Friday Sep 10 2021 08:24

5 min

Yesterday I talked at length about the stock trading of Robert Kaplan, the head of the Dallas Fed, which obviously posed some questions about conflicts of interest. Now the quiet uproar this caused has forced Kaplan and his pal Eric Rosengren, the Boston Fed president, to do something. Both will sell all individual stock holdings by Sep 30th and reinvest in passive funds. “While my personal saving and investment transactions have complied with the Federal Reserve’s ethics rules, I have decided to address even the appearance of any conflict of interest by taking the following steps,” Rosengren said. Ok sure, but it just has a bad smell to it.

Stocks are nursing a slight bounce after a tough week, but the downside is open. The FTSE 100 found support at the 7,000 marker, testing its lowest in almost a month but holding the recent range for the time being. US markets were lower for a 4th straight day, the Dow Jones losing more than 150 points, the S&P 500 off by half of one percent and now a little over 1% below the all-time highs. A dovish European Central Bank has eased some concerns.

The ECB did little to rock the boat, announcing a modest taper, but this was not exactly hawkish. PEPP will be conducted at a slightly slower pace, but this is all just tinkering at the edges. Stocks found some bid, the euro also rose a touch but turned around – just a hint of noise, no new direction or anything to change the mind of any investors out there. Lagarde stressed it’s not a taper but ‘recalibration’ of PEPP.

Message on rates clearly dovish and signalling they are going to look through ‘transitory’ spikes in inflation: “The Governing Council expects the key ECB interest rates to remain at their present or lower levels until it sees inflation reaching two per cent well ahead of the end of its projection horizon and durably for the rest of the projection horizon, and it judges that realised progress in underlying inflation is sufficiently advanced to be consistent with inflation stabilising at two per cent over the medium term. This may also imply a transitory period in which inflation is moderately above target.”

Although inflation forecasts were revised higher, inflation in 2023 is still seen back down to 1.5% – so no signs of a rate hike in my lifetime…I reckon I could get round a table 8 times a year with my mates and say ‘shall we buy more bonds?’ and they would say ‘yeah, let’s buy more bonds’. It’s not monetary policy, it’s just outright repression, manipulation and ultimately a form of theft.

And if you want to see what mega central bank action does – BofA reports today in their Flow Show that the annualized inflow to global stocks in 2021 of $1tn is greater than the cumulative inflow of prior 20 years ($0.8tn).

Stagflation: UK economic growth slowed sharply in July – the reopening burst bust. Output rose by just 0.1% in July, missing expectations for +0.6% expansion.

US initial jobless claims hit their lowest since the pandemic at 310k, whilst continuing claims also fell slightly.

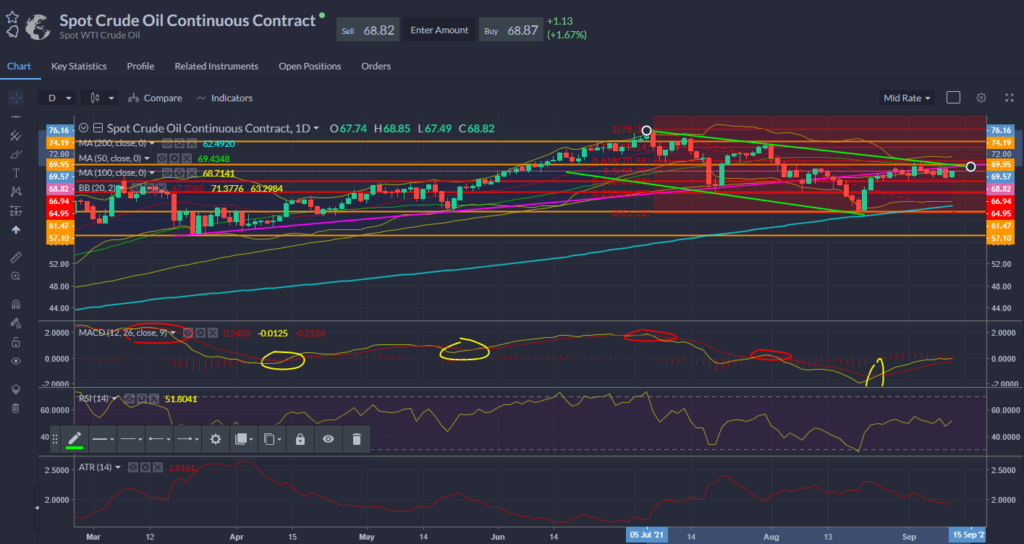

Oil weakened but then recovered some ground after China said it would auction off some state crude reserves to help refiners. WTI remains in a tight range as the market looks for fresh catalysts from the demand unknowns. Near-term downtrend remains in force.