Thursday May 21 2020 13:43

4 min

Tech companies surged to record highs yesterday, with Amazon stock closing 2% higher at just below $2,498.00 per share. The move helped fuel another 2% gain for the NASDAQ, which is now trading within 3% of February’s all-time high.

Amazon stock has rallied over 50% from the lows struck in mid-March and is up 32% since the start of the year. Gains have been fuelled by expectations that the company is well positioned to benefit from shifts in consumer behaviour due to the coronavirus pandemic.

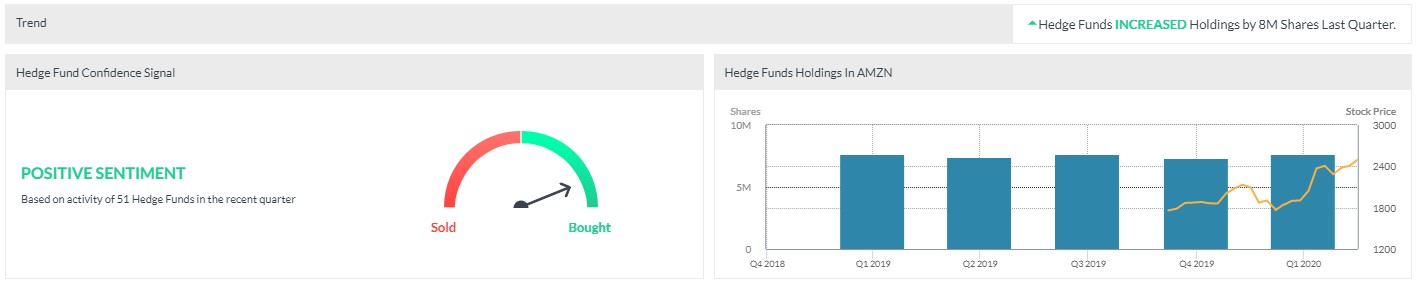

Hedge funds in particular have never been more bullish on AMZN stock.

Holdings increased by 8 million shares in Q1, with the number of bullish positions on AMZN amongst hedge funds rising 25% to 251. Amazon was the number one stock amongst hedge fund managers at the end of December and March.

Amongst those opening new positions in the first quarter were Jorge Lemann of 3G Capital Partners, Brad Gerstner of Altimeter Capital Management, and David Tepper of Appaloosa Management.

Social distancing, lockdown measures, and supply shortages in bricks-and-mortar retailers drove consumers online during the first quarter, helping push Amazon sales up 18% internationally and 29% for North America. Q1 earnings, released at the end of April, showed revenue of $75.5 billion and earnings per share of $5.01 for the first three months of 2020; revenue was higher than estimates, while EPS fell short.

Amazon’s Web Services cloud computing business saw sales grow 33% during the period, surpassing the $10 billion mark for the first time. Sales growth continues to slow, but the shift to homeworking could see many more businesses needing to harness the power of the cloud to keep operations running, and this could be a long-term shift in business culture rather than a temporary measure.

Subscriptions to Amazon Prime were up as well; the combination of expedited shipping and video and music streaming proving an offer that is hard to resist while stuck at home. Advertising revenues also climbed, growing 33% to over $3.9 billion. Here, again, Amazon is set to benefit as businesses adapt to the pandemic; more marketing spend is being directed online as other channels, such as event sponsorship, dry up.

However, Amazon is known to spend big, and it looks like Q2 will be no exception. On the Q1 conference call, Jeff Bezos told investors that he expected to spend the $4 billion or more in estimated operating profit from Q2 on “Covid-related expenses getting products to customers and keeping employees safe”. The stock had fallen after hours, but fund managers are betting that the costs will help Amazon to operate more effectively under “new normal” conditions going forward.

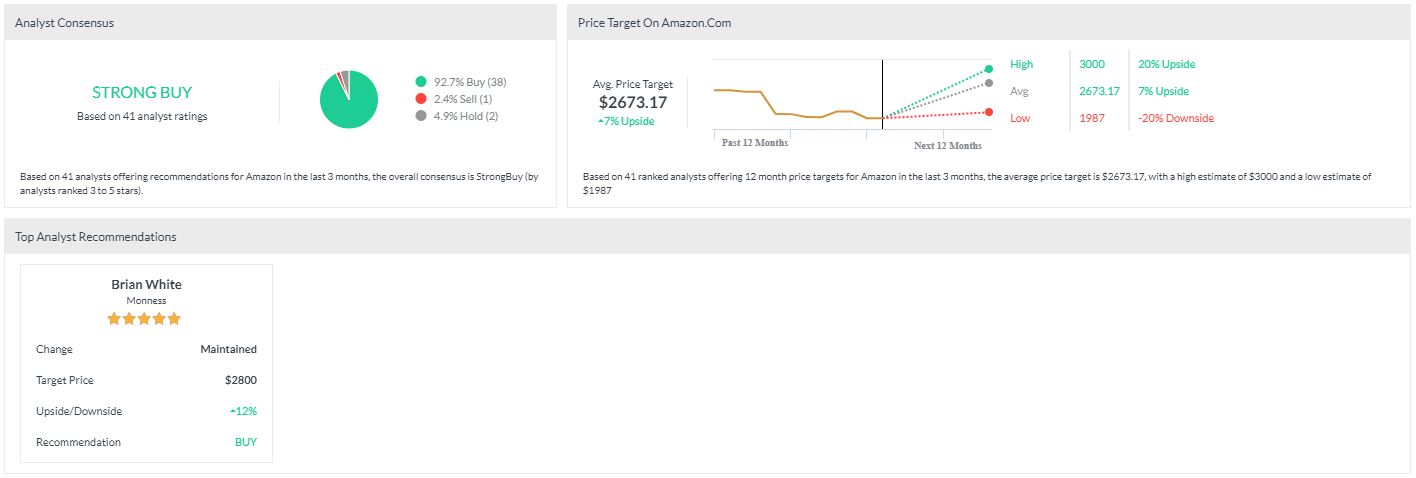

Amazon holds a “Strong Buy” rating amongst Wall Street analysts, with a price target of $2,673.17 representing a 7% upside. Only one of 41 analysts covered by our Analyst Recommendations tool has a “Sell” rating on the stock.