Wednesday Sep 16 2020 10:40

4 min

Tesla Battery Day primer

Investors are charged up with excitement ahead of Tesla’s Battery Day event. Shares have rallied about 25% in the last week after the stock tapped on the 50-day simple moving average following some heavy selling in the middle of the Nasdaq’s early September pullback.

This of course followed disappointment at missing out on S&P 500 inclusion, and some very aggressive bid that took place in and around the stock split. So is Battery Day all hype, or is there something to it?

Tesla’s 2020 annual meeting of stockholders will be held on Tuesday, September 22, 2020, at 13:30 Pacific Time. Immediately after this meeting, Tesla will hold the Battery Day event.

CEO Elon Musk, in his usual caution, said in January that the event will ‘blow your mind’. Recently he toned it down a bit, teasing ‘many exciting things’. Whilst we should always take his pronouncements on Twitter with a pinch of salt, clearly there is a high degree of expectation and speculation – and speculative buying of TSLA stock – taking place in the run-up to the event.

To deliver on its EV promise, Tesla needs to own the battery space. Without this, it’s not so different to an OEM. Musk commented on this at Tesla’s Q4 2019 earnings call in January, explaining that in order to ramp up Model Y production, introduce the Cybertruck and launch the Semi electric truck, a lot more batteries would be needed.

“So, the thing we’re going to be really focused on is increasing battery production capacity because that’s very fundamental because if you don’t improve battery production capacity, then you end up just shifting unit volume from one product to another and you haven’t actually produced more electric vehicles,” Musk said.

And whilst Tesla has a lead in the powertrain stakes, traditional players may catch up. “It’s worth noting that the Model S has like a 100 kWh pack, the [Porsche] Taycan has like a 95 kWh pack. The Model S is steadily approaching 400 miles of range. The Taycan has 200 miles of range. So we must be using that energy pretty efficiently, and the powertrain is a big part of that,” Musk added in January.

Whilst battery production is one thing, making the batteries more efficient is quite something else. Tesla’s acquisition of Maxwell, an ultra-capacitor manufacturer and battery technology business based in San Diego, is a considerable factor.

My expectation is that Musk is about to announce if not a leap then a progression in battery technology that brings EV costs down to, or close to, traditional automobiles. It would be a surprise if Tesla were not able to say it has made further progress on batteries that are more energy dense and have a longer life.

We note for example, that on August 24th this year Musk said battery cells of 400 Watt hours per kilogram (Wh/kg) with a high cycle would be possible in volume within 3 to 4 years, way beyond the current 260 Wh/kg in the Model 3, which could indicate knowledge of some improvement coming in the Tesla batteries.

There has also been speculation that Tesla may unveil “silicon nanowire anode” technology that can greatly increase battery density and cell life. All of this remains speculation, of course.

If Tesla can both lower costs and increase battery energy density and life, it would be a significant step forward for the company and further cement its lead in the EV space. However, given the recent rampant speculation on the stock and Musk’s capacity to somewhat overstate his case, there is a considerable risk of a buy-the-rumour, sell-the-fact trade.

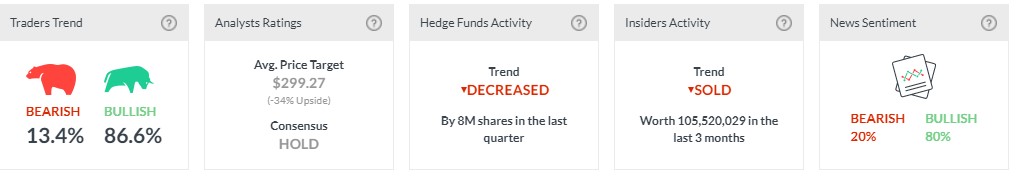

Whilst client flows remain positive (87% bullish), analysts remain downbeat – the average price target of $300 vs the current $450 for the stock implies a 34% downside. We also note that hedge funds have been decreasing their holdings.

Baillie Gifford, one of the top shareholders, recently reduced its stake as the holding approached fund limits, but also because of fears that valuations had just got silly. Our insider signals tool also delivers a sell signal on the stock.