Wednesday Mar 10 2021 15:06

7 min

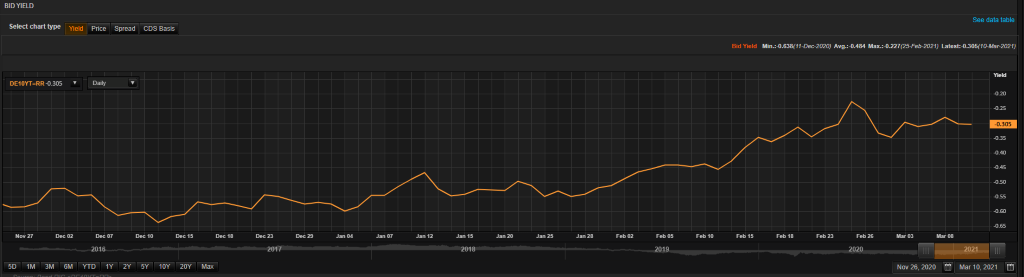

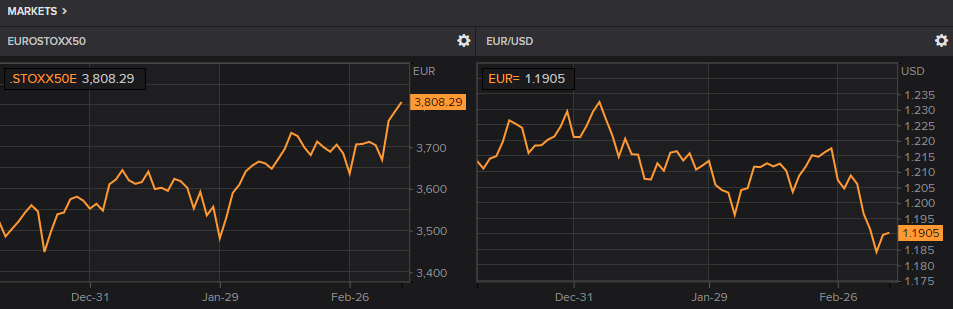

The European Central Bank meets on Thursday for its second meeting of 2021. It will not be unaware of the rise in yields that has taken place since it last convened. This should be exactly what it wants – higher yields imply higher growth and higher inflation. But it doesn’t want tighter financial conditions to choke of the recovery before it has even had a time to start – let’s not forget how far the Eurozone has fallen behind peers (notably the US and UK) in terms of vaccinations. A declining euro has helped ease some worries for the ECB, but this is a central bank in a quandary: even if the current rise in yields is trifling and absolute levels low historically, failing to lean against the rise in yields could cause the curve to steepen further and lead to an ‘unwarranted’ tightening in conditions. The market focus will be on the ECB’s reaction function to the rise in yields – what, how, when and for how long.

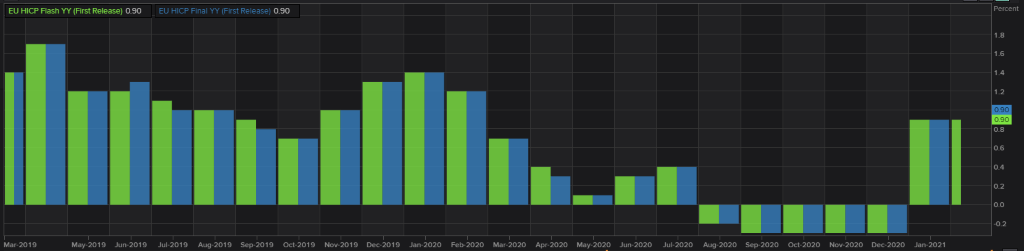

Inflation is starting to pick up – assumptions for higher growth, lower inflation offered in December are out of date. Inflation is going to be higher – partly because of the pick-up in oil prices in Q1. Growth will likely miss targets since the lockdowns are lasting much deeper into the year than feared at the end of 2020. So the ECB ought to be saying growth will be weaker and inflation higher – the problem is higher oil and goods prices is not what the ECB really wants to see (cost push vs demand pull). Recent soft retail sales and jobs figures point to a double dip recession. However I don’t believe the ECB will say that risks are tilted to the downside, rather that given optimism over vaccines the recovery will gain momentum but with a high degree of uncertainty as to the exact path of growth. Inflation can probably be pinned to one-off factors.

Inflation rose by the most in ten years in January.

