Monday Nov 9 2020 15:31

5 min

Stocks have rallied on news that we could soon have an effective vaccine against Covid-19.

Initial optimism is exceedingly high and could fade – we should not be jumping any guns here – but ultimately a vaccine that works effectively would be good for the economy and favours the cyclical parts of the market that we thought were going to struggle as a split Congress meant less stimulus.

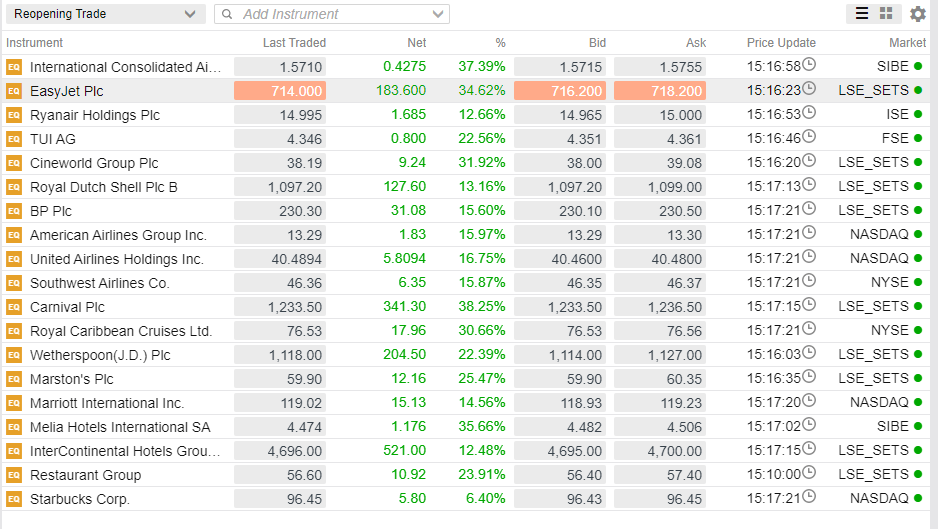

A working vaccine is positive for cyclicals and value – the reopening trade essentially. The dichotomy in the market is stark: the biggest gainers in a frantic session today are among those stocks worst hit by the pandemic – travel and leisure chiefly, whilst Covid winners are doing poorly. We should be careful in overreacting – but it’s clear the market is forward-looking and pricing in recovery in a number of beaten-down areas next year.

Several questions remain, which won’t be answered right away.

When does the vaccine get rolled out fully? So how quickly are we ‘back to normal’ effectively? The UK has pre-ordered 30m doses of the vaccine, but what about other countries?

Given the US election result, does this make it harder to agree stimulus that is required now for the economy?

If this is a higher yield, higher inflation world, how does the Fed start to adjust? Will it even consider thinking about thinking about raising rates? Lots of Fed speakers this week to frantically rewrite their speeches.

