Buffett moves: Warren Buffett’s Berkshire Hathaway bought $1bn in Activision (ATVI) shares weeks before Microsoft announced its acquisition of the video games maker. Timing is everything.

He’s also upped his Chevron (CVX) position by over 30% to make it his ninth biggest holding, having first bought the stock at the end of 2020. Chevron is up 16% YTD and rallied 39% last year. Regulatory filings show Berkshire owned over 38 million shares of Chevron as of the end of 2021, which is about a third more than in the previous quarter. The stake is worth about $4.5 billion.

Berkshire pared its holdings in credit card companies, slashing its Mastercard (MA) stake by 7% to 4 million shares, and cutting its Visa (V) holdings by 13% to 8.3 million shares. It also disclosed a stake in Nu Holdings, the parent company of Brazilian digital bank Nubank.

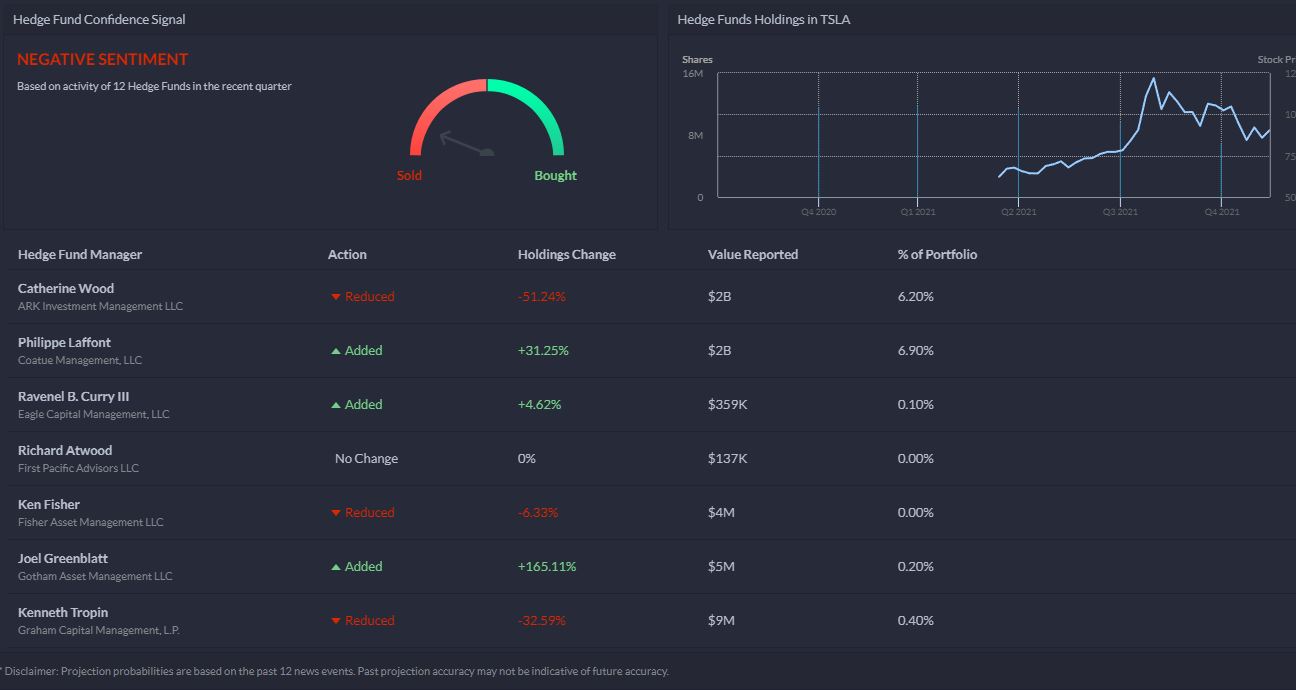

Meanwhile, Greenlight Capital’s David Einhorn disclosed a new bet against Tesla (TSLA). New fourth-quarter filings at the SEC show he was long puts against 100,000 Tesla shares, commanding a notional short position of around $106m. Einhorn has been one of the most vocal critics of Tesla and has been trading in and out of short positions for years.

You can find the latest hedge fund holdings and changes in the platform – here’s the latest on Tesla.

Asset List

View Full ListLatest

View all

Thursday, 25 July 2024

6 min

Thursday, 25 July 2024

7 min

Thursday, 25 July 2024

8 min