Tuesday Apr 27 2021 14:49

4 min

So far it looks very much like profit margins are holding up, earnings are rising fast at most companies and earnings expectations are doing fine. Wednesday sees the big one: Apple.

Shares in Apple are up just 1.5% YTD but the stock has nevertheless enjoyed a stellar run up in the last 12 months and in the last month has rallied from a trough around $116 to $134 by Tuesday to get back close to the all-time high. The pandemic has been good for Apple but the value rotation has crimped gains this year. But this remains a go-to stock with immense potential and expectations are not too high for once, albeit with the stock trading at about 36x trailing 12-month earnings it’s looking pretty rich. Here are a few things to look out for from Wednesday’s Apple earnings.

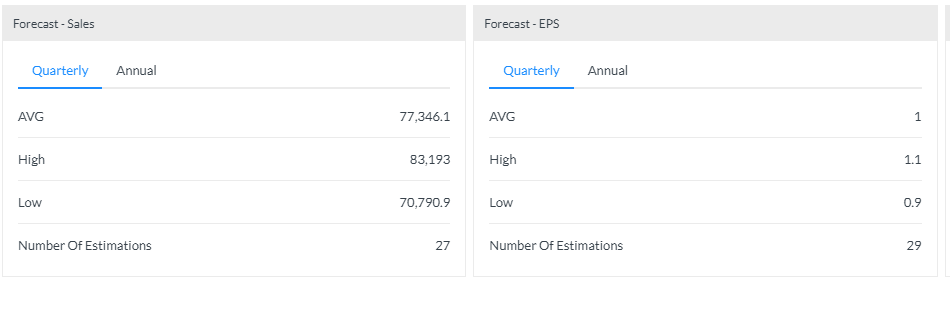

Apple is seen reporting EPS of $1 on $77.30bn in revenues. Last quarter it blew past expectations posting all-time record revenue of $111.4 billion, up 21% year over year, and quarterly earnings per diluted share of $1.68, up 35%.

Guidance: Apple has declined to offer guidance since the pandemic struck, so investors will be keen for this to change now that the clouds of the coronavirus are lifting. The capital return programme (see below) update is usually made alongside the March quarter and so now would be a reasonable time to star offering some guidance for the coming quarters.

iPhone: Still the golden goose, but there are concerns about a softening in demand as well as lower demand in China. Demand will be decent, with about a third of the iPhone installed base up for renewal, albeit we likely see some moderation from the last quarter. Overall, the Street may underappreciate the resilience in iPhone demand from the delayed launch last year and picks up market share thanks to stimulus cheques.

Mac and iPad: Can very strong demand for home computing products like Macs and iPads hold up the pandemic abates? Whilst vaccinations are driving a lifting of lockdowns, I still see a strong demand from WFH and home education trends globally.

Ecosystem: Revenues from Services remains a central plank of the investment thesis and with a growing installed base this should continue to deliver. Last quarter Services growth reached +24% with the first quarter of Apple One subscription bundles helping to lift the category.

Returns: I think this quarter will underline just how strong the free cash flow is and investors are going to start to see more cash coming their way after a record year for sales. Apple could aggressively add to share buybacks and increase the dividend to as much as $0.90, implying a 10% increase.

Last quarter’s summary: Apple shares fell in the aftermath of its January earnings report covering the holiday quarter. Revenues hit a record $111.4bn, well ahead of forecasts and representing 21% year-on-year growth thanks to broad-based gains across its product suite. The iPhone 12 launch quarter was exceptionally strong, with sales +17% in iPhone, taking the installed base for iPhones to 1bn from 900m. Mac revenues rose 21% yoy, whilst iPad sales jumped 41%. As noted in our preview, growth in personal computer sales driven by pandemic trends such as work from/stay at home was always likely to boost Mac and iPad sales. Growth in Other Products – devices like the Apple Watch and AirPods, climbed to 29% yoy. Services growth reached +24% with the first quarter of Apple One subscription bundles helping to lift the category. The growing installed iPhone user base should further support Services growth in the coming quarters, we noted at the time. We also noted very strong international sales (now 64% of total sales vs 61% a year ago), whilst revenues from Greater China rose 57%. The confidence in Apple fiscal first quarter earnings was well justified and the slight pause in the shares reflects a little profit taking after a strong run in 2020 whilst the lack of guidance for the second quarter was a thorn. A record-breaking quarter but it should not be seen as a high watermark for Apple.

Forecasts

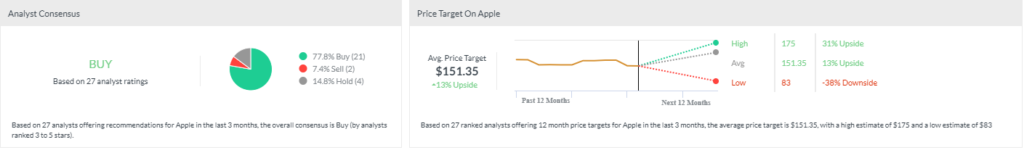

Analysts