Friday May 21 2021 08:29

4 min

European markets are tentatively higher in early trade on Friday, solidifying gains from Thursday’s upbeat session as global stocks made gains. DAX traded not far off recent intra-day all-time high at 15,440, but 15,500 continues to act as headwind for bulls and early gains were largely pared after one hour of trading, whilst the FTSE 100 dropped more than half of one per cent in early trade to drop under the key 7,000 level. Tech shares led a rebound on Wall Street as stocks in the US snapped a three-day losing streak. The S&P 500 rallied over 1% to 4,159, with the Nasdaq up 1.8% to 13,535. NDX rallied almost 2% as the big tech names that have the biggest impact on the index put in a strong day with Apple and Netflix both up 2%, with other FAANGs rising 1% and Tesla +4% and ARKK rose 3.5%. Futures indicate the major US indices will open higher later.

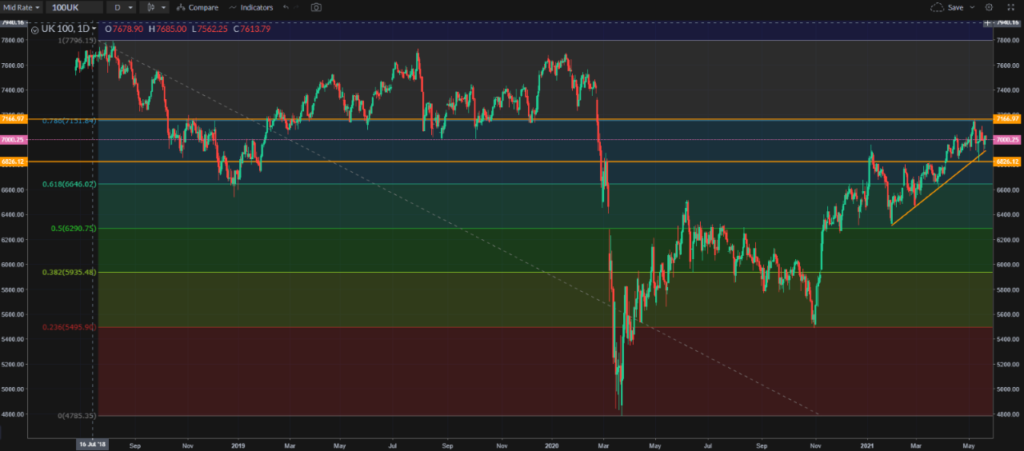

On the FTSE, tech and energy are leaders, whilst healthcare and industrials (yesterday’s gainers) are lower as the market continues to really chop around these 6,850-7,150 ranges. Until we see a breach in either way, this is our stomping ground for the time being. The big rejection of the 6800 handle on May 13th indicates little appetite for the lower end, but many factors are at work here. Not least, as discussed yesterday, the exposure of basic resources and energy stocks to the growth in emerging markets that could be affected by covid.

UK retail sales beat expectations as all that pent-up demand was unleashed in April as non-essential shops were allowed to reopen on the 12th of the month. Sales rose 9.2% from March, versus forecasts of +4.5%. GBPUSD was bid up to 1.42 ahead of the release before peeling back to the 1.4180 area.

PMI numbers show progress in Europe, with the composite index for the Eurozone at 56.9 vs 55.1 expected, helping to keep EURUSD close to a 3-month high, however it keeps hitting a brick wall at 1.2240 and has retreated a touch from here this morning to sit at the 78.6% retracement of the Jan-Mar drop. With a potential topping patter at this area we could look to a retreat to 1.2170 area should the dollar catch any yield-related bid. Upside breach of 1.2240/5 area, the Feb swing high, calls for return to the Jan highs. Of course it all depends on markets’ analysis of the relative pace of change in expectations for the ECB and Fed tapering actions.

Gold remains steady around the 50% retracement of the Aug-Mar decline. Treasury yields are steady, with 10s around the 1.64% level – so far not seeing much direction from the bond market but I’d expect this to shift up a gear soon.

WTI is testing nearly one-month lows at the $62 handle following the last couple of sessions’ weakness. Fears about tapering maybe, fears about demand in Asia rolling over and fears about Iranian crude coming back on the market certainly. Potential triple top could herald breakdown to the $60.60 area after downside breakout of the longer term trend line. But if bears can’t get it here then look for rebound to the $64 area.

Asset List

View Full ListLatest

View all

Sunday, 11 May 2025

6 min

Friday, 9 May 2025

9 min

Thursday, 8 May 2025

5 min