Thursday Apr 28 2022 08:35

9 min

The trading activity of Archegos was kind of wild. Archegos Capital Management “engaged in manipulative trading that impacted multiple securities”, the SEC alleges in a filing following the arrest by Feds of founder Bill Hwang and CFO Patrick Halligan. They’ve been charged with racketeering, fraud and market manipulation.

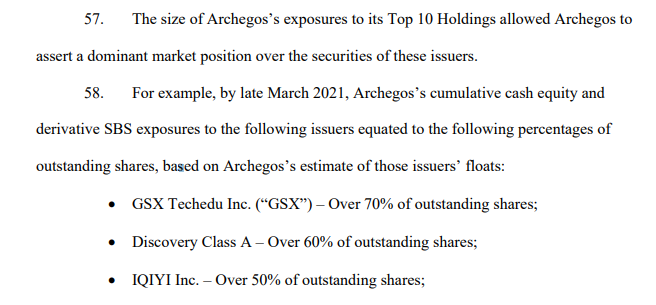

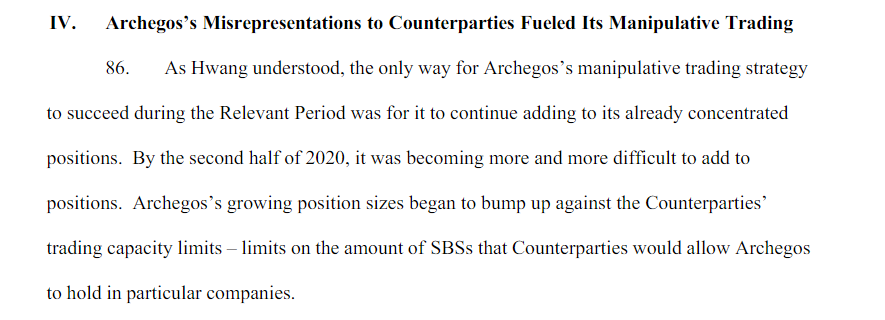

The charge sheet focuses on the use of Security-Based Swaps (SBS) a synthetic derivative product used by Archegos to mask its true exposure to any one stock, as well as spreading its trading across multiple counterparties to further hide its activity. The accusation is that by hiding this exposure it left counterparties without an accurate view of how much exposure Archegos had to a security – which in some cases amounted to 70% of the issued share capital*. This meant they were not suitably hedged to the synthetic positions. Counterparties were very often relying on Archegos to be truthful – which it clearly wasn’t.

In fact, Archegos “intentionally and recklessly gave materially false information to counterparties, or omitted material information, regarding the concentration and liquidity of its portfolio”. If you recall this left Credit Suisse and others holding the bag as it eventually collapsed under the weight of its own leverage.

As for the trading activity itself….is it terribly illegal? Once it started getting close to owning 5% of a company’s stock, at which point you need to declare your holding, Archegos would start buying SBSs to mask who the real owner was. It also “purposefully engaged in [a] series of transactions and trading activity in the pre-mkt to ‘set the tone’ when liquidity was low, during day by bidding up prices and in the last 30 minutes of the trading day when maximum impact could be achieved on closing or ‘mark the close’. I mean, he was long in a very concentrated way which was dumb. It looks like the dumbest strategy ever…but is it illegal to buy more stock or SBSs to add to your long positions…whatever time of day it was? I don’t know but there is probably (?) lots of this happening as we speak. Misleading counterparties was clearly not OK, but carefully timing trades?

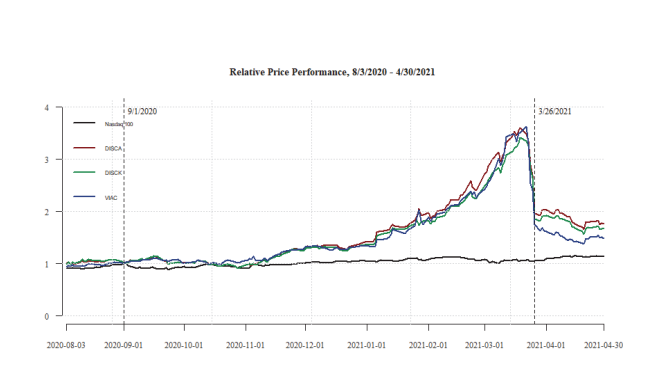

These efforts were intended to enhance the share price of the top 10 holdings at strategically important moments “in order to induce others to purchase securities, to stave off price drops or to enhance end of the day pricing including for margin purposes”. All this explains some of the crazy intraday moves in some of these stocks. Inducing others to buy by artificially inflating an asset price is clearly not OK, but the charge sheet basically says they were building positions at various times of the day. It’s hardly a crime to want the stocks you own to go up. Maybe…it was also very clear when it all unwound that there were no other buyers of the stocks at those elevated price – Archegos had become the market in effect.

