Thursday May 5 2022 08:23

3 min

So, the Fed raised rates by 50bps, as was widely expected. But it allayed many fears about a more aggressive hiking cycle, with chair Jay Powell saying larger hikes were not discussed. Taking the 75bps moves off the table is a bit of a surprise, but it allowed markets to rally handsomely. The S&P 500 rallied 3% and the Nasdaq jumped 3.2%. This was a sell the fact type trade as expected. Whilst additional 50bps hikes are something the FOMC should be considering over the next couple of meetings, 75bps moves are “not something that the committee is actively considering”. Powell was keen to cool some of the wilder speculation in the market but it does little for the overall path of rates. The Fed is also commencing quantitative tightening. It will start at $47.5bn a month in June before getting to a monthly maximum of $95bn.

It’s the first 50bps hike in 22 years. It underscores just how urgent the Fed feels the inflation situation has become. But it was a dovish 50bps….which you have to applaud in many ways. The market is still pricing for multiple hikes this year… about 2.88% by end of year before the meeting down to about 2.80% after…the exact path is unclear but everyone seems to think they know the destination. It goes back to my comments last week about max CB divergence that was letting the dollar rampage – this seems to have passed. Cue weaker dollar, Vix lower to bring about another bear market rally until everyone realises the Fed is still going super aggressive.

European stock markets are following the US higher in early trading today. The FTSE 100 was last up 1.4% at 7,600, while the Dax bounced over 2%. Shell boosted the London market as it rallied 3% on its highest quarterly profit since 2008.

Confidence in China is down, largely as you would expect given the state of lockdowns. China’s Caixin Services PMI fell to 36.2 vs the 40 forecast, and down from 42 last time. It was the second lowest reading since the survey began in November 2005.

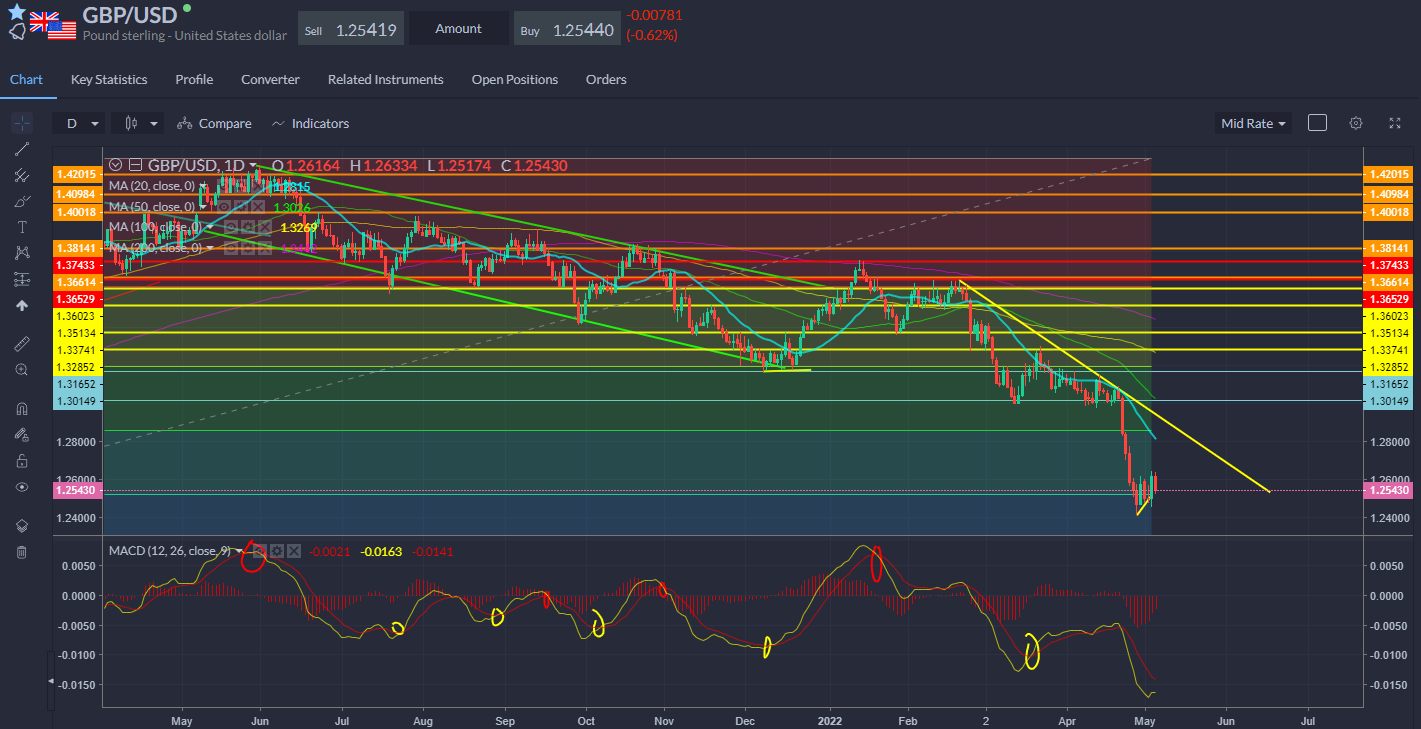

The Bank of England is expected to raise interest rates for a fourth straight meeting later today. UK inflation surged to 7% in March, the highest reading in 30 years. Bank of England governor Andrew Bailey is worried about persistently high inflation. So despite worries about slowing growth, a tight labour market gives the BoE the room to raise rates for the fourth straight meeting next week. Moreover, the BoE has a credibility problem around inflation so it needs to act. News about active QT would also be a signal, but the key is the rate hike. This would take the base rate to 1%, its highest since 2009. Does it offer any relief for sterling? GBPUSD has been crushed by the dollar steamroller – a hawkish BoE could help ease the pain – again as we move further away from peak CB divergence thinking of last month. However, given a hike is priced in, the pound might struggle for any immediate relief. Instead I think we see turbulence but a slow grind back up for sterling over the coming months.