Friday Oct 29 2021 09:14

4 min

For the first time since 2016, Apple has missed Wall Street earnings estimations – but the big tech’s growth continues at a terrific pace.

Global supply chains issues thrown up by the COVID-19 epidemic caused Apple to miss earnings estimations this quarter.

Sales of the brand’s flagship iPhone, iPad and iMac models were affected. A worldwide computer chip shortage has been affecting many tech companies. Only Tesla’s Q3 earnings seem to buck this trend.

“We had a very strong performance despite larger than expected supply constraints, which we estimate to be around $6 billion,” Apple CEO Tim Cook said.

However, overall revenue was still up 29%, going to show just how much of a behemoth Apple is.

The key takeaways from this quarter’s Apple earnings report are:

Apple shares also fell 3% in general trading after financials were published. At the time of writing, they had climbed 2.5%, on their way to making up yesterday’s losses.

Despite the chip shortage, which also coincided with pandemic-led labour issues in Southeast Asian manufacturing hubs, it seems all major revenue streams were up year-on-year for Apple.

Even with that $6 billion loss, Apple appears to be in a very healthy place. The 47% increase in iPhone sales is particularly notable. Not even a global pandemic, component shortages and manufacturing snags can halt the world’s most popular smartphone’s growth.

Annuals total fiscal revenue for 2021 is up 33% against 2020 at a total of $366bn.

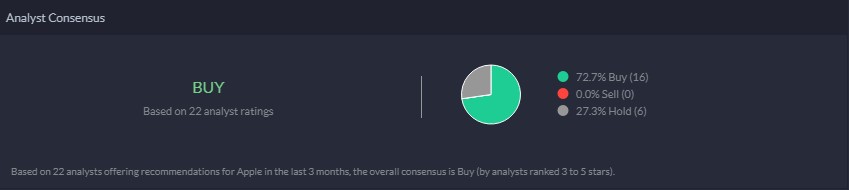

Apple holds a buy rating according to the Markets.com analyst recommendations:

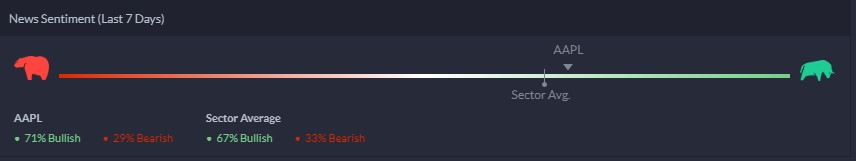

News sentiment is bullish, but only slightly above the average for the technology sector:

iPhones are obviously the cornerstone product driving most of Apple’s growth. The iPhone 13 model has recently been introduced, but only came a month before the quarter ended. Its impact won’t really be recordable until the next earnings season.

The next biggest growth area for the California tech brand was its services department. Revenues generated by services is up nearly 26% year-on-year. Services cover App Store sales, music and video subscription services, advertising, extended warranties, and licensing.

According to Tim Cook, Apple now boasts 745 million paid subscriptions.

“That’s up 160 million year-on-year, which is up five times in five years. So, it’s been quite the growth cycle,” Cook said.

The iMac segment did not match its stablemates’ spectacular growth, although sales were up over the year. However, growth only clocked in a 1.6%.

Apple has yet to give official guidance on the next quarter, but it has made some key predictions.

Speaking to analysts after the earnings call, CFO Luca Maestri said he expects iPad sales to decline in December. Supply constraints will affect manufacturing and subsequently sales. However, iPhone sales will likely continue accelerating, especially with the iPhone 13 available to consumers worldwide.

US Q3 earnings season is in full swing. Stay tuned for more updates. In the meantime, check out our earnings calendar to see which megacaps are reporting and when.