The sheet also alleges Hwang carried out transactions “solely intended to maintain certain prices and to counteract selling pressure”. Ok maybe this sounds a little like manipulation, but again why shouldn’t they buy to defend a price level?

The document then goes on to say Archegos shifted from highly liquid large cap companies to less liquid, China-based issuers, as well as smaller cap US media and tech companies. Is that really a crime? This just sounds like a bad investment decision.

Anyway, I would recommend reading the document itself. Here are some highlights.

The trading strategy was kind of wild:

“Its long positions tended to be both highly leveraged and highly concentrated. Archegos traded on margin extended by its Counterparties, maintaining leverage ratios of between 400% and 700%, and sometimes as high as 1000% (meaning if it invested $100 in capital, it had $1000 in exposure). It took long positions in only about 100 issuers, with typically between a third and half of its overall gross exposure concentrated in just its ten largest positions.”

And very concentrated:

Hwang was the market for many of his stocks. Archegos’s trading of the equities of and SBSs referencing its Top 10 Holdings frequently exceeded 20%, often reached 30%, and even surpassed 40% of certain issuers’ daily trading volume.

“Hwang knew that Archegos could impact markets through the exercise of its sheer buying power. For example, in June 2020, when asked in a text message by an Archegos analyst whether ViacomCBS’s stock price improvement that day was “a sign of strength,” Hwang responded, “No. It is a sign of me buying,” followed by a “tears of joy” or laughing emoji.”

The strategy was to squeeze shorts (isn’t that what Reddit did?). We knew this at the time, but was it illegal? As of March 29th 2021 short interest stood at 18% of Viacom and 28% of Discovery shares.

It looks like he set up a Ponzi scheme and he was the victim. The only way the strategy would work would be to continue adding to its already bloated positions.

We know how it all unfolded…but what was the CRO doing all day long?

*The 70% holding was in GSX Techedu, under SEC investigation for artificially inflating revenues

This is not Hwang’s first rodeo: In 2012 he, on behalf of Tiger Asia, pled guilty to criminal insider trading charges.

Meanwhile.,. Tesla shares steadied after the 12% decline in the previous session. Twitter shares declined another 2%. Musk continues to do Musk things

Earnings aplenty…Barclays shares rose after profits beat expectations at £1.4bn for the quarter, though this was 18% below last year on higher litigation and conduct charges. Revenues rose 10% to £6.5bn. Expenses rose to £4.1bn from £3.6bn a year ago, which included £500m for litigation and conduct charges.

Spotify added 2m users – Joe Rogan to thank? MAUs grew 19% to 422 million whilst its Premium Subscriber base grew 15% to 182 million.

Boeing stock dropped to its lowest in well over a year as it missed on the top and bottom lines. Revenues came in at $14bn, some $2bn short of expectations, with losses at $2.75 per share against the expected loss of 27 cents a share. Management blamed higher costs in both commercial and defence sectors and the war in Ukraine. Boeing also said it is pausing production of its 777X plane, deliveries now not expected to start until 2025.

Visa beat on revenues and earnings…spending is strong, especially in travel. Shares rose over 6%.

Facebook shares soared in the after-hours market by 18% despite slowing revenue growth as the company reported better-than-expected daily active users and profits that beat Street expectations. The results clearly show the headwinds faced by Meta but there’s been a lot of negativity already backed into the shares. This relief should boost sentiment around the Nasdaq later – futures are higher this morning after the cash market stabilised yesterday following Tuesday’s rout.

European stock markets are broadly higher in early trading, with the FTSE 100 +0.8% near 7,500 and the DAX up more than 1.5% around 14,000. Stocks in the US were steady yesterday, Asia solid overnight boosted by Facebook. Amazon, Apple and Twitter report later today.

FX

Euro makes a fresh 5-year low, no respite in dollar buying. DB – “This is the EUR’s problem (versus the USD) in a nutshell: Based on market pricing, even if the Fed stops tightening in June 2022, the US is expected to have higher rates than the EUR through the whole of 2023.” Does the ECB have the cojones to raise rates? low for sterling too with GBPUSD looking at a 1.24 handle briefly this morning before paring losses.

Remember the Fed comes next week so it’s blackout time, but this from BofA: “The Fed is likely to shift from a source of volatility to one of more stability over coming months. A more certain Fed should help lower rates vol and provide confidence to the market. Greater rates certainty should give investors more comfort to lean long duration”. US GDP data for Q1 is today.

Meanwhile the yen has sunk to a 20-year low against the US dollar as the Bank of Japan reiterated its yield curve control policy, saying it ‘will offer to purchase 10-year JGBs at 0.25 percent every business day through fixed-rate purchase operations, unless it is highly likely that no bids will be submitted’. USDJPY rushed to 130, a level that could spark intervention by the BOJ.