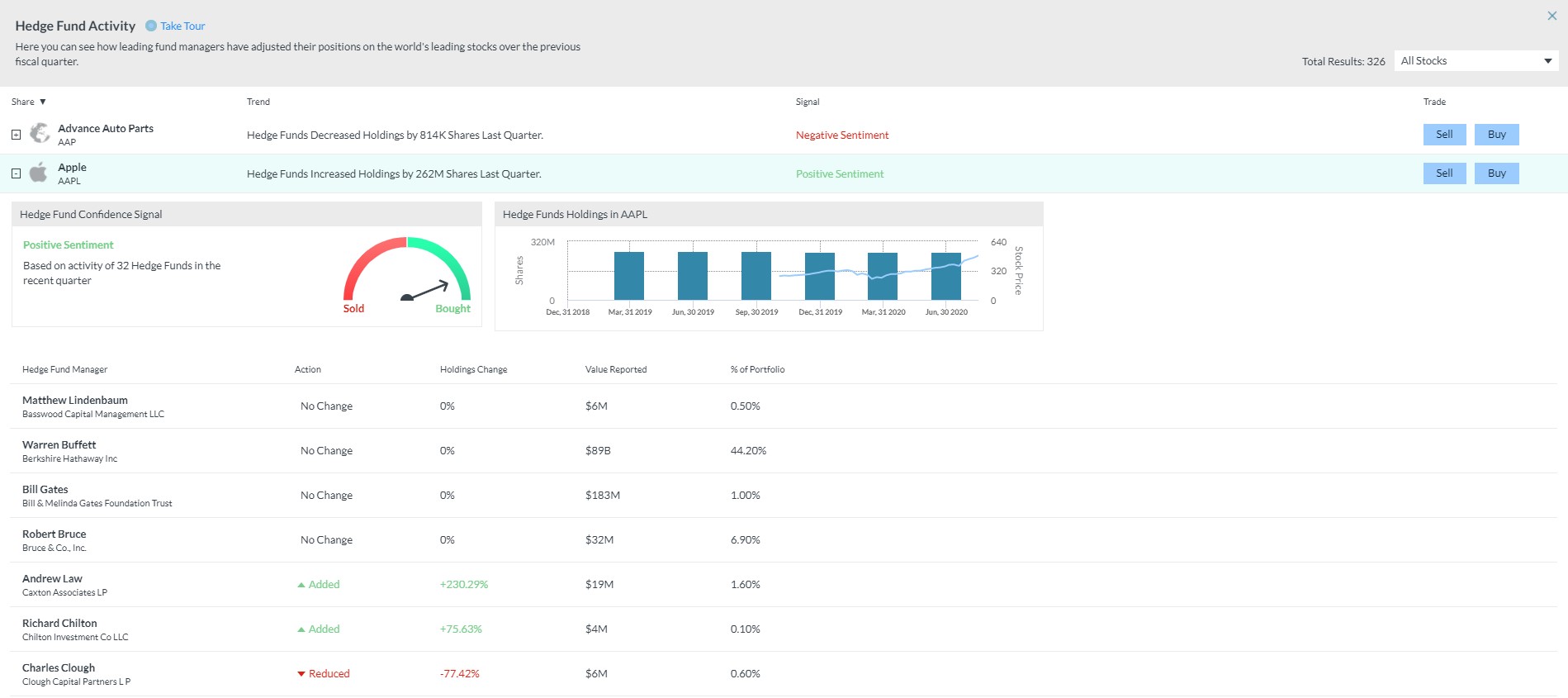

You can find out more about what the world’s top money managers have been buying and selling with our Hedge Fund Confidence tool in the Marketsx online trading platform.

Use it to get sentiment signals on top stocks with data on who’s being buying and selling US shares.