Wednesday Nov 18 2020 09:01

7 min

Lockdown may be the word of the year, but rotation is the name of the game in November. The main debate taking place among traders is whether it’s got legs.

Bank of America’s global fund manager survey paints a worrying picture. Things won’t be different this time, the report seems to indicate.

The net percentage of respondents expecting a steeper yield curve is at levels similar to the most elevated extremes of recent years – eg in Oct 2008 (Lehmans), the 2013 ‘taper tantrum’ and the Nov 16 Trump election win. After each of those, whilst the yield curve did continue to steeper for a short time, it was a false alarm and the curve went on to flatten.

Investor positioning has already moved dramatically with the biggest flows into small caps, emerging markets, value sectors, banks and energy – all those seen to benefit most from the vaccine back-to-normal trade. Indeed, the percentage of respondents who think small caps will beat large caps is at the highest levels on record.

The rotation trade has the makings of a very painful one if tech bounces. Investor positioning is clearly becoming a little crowded and there are reasons to be doubtful about the duration of the rotation trade. Note yesterday saw a clawback in the opposite direction after Monday’s value bump from the Moderna news.

As per the FMS, it’s all just a little too one way right now.

But there are reasons to be hopeful:

Small caps have a lot of catching up to do (Russell 200 futs in blue vs Nasdaq 100 futs in purple and FTSE 100 futs in green in 2020)

Results from AP Moller-Maersk are encouraging for the global economic recovery. Although Q3 revenues fell 1%, earnings before nasties rose 39% year-on-year to $2.3bn. It also raised its guidance for the third time since the pandemic struck, and the second time in as many months, hiking its full-year outlook to $8bn-$8.5bn. The company also announced a $1.6bn share buyback programme to last 15 months. The company is benefitting from the increased demand for physical goods over experiences.

European markets were generally a little softer again early on Wednesday as investors looked to consolidate some of the recent gains. I would anticipate this to be more of a pause than a pullback.

WTI crude oil (Dec) was steady around the $41.50 level after the OPEC+ technical committee broke up without offering a recommendation on extending production cuts. The Committee’s recommendations will be provided to the OPEC+ meeting on Dec 1st, after the core OPEC meeting on Nov 30th.

Meanwhile, the API report showed a build in crude oil inventories of more than 4.1m barrels vs expectations for under 2m. EIA data later today seen at +1.7m. Given this API number and last week’s big EIA print, I think we are now seeing the real flip from draws to builds in inventories that will put near-term pressure on prices and force OPEC+ to extend cuts for 6 months if it not to disappoint the market.

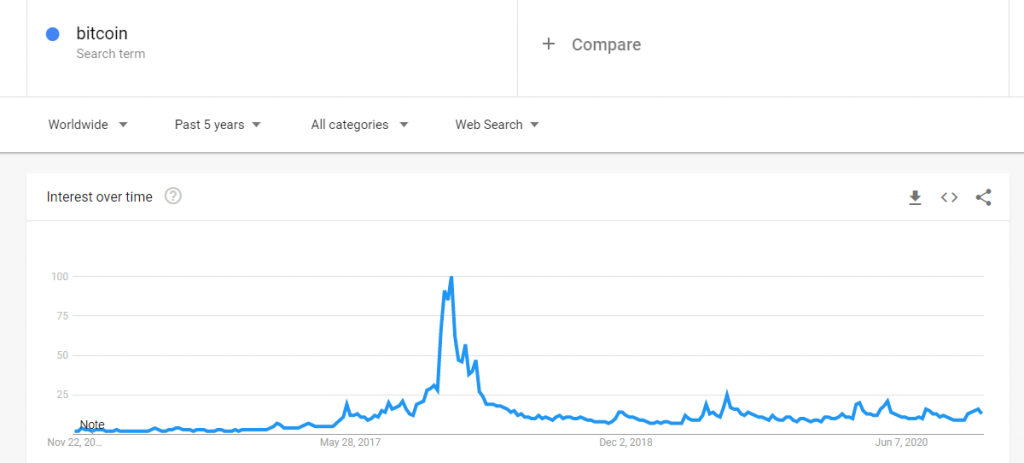

Elsewhere, Bitcoin prices continue to shoot to the moon, now surging past $18,000 overnight. What’s remarkable this time is the lack of hype around Bitcoin, as per this Google Trends survey. Why is there not the interest this time around? Too mainstream perhaps…

Are sterling traders pricing for a Brexit deal? GBPUSD moved higher with indications pointing towards a deal being done in the coming days. GBPUSD advanced to 1.3280 with the more-than two-month high at 1.33130 potentially offering near-term resistance. UK inflation rose to 0.7%, ahead of expectations for 0.5%, which offered some additional support to the pound this morning.