Bund yields on the up, gaining 26bps in February (source: Refinitiv)

Euro down, Stoxx up (source: Refinitiv)

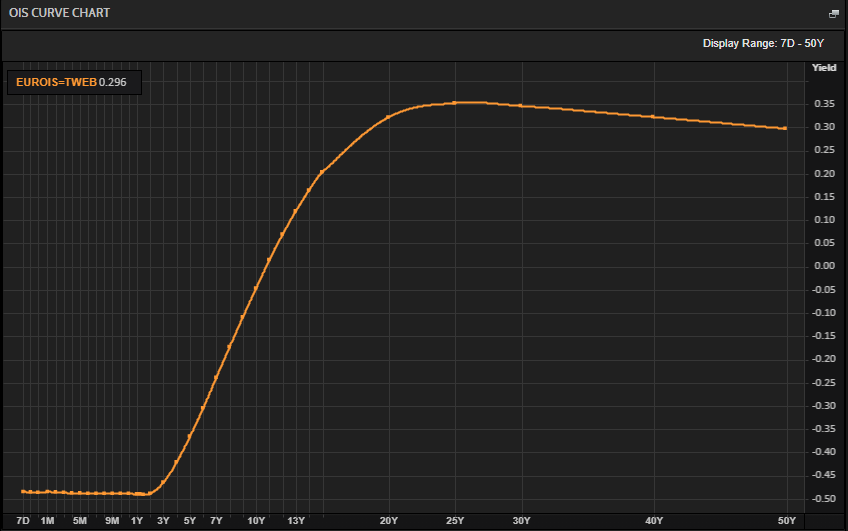

Chief economist Philip Lane has already stressed the importance of the yield curve to the ECB – noting that there are ‘two key yield curves in the euro area for the funding conditions of all sectors in the economy’. These are the overnight index swap (OIS) curve (shown below)– which is seen as a proxy for a risk-free curve in the Eurozone – and the GDP-weighted sovereign bond yield curve.

(source: Refinitiv)

Executive Board member Panetta was very dovish last week, stressing that the ECB should not hesitate to ramp up emergency asset purchases. He said: “The steepening in the nominal GDP-weighted yield curve we have been seeing is unwelcome and must be resisted. We should not hesitate to increase the volume of purchases and to spend the entire PEPP envelope or more if needed.” Panetta has previously said that financing conditions in December should be the benchmark; deterioration from this level would be cause for action, in his view. GDP-weighted sovereign bond yields have risen by around 30bps in 2021.

Germany’s Schnabel has been anchoring expectations by saying the PEPP envelope is a ‘ceiling not a target’. Weidmann has also suggested some tightening of conditions is nothing to worry about.

I think the ECB will this week seek to increase the pace of PEPP purchases in an attempt to lean against rising yields, and it may increase the envelope size. However, on the latter, with hawks off-side it is more likely that Christine Lagarde will signal the envelope is not a ceiling and that the ECB stands ready to increase it if necessary. Currently the PEPP envelope stands at €1.85tn, with around €1tn still unused.

The problem with this thesis is that the ECB has lately been slowing the pace of asset purchases under PEPP which suggests the ECB is not actually that concerned about the rise in yields and does not have a particular target in mind.

At its last meeting of January 21st the ECB left everything on hold as expected. There was a change to the statement around recalibrating PEPP that ruffled some feathers but really was nothing to note – Lagarde and co had been saying this since the Dec meeting and only affords the ECB the kind of optionality it wishes to retain.

The statement featured the following that had not been present before: “If favourable financing conditions can be maintained with asset purchase flows that do not exhaust the envelope over the net purchase horizon of the PEPP, the envelope need not be used in full. Equally, the envelope can be recalibrated if required to maintain favourable financing conditions to help counter the negative pandemic shock to the path of inflation.”

So PEPP could be smaller or larger, it all depends on financing conditions. Asset purchases could go up. Could go down. I stressed at the time that this was not a new thing, but a reiteration of what Governing Council members had been saying since the last meeting. You could argue it’s a slight sop to the hawks as it means they could reduce the PEPP envelope – or not use if fully.

Increase pace of purchases: To combat the rise in bund yields (Should it choose to) the ECB will need to accelerate the pace of PEPP purchases at quite a rate, at least doubling, or even trebling. This would send the signal to the market that the ECB is doing all it can right now to combat any undesirable tightening in financial conditions.

Extend duration of PEPP: It would make sense for the ECB to say it will extend the PEPP programme beyond March 2022.

Increase the size of PEPP: There is a less obvious win in increasing the envelope, particularly as the ECB has used so little so far. It is far more likely that the Governing Council will stick to the January guidance of maximum optionality.

On the daily we can see the big move lower following the Feb 25th gravestone doji which ran out of steam at the big horizontal support line we’d drawn around 1.1850 coinciding with the bounce off 30 on the 14-day RSI. This seems to have created a pause for bears and the failure to test the 200-day SMA will give them some cause for concern. Increasing the pace of PEPP might see the 1.1850 area tested again.

Asset List

View Full ListLatest

View all

Monday, 28 April 2025

5 min

Sunday, 27 April 2025

12 min

Sunday, 27 April 2025

6 min