Monday Jun 22 2020 14:33

5 min

Trump knows that antagonising China is a dangerous game. But in the run up to the election, it’s also a political necessity.

Before the coronacrisis, there was already a perfect storm of economic and security disputes brewing between the US and China. Covid-19 compounded all the existing issues as well as adding a whole new dimension to the rift. Tension is escalating on all fronts.

Phase one of the trade deal is dead. The promises made by China – purchasing at least $200 billion in US exports over two years – looked unrealistic from the get-go. But the virus means meeting phase one’s targets will be downright impossible. Throw in that China is already buying more from competitors (its imports from Brazil are up 35% on May 2019) even in an economic downturn, and any revival of the Trade Deal before the Election look dead and buried.

The tech war has entered a period of unprecedented turbulence. Trump continues to affirm that Huawei threatens national security, upping the ante in May when a new rule was issued barring Huawei and its suppliers from using American technology.

The Trump administration is reportedly exploring several measures that could punish China for its handling of the virus, including suing the Chinese government for reparations and cancelling US debt obligations to the country. Meanwhile, China has ordered its state-owned enterprises to stop purchases of US farm products after the US threatened to withdraw its special status treatment for Hong Kong – itself a response to China’s new security law for the territory.

The President was aiming to run his campaign based around strong economic performance, and failing that, a successful response to the pandemic. As both these options become increasingly difficult to achieve, China must serve as the scapegoat on which Trump can pin his administration’s failings.

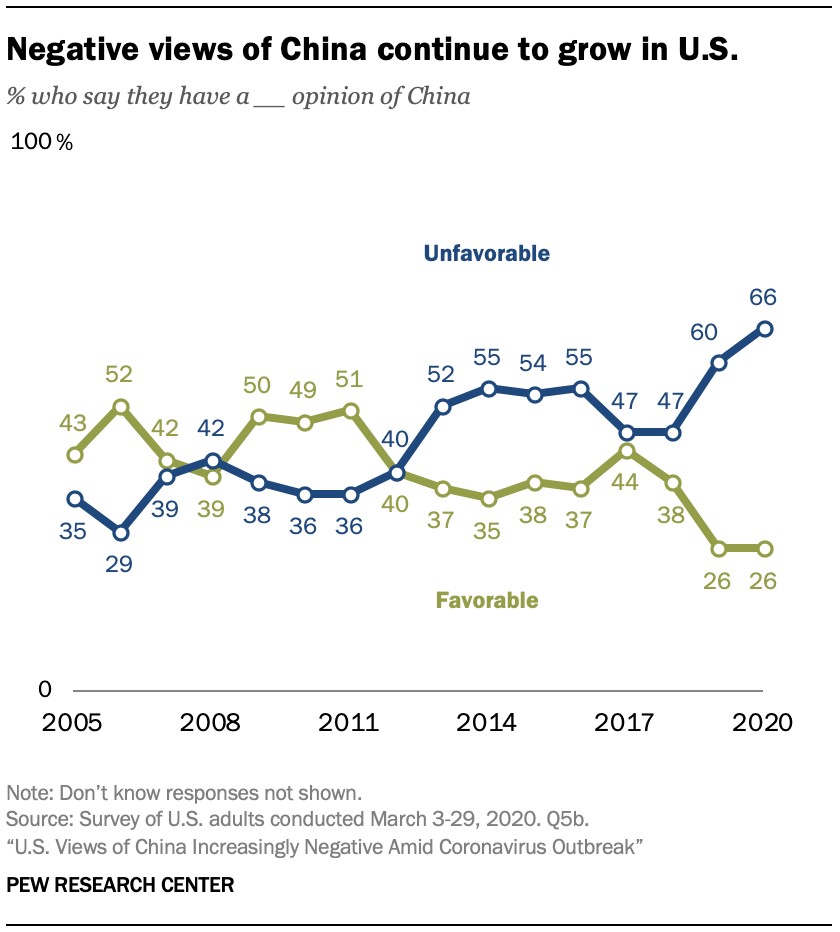

Usefully for Trump, the American people aren’t too fond of the Chinese right now either. A Pew Research Center poll from April suggests that Americans have increasingly negative views of the country with two-thirds now holding an unfavourable opinion towards China.

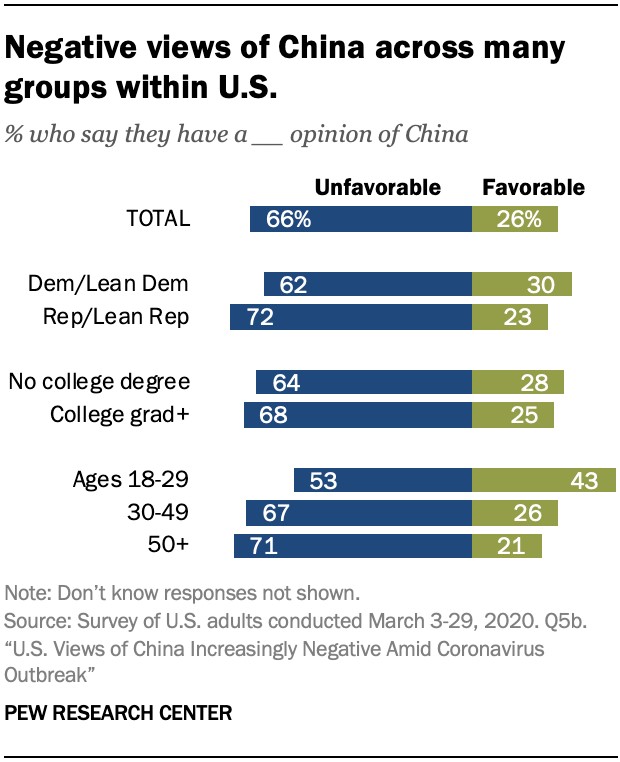

This sentiment is widespread across a range of groups in America, which is unusual in an ever more polarised electorate.

A Republican ad campaign has been launched proclaiming, “One nation deserves the blame: China”, while the America First Action SuperPAC says it’s spending around $10 million on ads in swing states condemning Biden over China.

Each also believes they can use China to score personal points against the other candidate.

This fight isn’t without its risks however.

As we know though, Trump is no stranger to risky political moves. With winning the election his top priority and alternatives running out, the President will hold onto the anti-China card for dear life to avoid being trumped by Biden.

The battle of ‘who’s tougher on China’ shows no signs of relenting. Both candidates will be forced to push harder and harder to have the last word on an issue which has galvanised such a strong reaction among the American public.