Thursday Nov 11 2021 16:07

5 min

The sparkle falls off the House of Mouse as Disney posts a fourth quarter earnings miss in its latest financial report.

Disney latest earnings failed to meet Wall Street expectations when they were published after the closing bell yesterday.

Fourth quarter revenues and earnings-per-share both came in below forecast levels. Disney joins Apple as one of the megacaps missing earnings this reporting season.

The key takeaways from the House of Mouse’s latest financials are:

A slowdown in streaming subscribers for the entertainment conglomerate’s Disney+ service is on the cards, despite numbers falling in line with Disney estimates. During the last quarter, Disney added 2.1m subscribers bringing the total up to 118.1m.

Comparatively, Netflix added 4.4m subscribers according to its last earnings report.

Average monthly per-subscriber revenues are also down about 9% year-on-year. As of Disney’s last reported figures, the company earns $4.12 per month from Disney+ subscription fees. Total sub numbers across all of the streaming services owned by Disney, including ESPN+ and Hulu, reached 175m.

Direct-to-consumer revenues rose 38% to $4.6bn in Disney’s fiscal fourth quarter. Content licensing and sales revenues also increased by a healthy 9% to $2bn. However, due to higher marketing and operational costs, content licensing and sales said it was operating at a $65m loss for the quarter.

Cinemas have only recently started to reopen around the world. Only a few Disney properties made it to theatres but still offered decent returns. Fall Guy, Black Widow, and Shang-Chi and the Legend of the Five Rings were the main Disney releases of the quarter. Two of these fall under the Marvel umbrella. Marvel films tend to be something of a cash cow for Disney.

Attendance at Disney’s theme parks across the world picked up as vaccinations took hold globally in H2 2021.

Revenues across Disney’s parks and cruises segment showed a 26% increase to $5.45bn – despite $1bn in costs accrued by bringing the business’ leisure facilities up to COVID-safe standards. As it stands, all Disney parks, resorts, and cruise liners are operational again.

Pandemic-incurred travel restrictions have been lifted by the United States. Disney is anticipating the return of international visitors to its parks, especially those in California and Florida.

“We’re seeing really great demand. Very thrilled with our demand. Not only internationally but especially domestically, but particularly, again, because of our guest experience improvements at numbers that are very, very strong and very, very healthy,” Disney CEO Bob Chapek told CNBC. “So not only do a lot of people want to come but when they come, they want to really engage in Disney.”

Disney appears to be the next brand to be exploring the metaverse after Facebook’s parent changed its name to Meta last week.

In a post-earnings call to analysts, Chapek touched on Disney’s plans to blend all of its properties and content into a seamless multi-channel customer experience.

“Suffice it to say our efforts to date are merely a prologue to a time when we’ll be able to connect the physical and digital worlds even more closely, allowing for storytelling without boundaries in our own Disney metaverse,” the Disney CEO said. “And we look forward to creating unparalleled opportunities for consumers to experience everything Disney has to offer across our products and platforms wherever the consumer may be.”

In the near future, however, the focus appears to be ramping up the content offer across Disney’s various streaming platforms. Most of this won’t land until the fourth quarter of 2022.

“Q4 will be the first time in Disney+ history that we plan to release original content throughout the quarter from Disney, Marvel, Star Wars, Pixar, and Nat Geo, all in one quarter. This includes highly anticipated titles such as Ms. Marvel, and Pinocchio,” Disney Chief Financial Officer Christine McCarthy said on the company’s earnings call.

However, subscriber growth could be limited to “low single-digit millions” according to Disney estimates.

This could affect Disney’s share price. The stock is already down nearly 8%. Atlantic Equities has downgraded Disney in light of slowing subscriber numbers. The investment bank has slashed Disney’s guide price from $219 per share to $172.

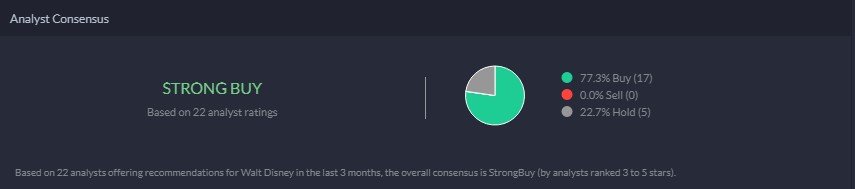

Despite this underperformance, Disney still holds a strong buy status according to the Markets.com Analyst Consensus tool. This is based on 22 analysts offering recommendations on the stock over the past three months:

Unsurprisingly, given this quarter’s earnings miss, news sentiment on Disney is bearish: