Wednesday Aug 4 2021 15:27

4 min

Alibaba misses earnings estimates but the Chinese eCommerce giant has plans afoot to restore investor confidence after reporting fairly disappointing quarterly results.

For the first time in two years, Alibaba earnings fell below market estimates. The headline is that the Chinese government’s ongoing crackdown on the internet sector has taken its toll on the eCommerce firm. There is still more at play here though.

In its latest quarterly report, Alibaba reported revenues of 205.75 billion yuan ($31.83bn). That’s a 34% increase year-on-year, but still came up shy of the 209bn yuan forecast by market analysts.

Subsequently, net profits slid 8% compared with the previous quarter.

Alibaba also reported 45.1 billion yuan in net income, or about $7 billion, slipped from 47.6 billion yuan

The company swallowed an 18 billion yuan ($2.8bn) antitrust fine earlier this year. Alibaba, like rival Tencent, has recently come under intense scrutiny from Chinese authorities. They believe the pair, which have so far reused to work together, are essentially establishing monopolies in their respective spheres – hence the major fine levelled by the CCP.

But the drop in revenue also comes from investment in an effort to enhance and expand Alibaba’s offer.

“We are investing our excess profits and additional capital to support our merchants and invest in strategic areas to better serve customers and penetrate into new addressable markets,” said Group Chief Financial Officer Maggie Wu in a statement.

However, it goes without saying the fines and shifting regulatory environment in China has caused consternation for Alibaba’s executive team.

“We are in the process of studying the regulatory requirements, evaluating the potential impact on our relevant businesses,” Daniel Zhang, Alibaba’s chairman and chief executive, told analysts on Tuesday. “We will respond with action.”

To reassure investors, Alibaba has revealed it plans to increase its shares buyback plan to $15bn from its current $10bn level.

According to Zhang, Alibaba plans on reinvesting incremental profits into numerous business areas. This includes more cash towards its technology development and ventures, as well as user acquisition, infrastructure, and methods to lower its merchant partners’ operating costs.

For example, instead of funnelling more users through flagship app Taoboa, the eCommerce firm said it plans to take a multi-app approach to grow new business. Alibaba said this would help it reach customers in rural China as well as lower-tier cities outside of the mega metropolises up and down the country.

“We are working on building a more complete app matrix to better serve the different needs of different consumers,” Zhang said.

The newly-launched Taoboa Deals app, built around budget eCommerce for customers with tighter budgets, is a good example of this. Since going live, Taoboa Deals has accrued over 190 million annual active users in just 16 months.

“When we plan our incremental investment, we always focus on value creation,” Zhang said. “We think that for other companies who are continuously loss-making but still try to enlarge their scale by subsidies, at the end of the day, they have to let the market see the real results.”

Alibaba shares have been sliding in recent weeks as part of the broader fall in Chinese tech stocks. At the time of writing, however, shares were back in the green, tracking 2% upwards.

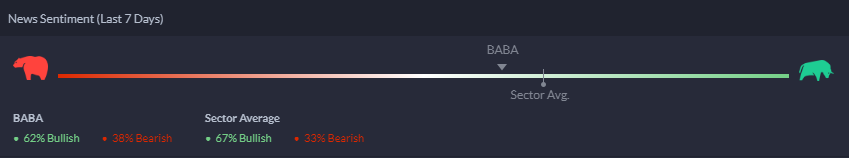

Market consensus is still positive about Alibaba shares, as per the sentiment tracker on the Markets.com trading platform:

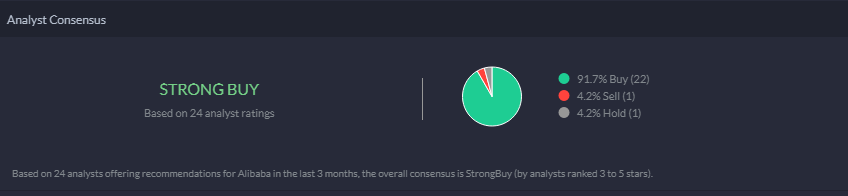

The analyst recommendations tool puts Alibaba as a strong buy:

But all depends on how successful Alibaba’s investment plans are – and how successfully the company can navigate a changing regulatory landscape.

To see which large caps are still due to report on Wall Street this season, make sure you check out our earnings calendar.