Monday Mar 15 2021 13:41

4 min

European stocks cool, gilts are higher, Empire State manufacturing points to inflation. After rising to 6,805 in early trade the FTSE 100 has pared gains to trade broadly flat for the day.

Gilt yields on the march higher this morning…taking out new highs after Bank of England governor Andrew Bailey was on the wires this morning sounding calm about the march higher in yields.

US futures are mixed but overall showing little real impetus. Some single stock names to watch include AMC (a meme stock favourite), which is up 9% pre-market as it embarks on re-opening cinemas in California. GameStop is +4.5% or so with Koss +9.

NXP Semiconductors, Penn National Gaming, Generac and Caesars Entertainment all rose pre-market as they are set to be added to the S&P 500 as part of its quarterly rebalancing.

Airlines up as the US Transportation Safety Administration said screenings are at a 1-year high. The TSA said officers screened the most people in a single day on Friday since Mar 15th 2020. Travel is clearly picking up.

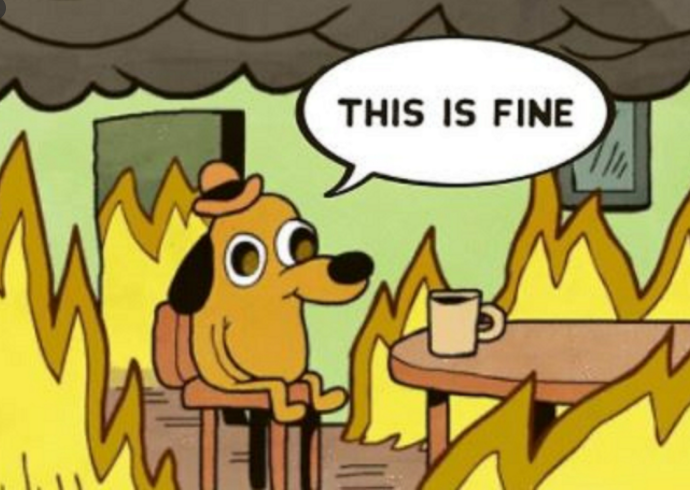

Tesla shares were flat ahead of the open after a frankly bizarre update from the company saying that Elon Musk’s title was changing to Technoking of Tesla, whilst CFO Zach Kirkhorn would henceforth be known as ‘Master of Coin’. More crypto focus or just epic trolling…? The stock remains in a bear market over 20% off its highs. All perfectly normal and I’m sure absolutely fine…

NY Fed’s Empire State Manufacturing Survey rose to 17.4 in March from 12.5 in February, which was ahead of expectations and the best reading in 8 months. Of note was the inflation component: “Input price increases continued to pick up, rising at the fastest pace in nearly a decade and selling prices increased significantly.” The report added that: “Looking ahead, firms remained optimistic that conditions would improve over the next six months, anticipating significant increases in employment.”

US 10-year yields trade a little short of Friday’s peak, hovering around 1.62% this afternoon ahead of the open. Gold trades up at $1,732 with near-term resistance offered by Thursday’s highs around $1,740.

Bitcoin entered correction territory from its all-time high over the weekend, again looking like it not a great store of value. Purely speculative accumulation going on here.

But with all these mega stimulus cheques landing the big question is where does the money go? Middle-class couples with two kids will receive up to $5,600 on top of any earnings. This excess liquidity will need to go somewhere.