Friday Feb 12 2021 09:23

4 min

European stock markets got off to a soft start on Friday as investors sounded a cautious note to end a week marked by a general lack of direction. The S&P 500 rose slightly on Thursday to eke out a fresh record high with the Nasdaq up 0.38%. Stock markets across Asia are closed for the lunar new year celebrations. The NYSE will be closed on Monday for the Presidents’ Day holiday.

Britain’s economy held up better than expected in the final quarter of 2020, but the outlook for the start of 2021 is a little bleak. Gross domestic product (GDP) grew by 1% after Q3 growth was revised to +16.1%. Despite this, the economy is still 6.6% smaller than it was before the pandemic and restrictions that remain in place are crippling. Vaccines might get the economy roaring again, but only if the government has the bottle to end restrictions as quickly as possible.

Cue Jet2, which has raised £422m in a placing because of uncertainty over travel and the summer season. Executive chairman Philip Meeson said the funding will “will provide sufficient liquidity on an extended and likely unpredictable shutdown basis to deal with this continually challenging trading environment”. The government has been striking a very downbeat note on booking summer holidays despite a startling fall in cases and rapid vaccinations, which has many worrying that restrictions won’t be dispensed with as quickly as they should. Shares fell 6%.

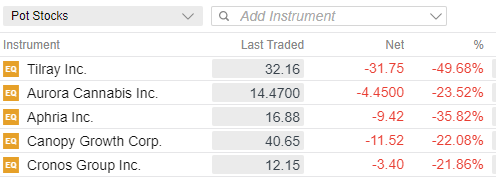

Instant comedown: pot stocks reversed gains as a Reddit-fuelled rally unwound in spectacular fashion. Tilray declined 50% – its worst day on record – having jumped 50% the previous day. Canopy Growth, the largest stock, fell 22%. It’s schizophrenic market we trade in these days. Meanwhile, US regulators are probing whether market manipulation or other forms of misconduct was behind the rally in GameStop last month.

Disney shares moved higher after another blockbuster quarter for its streaming service offset losses at its parks. Revenues from parks fell 53% due to pandemic closures, but subscribers to its Disney+ streaming platform reached almost 95m. Including Hulu and ESPN+, Disney’s paid streaming membership now exceeds 146 million. It is catching up with Netflix quickly as it throws some serious effort into new content and has the advantage of established brands and intellectual property like Star Wars. Average monthly revenues from Disney+ subscribers fell to $4.03 from $5.56 however, after the launch of its Disney+ Hotstar service in India and Indonesia last year. Whilst the outlook for its streaming service is positive, for parks it will be determined by the rate of vaccination and opening up international travel.

Elsewhere, the dollar found some bid in early trade on Friday as bulls seek again to reverse the downtrend. GBPUSD retreated to test trend support under 1.3780, whilst EURUSD tests 1.210. Oil is a touch weaker after a downbeat report from the IEA, which said oil demand is expected to fall by 1 mb/d in the first quarter from already low Q4 2020 levels.

Bitcoin hit a fresh all-time high a little short of $49k after BNY Mellon and Mastercard delivered more of the corporate support + mainstreaming that has been building in recent months. BNY will become the first big national custodial bank to offer custody services for crypto assets. Cryptocurrencies are becoming part of the mainstream, the bank says. Mastercard will start supporting some cryptocurrencies later this year, which of course follows PayPal’s big announcement last year that stoked the bull market in the fourth quarter. Hot off the heels of Tesla’s $1.5bn investment in Bitcoin these developments, these developments are giving more juice for the rally.

Chart: The FTSE 100 has traded in a tight 100-point range in February