Sunday Jan 9 2022 07:39

7 min

It’s a veritable bonanza of big data reports from the United States this week. Two major inflation indicators, in the form of CPI and PPI numbers, are released, alongside retail data from what’s usual a golden period for consumer spending.

First up in the week’s US data blitz is Consumer Price Index inflation. The report, sharing numbers for December 2021, lands on Wednesday afternoon.

We already know inflation is running hot. The question now is just how hot it will continue to run.

The CPI rose at its fastest pace for nearly 40 years in November, according to December’s report. Surging prices of staples like food and gasoline caused a 6.8% year-on-year jump.

Energy prices are in particular focus, rising 33% across 2021. High at-the-pump prices for gasoline even caused President Biden to dip into the US Strategic Petroleum Reserves in a bid to cool prices.

The key US WTI crude oil benchmark had made significant gains at the start of the 2022, so we aren’t necessarily seeing the effects of Biden’s oil release just yet.

Excluding volatile food and energy prices, core CPI was up 4.9% from a year ago – a new 30-year high.

High inflation has finally forced the Fed’s hand. It is accelerating its bond-buying programme and that should wrap up by March of this year. After that, as many as three rate hikes could be on the way across the year.

Inflation indicators come thick and fast this week. Next up are US Producer Price Index numbers, covering December’s data.

Like CPI, things are hot in wholesale price land. December’s report, focussing on the data for November 2021, showed a 9.6% PPI yearly jump. That’s the fastest rise ever recorded in November.

Core PPI, which again strips out wholesale food and energy prices, the rate of PPI expansion was still an eye-watering 6.9%. This was another record, although it should be pointed out that record keeping of these headline and core stats only goes back to 2010 and 2014 respectively.

It just goes to show that inflation is still singing the US economy, despite its ongoing post-pandemic recovery – or at least it was towards the end of 2021.

We’re likely to see hotter input prices going forward. Logistical snags and supply bottlenecks thrown up by the pandemic are still weighing heavily on wholesale costs. Prices of raw materials and commodities are still high too.

These high prices coupled with the release of pent-up demand and spending created a perfect inflationary storm across the pandemic. We are probably going to be seeing this for some time across 2022.

Official government retail sales data for the United States rounds off the week’s key data releases.

Things were looking up in December, following a softer November, the initial Mastercard reports say.

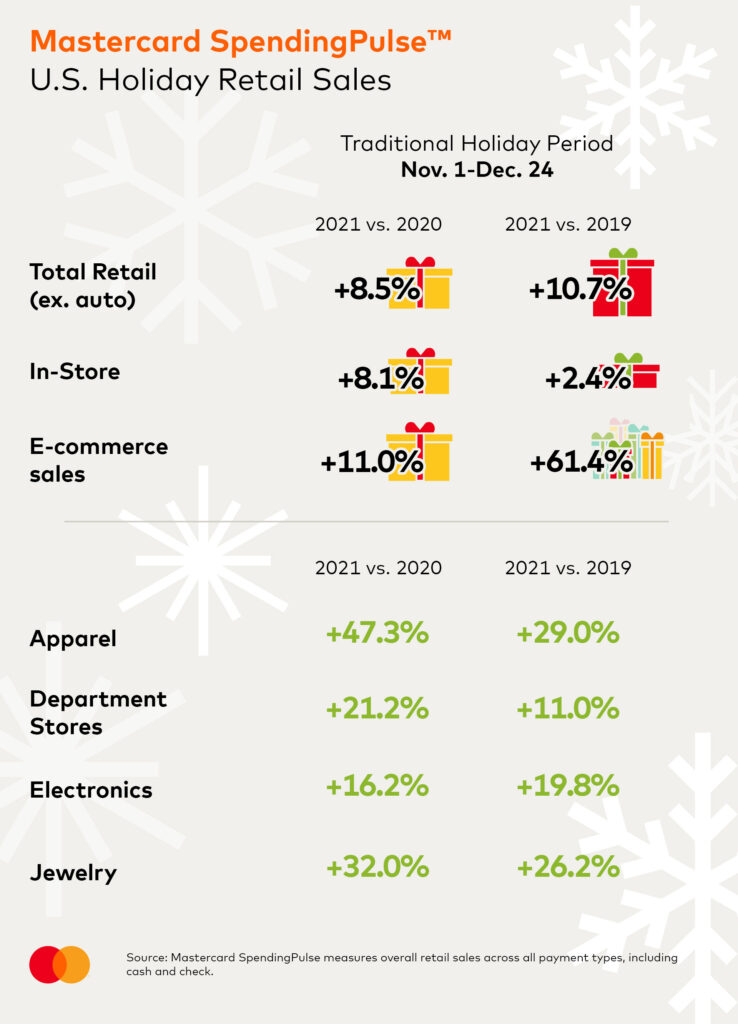

Mastercard Spending Pulse, the brand’s monthly retail review, shows an 8.5% yearly jump in retail sales in the run up to Christmas 2021. Online sales were up 11% in the review period, which ran from November 1st to December 25th.

“Shoppers were eager to secure their gifts ahead of the retail rush, with conversations surrounding supply chain and labor supply issues sending consumers online and to stores in droves,” said Steve Sadove, senior advisor for Mastercard and former CEO and Chairman of Saks Incorporated. “Consumers splurged throughout the season, with apparel and department stores experiencing strong growth as shoppers sought to put their best dressed foot forward.”

Key findings from the Mastercard report include:

Major economic data

| Date | Time (GMT) | Asset | Event |

| Wed 12-Jan | 1:30pm | USD | CPI m/m |

| 1:30pm | USD | Core CPI m/m | |

| 15.30pm | OIL | US Crude Oil Inventories | |

| 6:01pm | USD | 10-y Bond Auction | |

| Thu 13-Jan | 1:30pm | USD | PPI m/m |

| 1:30pm | USD | Core PPI m/m | |

| 1:30pm | USD | Unemployment Claims | |

| 15.30pm | GAS | US Natural Gas Inventories | |

| 6:01pm | USD | 30-y Bond Auction | |

| Fri 14-Jan | 8:00am | EUR | German Prelim GDP q/q |

| 1:30pm | USD | Core Retail Sales m/m | |

| 1:30pm | USD | Retail Sales m/m | |

| 2:15pm | USD | Industrial Production m/m | |

| 3:00pm | USD | Prelim UoM Consumer Sentiment |