Tuesday May 11 2021 13:19

4 min

US futures looking lower ahead of the cash equity open on Wall Street with NDX at 13,120 and the S&P 500 around 4150, implying about a 30pt lower open for the broad market. Dow being called about 200pts lower at 34,520. European stocks have extended losses with all the main bourses over 2% lower on the day. The USD is offered with the dollar index testing yesterday’s lows at the 90 round number support. Despite all the inflation chatter Treasuries not moving much with 10s barely holding 1.60%. Tesla is -7% in the pre-market and I expect ARK to have another bad session. Apple also -2% on high volume, with Palantir and Nio both -9% among the most active traded ore-mkt. Virgin Galactic called down 20% after losses of $0.55 a share were twice what was expected. Novavax declined -13% as it delayed plans to seek vaccine approval until the third quarter.

Just a few random thoughts and pointers here about what’s going on.

Inflation expectations are key – although we’ve not seen bond react too much thus far (Fed put) this is bound to be impacting the discount rate, which is going disproportionately affect growth/momentum. US 5y break evens at 2.71% or thereabouts are a multi-year high and being replicated to an extent in moves in other markets. Due to the pandemic (shut downs, savings) and the policy response (ultra- low rates, massive monetary growth and fiscal stimulus aka helicopter money), we have a perfect storm of wage-push, cost-push and demand-pull pressures that won’t be as transitory as the Fed thinks. Ultimately it goes back to the question asked by the great Paul Tudor Jones about a year ago: can the Fed suck all this money back out of the system as quickly as it injected it. The answer then was almost certainly no, and post the recent policy shift and vast pro-cyclical stimulus it is clearly absolutely no. So we have inflation worries and, as described on multiple occasions last year, the worry is that the Fed allows inflation expectations to become unanchored as per the 1970s. Too much spending, too much free money and too much dislocation for anything but. Higher taxes might help but they seem ‘too’ well targeted at the higher end of the spectrum to tamp anything down.

On the inflation and macro outlook, there is a degree of trepidation post jobs report and pre-CPI with that hot China PPI number sandwiched in between not helping. Can’t stress enough that the jobs report indicates inflation (be it of the stag kind or not) as wage push comes to fore and outstrips raw material/supply chain pressures and demand side pressures.

Stocks that are held long by hedge funds by definition part of problem. The GS hedge fund VIP index underperforming broader market. Could be related to prime brokers tightening leverage post Archegos. We may be witness a self-fulfilling HF selling cycle, that is, the more stocks fall the more the dealers sell and HF are ultimately forced to liquidate.

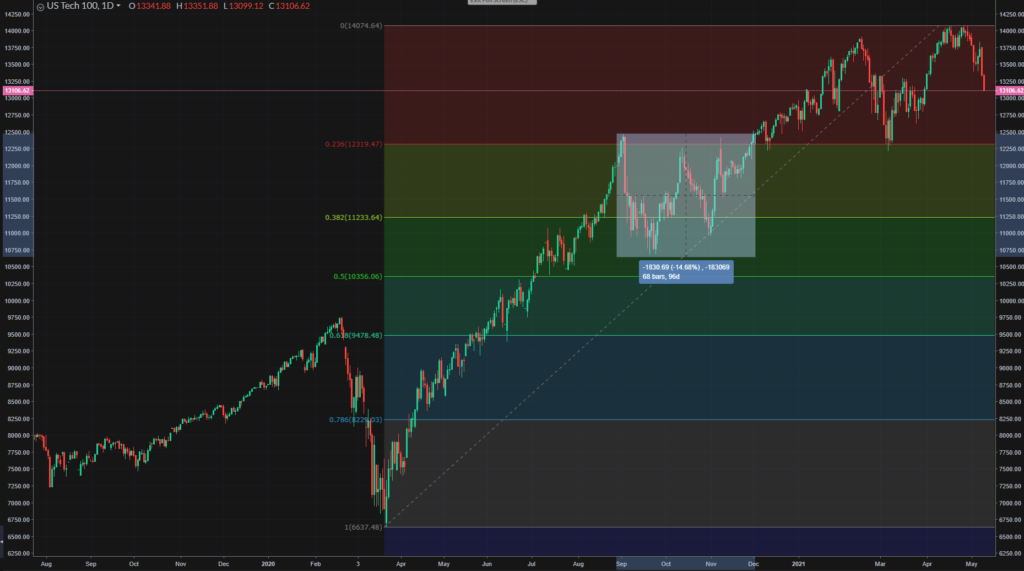

It’s a bit indiscriminate – lots of the big reflation plays off heavily which suggests this is a ‘sell everything’ kind of day (which could be why bonds are not moving as impetus to buy and drive yields down is offsetting the inflation stimulus to sell and drive yields up). This seems very similar to the sort of tech bleed we saw last September when we thought the macro picture was understood and tech looked a little overbought, whilst broader markets were not so much since it was well before the big Nov rotation began. If similar to that period then we might expect a similar 10-15% move off the all-time highs back to the March lows around 12,200, and it could take three months to regain. That is assuming there are not deeper problems ahead – a Fed taper tantrum is still ahead.

We’ve run up a fair bit and the technical setup was extended with US stocks in particular looking overbought. Although broken the 50-day line NDX yet to see real dislocation yet with the March lows still not tested yet. These are important levels to watch and for now we wait for the big tech/FAANG + Tesla + ARK nexus for the key market guide.