Thursday Jul 29 2021 09:13

5 min

Mark Zuckerberg’s social media behemoth enjoys a very strong record, but headwinds may blow strong across the rest of the year.

Facebook posts its fastest-growing quarter since 2016 with revenues expanding 56% in the quarter ending June 2021.

According to its results, Facebook notched up a 47% rise in its average price per ad. It also increased the volume of ads it delivered by 6% year-on-year.

That’s quite an interesting dichotomy. While revenues generated from its ad service is up massively, the number of ads delivered hasn’t kept pace. This may feed into problems down the line. It could also ultimately show how much more Facebook is currently charging for ad space.

Monthly average users (MAUs) also grew. Now, approximately 2.9 billion customers regularly use the social media network each month. Daily active users (DAUs) total 1.91bn, in line with Facebook expectations.

Across its multiple apps, which includes Messenger, WhatsApp and Instagram, Facebook’s total users clocked in at 3.51bn for the quarter – up from the 3.45bn registered in Q1.

Let’s have a look at the overall breakdown of Facebook’s Q2 2021 numbers:

Of course, ad revenues are Facebook’s chief cash generator, but it also has a variety of other products which bring in cash. Its “Other” segment covers commercial hardware, including Oculus Rift VR headsets. Revenues generated from this sector of Facebook’s business fell below the expected $685.5m at $497m.

Free cash flow also dropped. Estimates suggested it would total $9.08bn for this quarter. In reality, the figure was $8.51bn.

Regarding its 2021 H2 performance, Facebook said it expects “year-over-year total revenue growth rates to decelerate significantly on a sequential basis as we lap periods of increasingly strong growth.”

This is essentially unchanged from the guidance issued at the end of Q1.

A lot of Facebook’s future direction comes from what CEO Mark Zuckerberg calls the “metaverse”.

Zuckerberg describes this as “a virtual environment where you can be present with people in digital spaces.”

How this differs from the current experience is really yet to be seen. A new team has been formed at Facebook HQ to develop this vision into a tangible reality. Zuckerberg is certainly optimistic.

“In the coming years, I expect people will transition from seeing us primarily as a social-media company to seeing us as a metaverse company,” he said.

Advertising will probably still play a key role here, but Facebook may continue to develop its VR capabilities in order to pull off this project.

The key thing the markets took away from Facebook’s call with analysts and journalists was a slump in revenue growth. Facebook share prices fell 5% after the company’s guidance announcement, showing slowing revenues will be a thorny issue for investors moving forward.

This mirrors other tech giants like Tesla and Apple who experienced similar share price dips after reporting this quarter’s earnings, albeit for different reasons.

The social media giant said ad headwinds are most likely to going to blow strongly throughout the rest of 2021. Regulatory and platform changes were cited, as well as Apple’s iOS 14.5 update, which allows users more flexibility in how apps track their activity.

Rivals Snap and Twitter have seemingly managed to navigate their way through the iOS changes. It’s now up to Facebook to do the same.

Then there is government scrutiny and lawsuits against Facebook. A recent antitrust complaint from the Federal Trade Commission was dismissed by judges, alongside a separate complaint, filed by 48 states attorneys. The FTC, however, is determined to fight this and give Facebook another day in court. It has until August 19th to alter its complaint.

President Biden is apparently no fan of Facebook either. The sitting president has stated that Facebook is not doing enough to combat the spread of misinformation on its platforms, even going so far as to say, “they’re killing people”.

Despite the 5% post-report drop in pre-US market trading Facebook shares experienced on Wednesday, 2021 remains a strong year for price action.

Facebook shares are up 37% since January, beating the S&P 500’s 17% rise in the same period.

Analyst consensus is a strong buy:

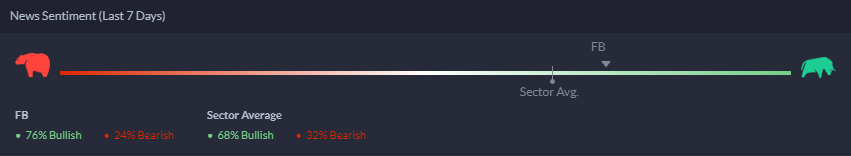

News sentiment is also bullish, placing Facebook higher than the sector average:

So, a strong quarter for Facebook. What’s next? Challenges will likely intensify, but the onus is now on Zuckerberg et al to stick to their forecasts and keep things in line with market expectations as the year progresses.

To see which large caps are still due to report on Wall Street this season, make sure you check out our earnings calendar.