Wednesday Oct 21 2020 14:39

3 min

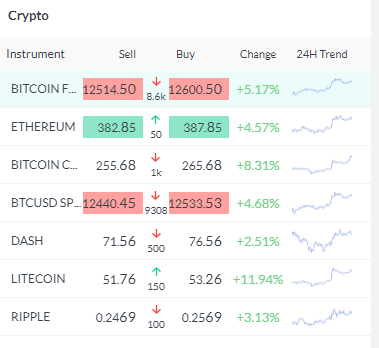

Bitcoin rose to its highest level in over a year, hitting levels not seen since July 2019 after PayPal said it will enable cryptocurrencies on its platform.

Initially, it will allow users to buy, hold, and sell Bitcoin, Ethereum, Bitcoin Cash, and Litecoin in the PayPal wallet. It will also enable users to spend cryptocurrencies for purchases at its 26 million merchants worldwide.

It is hard to know for sure right now what it means, but because of PayPal’s sheer scale and reach I would think the development may be a potential game-changer in the mass use of cryptos, though of course there are many other barriers to its widespread consumer and business adoption.

Mainstreaming in this way should boost the usage case and this would tend to underpin renewed bullishness around the crypto space, though we are at pains to stress that nothing is certain when it comes to cryptocurrencies.

The news rekindled bullish spirits in the crypto space today.

Meanwhile, GBPUSD rallied through 1.3140 to reach its highest since September after some positive news around Brexit.

Cable has risen more than 2 big figures from yesterday’s lows so far, underlining the pair’s sensitivity to headlines right now.

There had been strength building all day and then news crossed the wires in the last few minutes that Brexit talks are to restart with the aim of a deal by November 13th.

Clearly in mind is the informal meeting of heads of state in Berlin scheduled for Nov 16th, by which point Macron, Merkel et al will want to have a text to sign off. There has definitely been a narrowing in the gap since the UK shut the door last Friday. This is a positive and indicates that a deal is still more likely than not, though we would be cautious about assuming anything at this stage.

Elsewhere, it’s been a rather downbeat day for equities in Europe.

The FTSE 100 is close to lows of the day and near the September lows around 5800 heading into the close, down -1.3% and not helped by sterling strength. Euro Stoxx 50 trips the middle of the range near 3,200, down -0.66%.

US equities have opened on a firmer footing with the S&P 500 +0.5% and the Nasdaq +0.7% and recovering 11,600. Snap shares +30% after a blowout quarter saw +18% y-o-y rise in users and +4% from the July quarter. More time at home has clearly left consumers spending more time on social media channels like Snap. Gold is firmer above $1,920 and facing important resistance at the 50-day SMA at $1,925.