Friday Feb 26 2021 15:58

7 min

Travel stocks have taken a Covid-shaped battering over the past year, but things could be about to change. Is the time right to look at investing in travel shares again?

We all know the score when it comes to lockdown and travel stocks. They plummeted at the height of the pandemic, but with sensational vaccine development, approval, and rollout, they have started to respond again.

In our look at airline stocks, for example, we’ve seen Ryanair, IAG, and EasyJet shares make substantial gains across the second half of 2020 and into 2021.

The UK recently announced it had roadmap to get the country out of lockdown. That also gave travel stocks a shot in the arm. Britain’s vaccination programme has been one of the best in the world, and, if all goes according to plan, all social restrictions could be lifted by the end of June.

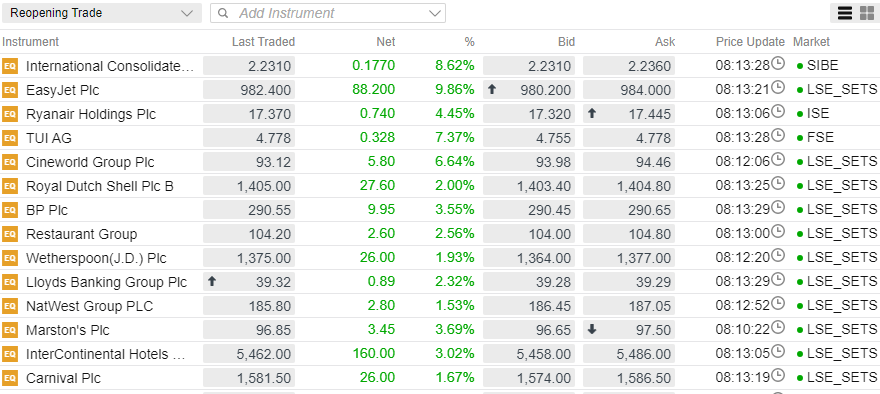

On that news, announced on Monday 22nd February, we saw some airline, travel agent, and hotel stocks jump:

Here you can see how sensitive travel stocks are to a reopening timeline with the shares leaping in the early part of the London session immediately after Johnson unveiled the roadmap. It’s not just air carriers whose stock price has benefited. German travel group TUI saw stocks rise by over 7%, while IHG rose at a more subdued, but still positive, 3%. Even cruise liner Carnival, which operates in a sector that has been bludgeoned by the ongoing pandemic, saw a small stock price jump.

What we don’t know at this stage is how international travel will be affected. Will countries be open to UK visitors that have been vaccinated? Will borders remain closed to all but essential travel while they sort their own vaccine regimes out? Time will tell.

Other stocks have also increased in value across the year. Expedia, for example, has rallied more than 200% since its March lows. Airbnb, however, has had a bit of a wobble, as its latest earnings call, its first as a publicly traded company, failed to match expectations.

Still a bit of a mixed outlook. But in the words of Boris Johnson, we’re looking at a crocus making its way through the winter frost. A thaw is on its way, which may lead to a real rally in travel stocks.

Of course, this is the markets. Anything can happen – especially in the topsy-turvy, pandemic-ridden world we live in. Make sure you do your proper analysis when looking at travel stocks, and make sure you’re picking the right stocks for you.

EasyJet

EasyJet has so far regained 44% of its value since grounding most of its fleet and restricted flights thanks to the pandemic. What it does have going for it is very strong cash reserves, enough to keep going for a year and half under current lockdown restrictions, plus its balance sheet has been backed by a £.15bn government loan.

While uncertainty still remains in the airline industry, EasyJet was one of the UK’s most popular pre-pandemic carriers. Price-conscious tourists may choose to return to EasyJet to whisk them away to warmer climes. This looks like it’s already happening. Upon PM Johnson’s proclamation the UK is on a “one way road to freedom”, EasyJet UK outbound flight bookings grew 337% while package deals took fight, soaring to 630%, compared with the previous week. You probably wouldn’t expect that to be sustainable, but it’s an indicator that short-term gains could be there with EasyJet stock.

Expedia

As we touched on earlier, Expedia stock has enjoyed 200% growth since its collapse in March. It is not yet back up to pre-pandemic levels, but few if any are anywhere near close to that level. But why is Expedia of potential interest to investors interested in travel stocks?

One thing there is a big cost cutting programme coming. Now, this might not be music to all investors’ ears, but there is a reason why that may pique your interest. In 2019, Expedia’s operating income totalled $903 million. CEO Peter Kern suggested in December, Expedia will be looking at cutting between $700-750m in fixed costs, and a further $200m in variable revenue cuts based on 2019 levels. If it can pull this off, then Expedia’s earnings potential may effectively double.

With lower travel restrictions in places like the UK in the rest of the year, Expedia may be able to secure more advance online bookings now too, as holidaymakers prep for trips the second half of 2021. This could very well support Expedia share price growth. We’ll have to wait and see but given the stock has already risen dramatically across the year, it might be worth looking at for those interested in travel stocks.