Thursday Oct 28 2021 10:07

4 min

Google parent company Alphabet comes out swinging in Q3, notching earnings and revenues beats for a second consecutive quarter.

Alphabet posts another strong quarter with revenues and earnings per share beating Wall Street estimates.

This is the latest third quarter earnings report from a FAANG stocks member. Facebook and Netflix have already reported their Q3 financials.

Check out the Google owner’s key stats below:

However, the search engine and web services firm did also record couple of revenue misses from some of its key cash generators.

Despite not meeting earnings, Google Cloud grew at a rate of 45% quarter-on-quarter. While YouTube revenues did not meet expectations, they showed year-over-year acceleration. In Q3 2021, YouTube ad revenue came to $5.04 billion. As you can see from the above, over $2bn was generated from YouTube advertising in the third quarter y-o-y.

Total revenue growth, incorporating all of Google’s services and networks, came to 41%.

Google’s profits came to $21bn – three times higher than pre-pandemic records. Operating losses for the sector were halved from $1.2bn to $644m.

Advertising generated $53.13bn across Alphabet’s brands. That’s a major increase over the $37.1bn recorded in the third quarter of 2020.

Alphabet shares, which remained fairly flat after the earnings call, are up about 57% across the year. At the time of writing, however, they had gained nearly 5%.

Much like FAANG stock contemporary Facebook, Alphabet noted the impact of Apple’s latest privacy update on money stemming from YouTube advertising. However, the update’s effects were more muted compared with Mark Zuckerberg’s social media platform.

In a call with analysts, Ruth Porat, Alphabet’s finance chief, said that the new privacy features had a “modest impact on YouTube revenues.” She added that “focusing on privacy has been core to what we’ve been doing consistently.”

The Apple App Transparency Tracking abilities in the iO4 operating system means users can limit how they are tracked. Customers can choose to essentially ignore a lot of ad targeting now. While this is bad news for the likes of Snap and Facebook, Google and Alphabet are less concerned. They own the Android operating system where iOS updates do not apply.

But according to Alphabet Chief Business Officer Philipp Schindler, the retail segment of Google and YouTube’s ad matrix generated the most returns. Some regions experienced a fourfold increase in Google shopping activity this quarter Schindler said.

Bricks-and-mortar isn’t dead. Instead, omnichannel [shopping] is in full force,” said Schindler in an analyst call, noting that cash flow from this sector was up 40% across the third quarter.

Alphabet has caught the green bug. Chief Executive Sundar Pichai says Google campuses will continue to up their environmental efforts. Pichai said the search engine will operate on renewable, carbon-free energy by 2030.

Google Maps will also be updated to offer drivers an eco-option, basically outlining the most fuel-efficient route to their final destination. Additionally, Google Cloud users will also be able to track their carbon footprints using data captured by Google services.

Google is also planning to build a $1.2bn office complex in New York City, presumably designed and built using environmentally-friendly materials. It is also planning to refurb its California campus using the same green building philosophy.

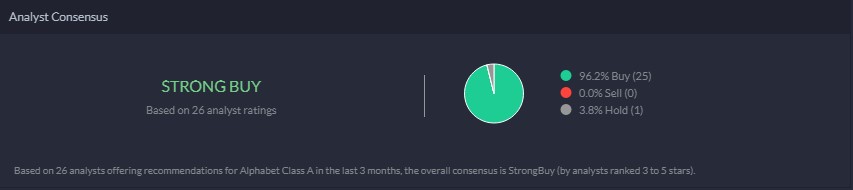

What’s the Alphabet market consensus?

According to the Markets.com analyst consensus tool, Alphabet holds a strong buy rating:

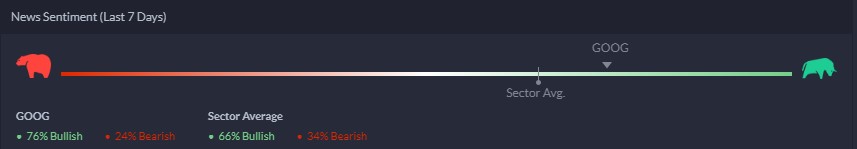

News sentiment shows the media thinks Alphabet is on a bullish footing too:

US Q3 earnings season is in full swing. Stay tuned for more updates. In the meantime, check out our earnings calendar to see which megacaps are reporting and when.