Tuesday Feb 23 2021 09:03

6 min

When companies tie themselves to any one horse it presents risks, even if it’s the most-fancied filly at the post. Thoroughbreds are temperamental creatures and liable to break down when being ridden too hard. So, when Tesla tied its fortunes to Bitcoin with a $1.5bn investment, it was reasonable to expect there could be problems ahead. Yesterday, for various reasons Bitcoin crashed from an all-time high in a brutally swift drop that took prices from near to $58,000 to $47,400. At one point, prices plunged $5,000 in 10 minutes before paring losses and attempting a recovery, which stalled at $55k before turning lower to trade under $49,000 this morning. Musk may have spooked some participants with his tweet saying the price was ‘too high’. But I feel that was an in-joke for followers. More importantly the market was ripe for a sharp technical pullback after a parabolic move, the kind that usually comes down under its own weight. There could be further to tumble – a 30% drawdown as we had in January this year would see prices back to $40,000. Also, Treasury secretary Janet Yellen – clearly not a cheerleader – warned that “Bitcoin is an extremely inefficient way of conducting transactions and the amount of energy that’s consumed in processing those transactions is staggering”.

Tesla shares fell sharply, closing down 8.55% on the day and finishing under its 50-day simple moving average. Shares are now down over 17% since the company reported it had purchased around $1.5bn in Bitcoin to hold on its balance sheet. The fall in Bitcoin yesterday may have dragged the stock down further, such is the symbiotic relationship being perceived in the market. But we also should stress that the technicals and options market activity have also been signalling a sell-off coming for Tesla.

The wider tech sector fell. Shares in Apple, Amazon and Microsoft all dipped by 2% and the Nasdaq closed down 2.5%. The Dow Jones turned around a 200-pt drop at one stage to finish up by 0.1%. Shares in GameStop (remember that?) rose 13% to $46 as it appeared that Keith Gill, aka Roaring Kitty, had doubled up on his stake, following his appearance at the House Financial Services Committee in which he said he still liked the stock at $44.

European stocks were mixed early on Tuesday with the DAX down and FTSE 100 higher. Crude oil prices rose with WTI north of $62 and Brent above $65 with US output expected to recover slowly from the winter storms. Treasury yields continued to rise with 10s spiking above 1.38% as Janet Yellen reiterated that now is not the time to do too little. Jay Powell begins his two-day semi-annual Congressional testimony today – will he push back on yields? I doubt it – the Fed is happy to let the economy overcook this year. The market may actually prefer a bit more of a steer.

HSBC said it will restart dividends despite reporting a 34% drop in annual profits – all ancient history. Pre-tax profits slipped to $8.8bn from $13.4bn previously as Q4 adjusted profits fell 50% and loan loss impairments rose by $1.2bn. Dividends to resume at $0.15 a share.

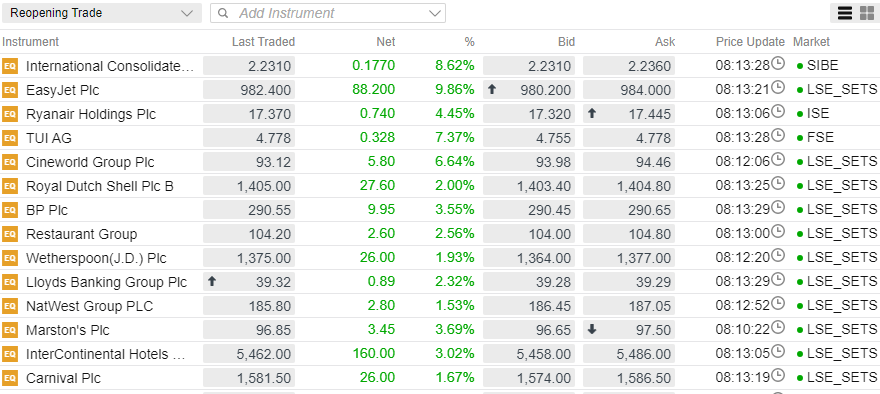

Airline shares roared higher on the promise of a salvaged summer season, following the government’s outline of how Britain will escape the pandemic restrictions. International travel will remain problematic and subject to restrictions, isolation and testing, but bookings have shot up. IAG rallied 8%, Ryanair rose over 4%, while easyJet jumped 10%. TUI climbed 6%. IHG shares rose 3% even as it struck a cautious tone and warned recovery would not really take place until later in 2021. Strong efforts to cut costs meant FY results were a little ahead of expectations, however.

Sterling seems to reflect optimism about the reopening of the UK economy after Boris Johnson’s roadmap out of restrictions. It may be slow and abundantly cautious, but words like ‘irreversible’ raise hopes that by June we really will be beyond Covid. GBPUSD made fresh 3-year highs close to 1.41 as the dollar softened – the failures by DXY to rally out of the descending trendline marked by the Feb 17th failure at 91 – point to more dollar weakness. EURGBP also dipped to its lowest in a year as the pound rallied.

For gold, yesterday marked a strong reversal but the medium-term downtrend remains in force.