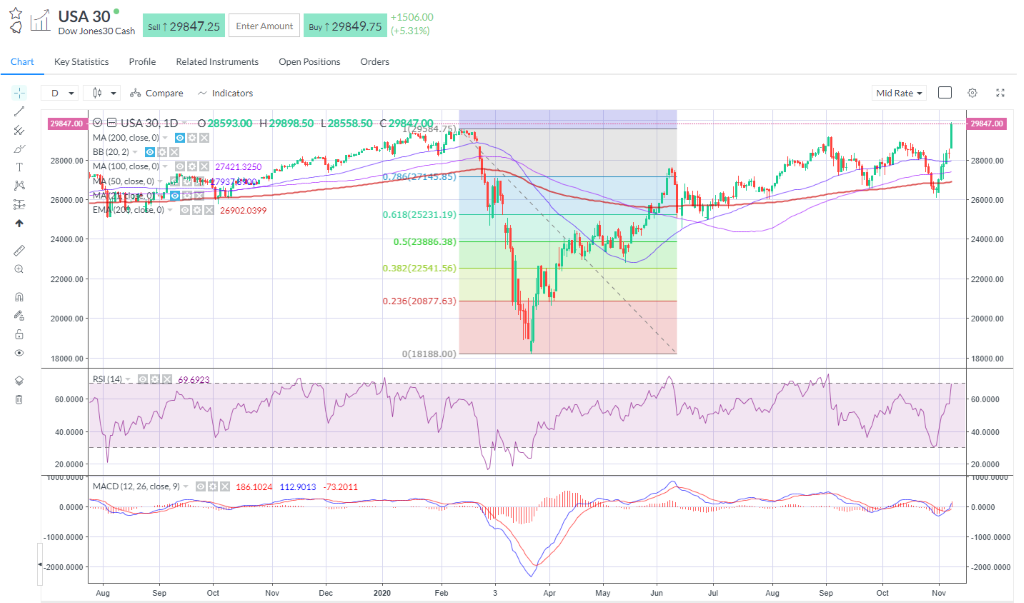

Major indices (ex-Nasdaq). The Dow is surging 1,500pts and set to open at a record high. The FTSE 100 is up over 5% with all sectors green, led by energy and financial and Utilities, Tech and Healthcare at the bottom but still positive as the news lifted the boats.

Travel stocks like IAG +30% and EasyJet +26% are among the best risers on the UK market, whilst Rolls-Royce +46% led the charge. Cineworld +47% and Carnival +31% also indicative of a major rotation back into these stocks that have been hardest hit by the pandemic. In the case of Cineworld the 9.4% stock out on loan points to a nasty short squeeze that may exaggerate the move.

Pubs and restaurants like JDW +15% and Restaurant Group +26% were among the other big gainers from the news. Back to normal means back to the pub – happy days!

Energy – A vaccine should help boost demand more quickly. As crude prices rallied, Shell +12% and BP +15% boosted the FTSE 100.

Financials – A vaccine is a yield steepener – Lloyds and Barclays both +10%.

Crude oil naturally rose on expectations that a working vaccine will equate to a swifter demand recovery, at least much quicker than we would have thought only yesterday.

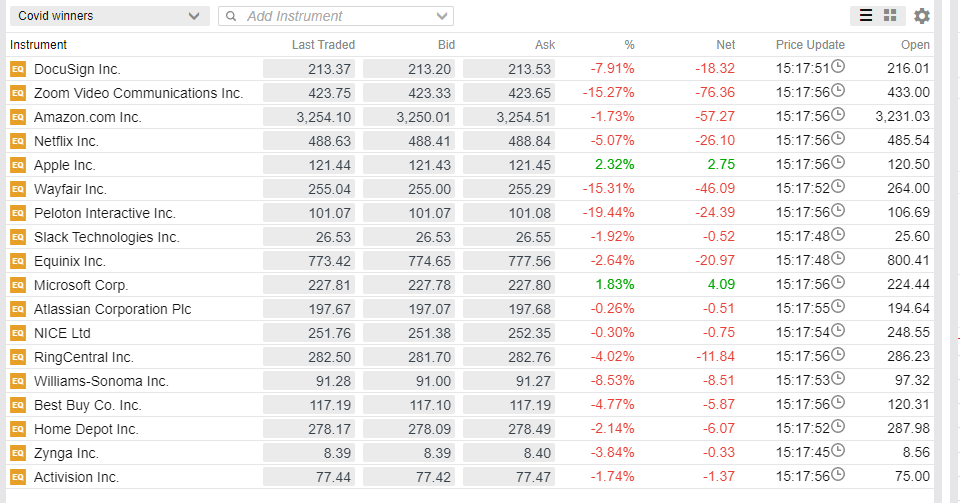

Covid winners: Stocks that won because of the pandemic are naturally on the hook. Stay at home and WFH stocks fell, hurting the Nasdaq. Zoom –15% and Peloton –11% pre-market is indicative of the rotation out of these Covid winners into reopening trades.

UK stocks in the red included the main winners from the pandemic – Ocado, Fresnillo and Kingfisher (back to normal means no DIY – oh happy days)

Keep an eye on these stocks when the US cash equities open later and (Covid Winners Basket).

Bonds – US Treasuries were offered with the 10-year yield spiking north of 0.92%. Inflation could come through next year with large excess savings to be deployed in many sectors of the economy, notably in travel.

Gold – higher yields weighed on gold prices, though we would expect inflation expectations to rise and this could offer ongoing support to prices.