Sunday May 10 2020 00:01

7 min

Economic data at the moment tends to fall into one of two categories: 1) How bad did things get in Q1, and, 2) How quickly are they likely to get better? Everyone knows the Q2 data is where the real pain lies, but markets want an idea of where things stood before the effects of COVID-19 lockdowns really began to bite.

To this end flash Q1 GDP figures from the UK, Germany, and the Eurozone this week will act as a primer ahead of data for the current quarter. The US has already reported its advanced GDP estimate for Q1, showing that the economy contracted 4.8% during the first three months of the year, compared to expectations of 4%.

The UK economy is expected to shrink 4.4% on the previous quarter, the German economy by 2.8%, and the Eurozone by 3.8%. If the US data is any indication, these forecasts may not be bleak enough.

The key question, though, is whether this weakness is the predicted impact of COVID-19 arriving earlier than expected, or a sign that the impact is worse than the already dire expectations.

The US will post inflation and retail sales data, and the University of Michigan will publish its preliminary reading of its latest sentiment index. Australian releases this week include the wage price index and employment change and unemployment rate figures.

On the other end of the scale, Chinese industrial production and retail sales figures for April will give markets a vague idea of what an economy on the other side of lockdown looks like. It’s not an entirely accurate bellwether – China returned to work around the same time that Europe battened down the hatches.

The shuttering of businesses across the West will damage manufacturing demand in Asia. Industrial production is expected to drop 4.2%, compared to a 1.1% drop in March. Retail sales had cratered nearly 16% in February. The unemployment rate is expected to tick higher to 6.3% from 5.9%.

Also on the post–COVID front, the New Zealand government will hand down its latest Budget release this week. Finance Minister Grant Robertson has already laid out his strategy in a prebudget speech (delivered via video link, of course): respond, recovery, rebuild.

Particularly interesting is that Robertson says this will be a chance to not just rebuild the economy, but rebuild it better. Will other finance ministers around the globe be looking to reshape their economies over the coming months and years, or simply get the train back on the rails? The notion could drastically change what markets should expect from the coming years.

Marriott earnings are due before the market opens on the 11th. The hotel giant recently raised $920 million in new cash through its credit card partners. Revenue per available room was down 60% during March.

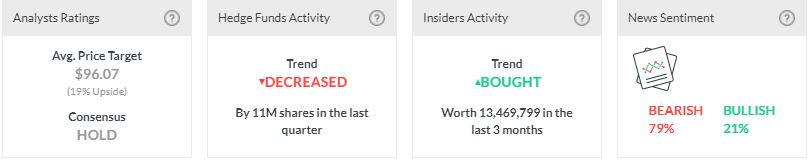

The stock has a “Hold” consensus with a 19% upside (based on the May 6th closing price) according to our Analyst Recommendations tool. Hedge funds has sold shares in the previous quarter, while insiders have snapped up the stock. The latest research on the stock from Thompson Reuters is available to download in the Marketsx platform.

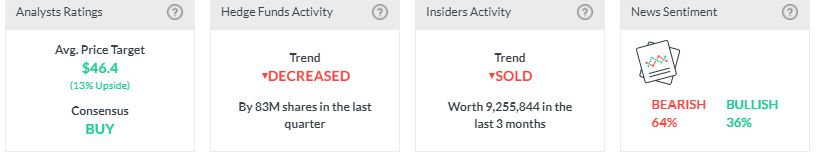

Cisco reports after the market close on May 13th. While analysts rate the stock a “Buy”, hedge funds dumped 83 million shares in the last quarter, with company insiders selling over 9 million in the last three months. The latest research on the stock from Thompson Reuters is available to download in the Marketsx platform.

Tencent Holdings, Sony, and Wirecard also report this week.

The following companies are set to publish their quarterly earnings reports this week:

| Pre-Market | 11-May | Marriott – Q1 2020 |

| 11-May | Bridgestone Corp – Q1 2020 | |

| 05.00 UTC | 12-May | Allianz – Q1 2020 |

| 12-May | Vodafone Group – Q4 2020 | |

| Pre-Market | 13-May | Tencent Holdings – Q1 2020 |

| After-Market | 13-May | Cisco – Q3 2020 |

| 13-May | Sony Corp – FY 2019/20 | |

| 14-May | Wirecard – Q1 2020 | |

| 14-May | Astellas Pharma – Q4 2019 |

| 07.15 UTC | Daily | European Morning Call |

| 09.00 UTC | Daily | Earnings Season Daily Special |

| 15.30 UTC | 12-May | Weekly Gold Forecast |

| 12.50 UTC | 13-May | Indices Insights |

| 18.00 UTC | 14-May | BlondeMoney Gamma Special |

Watch out for the biggest events on the economic calendar this week:

| 23.50 UTC | 10-May | Bank of Japan Summary of Opinions |

| 01.30 UTC | 12-May | China CPI |

| 07.00 UTC | 12-May | UK Preliminary Quarterly GDP |

| 12.30 UTC | 12-May | US CPI |

| 01.30 UTC | 13-May | Australia Wage Price Index (Q/Q) |

| 03.00 UTC | 13-May | RBNZ Interest Rate Decision |

| 14.30 UTC | 13-May | US EIA Crude Oil Inventories |

| 01.30 UTC | 14-May | Australia Employment Change / Unemployment Rate |

| 02.00 UTC | 14-May | New Zealand Annual Budget Release |

| 12.30 UTC | 14-May | US Jobless Claims |

| 14.30 UTC | 14-May | US EIA Natural Gas Storage |

| 02.00 UTC | 15-May | China Industrial Production / Retail Sales |

| 06.00 UTC | 15-May | Germany Preliminary GDP (Q1) |

| 09.00 UTC | 15-May | Eurozone Preliminary GDP and Employment Change (Q1) |

| 12.30 UTC | 15-May | US Retail Sales |

| 14.00 UTC | 15-May | Preliminary University of Michigan Sentiment Index |