Thursday Apr 22 2021 13:02

4 min

Tesla (TSLA) is due to release first-quarter 2021 results on Monday Apr 26th, after the closing bell. Consensus estimates indicate earnings per share (EPS) of $0.79 on revenues of $9.92 billion.

The company plans to webcast the conference call with analysts after the quarterly results at 17:30 (EST).

A fatal crash in Texas has thrust the safety of the company’s Autopilot system into focus. Although it is understood no one was at the wheel at the time. Autopilot is not meant to be left to control the vehicle exclusively, however there are concerns that some drivers have misunderstood the functionality of the system. Meanwhile it appears that the autopilot function was not engaged at the time of the crash. CEO Elon Musk tweeted on Monday: “Data logs recovered so far show Autopilot was not enabled & this car did not purchase FSD. Moreover, standard Autopilot would require lane lines to turn on, which this street did not have.”

Earlier this month Tesla reported record Q1 sales, delivering 184,800 vehicles, more than double the 88,400 reported last year and about 10k ahead of expectations.

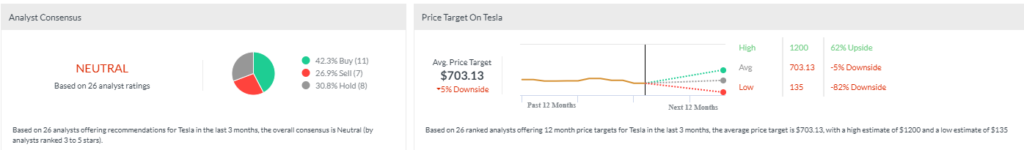

The strong first-quarter delivery numbers could send the stock nearly 15% higher, Mizuho Securities said earlier this week as it raised its price target on Tesla to $820 from $775.

“With a strong start to the year, we see upside to the TSLA 831K consensus deliveries given proposed Biden infrastructure package with $100B in EV rebates and potential extension and expansion of EV credits,” the analyst note said.

The addition of Bitcoin to the Tesla balance sheet this year portentous. The stock is down ~13% since the SEC filing on Feb 8th, but has recovered about 30% since hitting a low around $560 at the start of March to trade at $744 by the time the market opened on Thursday, Apr 22nd. Mizuho are unfazed by the crypto exposure: “TSLA regulatory credit sales and Bitcoin could be NT tailwinds, offset by near-term product/mix headwinds.”

Tesla has been forced to make a grovelling apology after a backlash from the state-run Chinese media following customer complaints. This is important – China is a key market for Tesla and other automakers who are seeking to tap the growing EV market in the world’s second-largest economy. Tesla has made a big investment in local production, which seems to be paying off. Tesla reported sales of $6.7bn in China last year, making it the second biggest for the firm after the US, whilst the Model 3 sedan was China’s best-selling electric vehicle in 2020. Meanwhile the Model Y is also proving popular, with production for the domestic market rising to 34,635 units in March, almost double the level in February.

The competition is getting fiercer for Tesla, and it remains the case that the chief bear thesis on the stock is that current valuations imply a massive market share gain from the traditional OEMs. Given the pace of progress they are making on the EV front, it seems hard to justify the Tesla multiple even allowing for ongoing sales growth and margin improvements.

This week’s Shanghai auto show displayed the range of competition from local Chinese rivals such as Xpeng, Nio and Geely. Mercedes recently said it will launch a range of new electric vehicles, including a battery-powered version of its S-Class saloon, in the next 18 months. Other rivals like BMW, VW and Audi have also seen their electric vehicles met with approval. For Tesla, things are only going to get tougher.

Take a position on Tesla ahead of its earnings report and start trading now.