Thứ tư Oct 22 2025 02:39

8 phút

Crypto trading for beginners: Buying bitcoin with minimal fees is a common goal for newcomers who want to keep transaction costs low while learning how crypto markets work.

Low-cost access reduces the drag on returns from trading and makes small, frequent trades more practical.

This guide outlines the principal options for acquiring bitcoin at minimal expense, compares low-fee venues and product types, and offers practical steps to trade with reduced costs on platforms such as markets.com. It also flags trade-offs around convenience, custody, and regulatory protections.

1, Choose the right access vehicle

There are several pathways to obtain bitcoin, and the cheapest choice depends on how you want to hold it, how often you will trade, and your tolerance for operational complexity.

Centralised exchanges: These platforms typically offer competitive trading fees and deep liquidity. Fee schedules often depend on whether you use market or limit orders, and some exchanges apply maker/taker pricing that rewards providing liquidity. Centralised exchanges can offer low spreads and high execution speed, which benefits frequent traders aiming to minimise per-trade costs.

Peer-to-peer and direct purchase: Buying from another person or marketplace may reduce some platform fees but can introduce higher spread or require more time and effort to arrange payment, identity verification, and settlement. For users focused strictly on minimising explicit fees, direct arrangements can be attractive if done within a trustworthy community and with secure payment methods.

Brokerages and apps: Some broker apps prioritise simplicity and convenience, bundling execution costs into wider spreads or fixed fees. While user-friendly, these venues sometimes carry hidden costs relative to pure exchange trading. Read fee disclosures carefully to compare the true cost of acquiring bitcoin.

Derivative platforms (CFDs and futures): Contracts that track bitcoin prices let traders gain exposure without taking physical custody. These instruments can reduce custody costs and simplify access but introduce financing charges and leverage-related risks. For short-term trading, derivatives can be cost-efficient when financing and spreads are low.

Over-the-counter (OTC) desks: For larger trades, OTC desks provide block execution with tailored pricing and minimal market impact. While OTC is not typical for beginners, it’s relevant if large sums need to be deployed with low explicit costs.

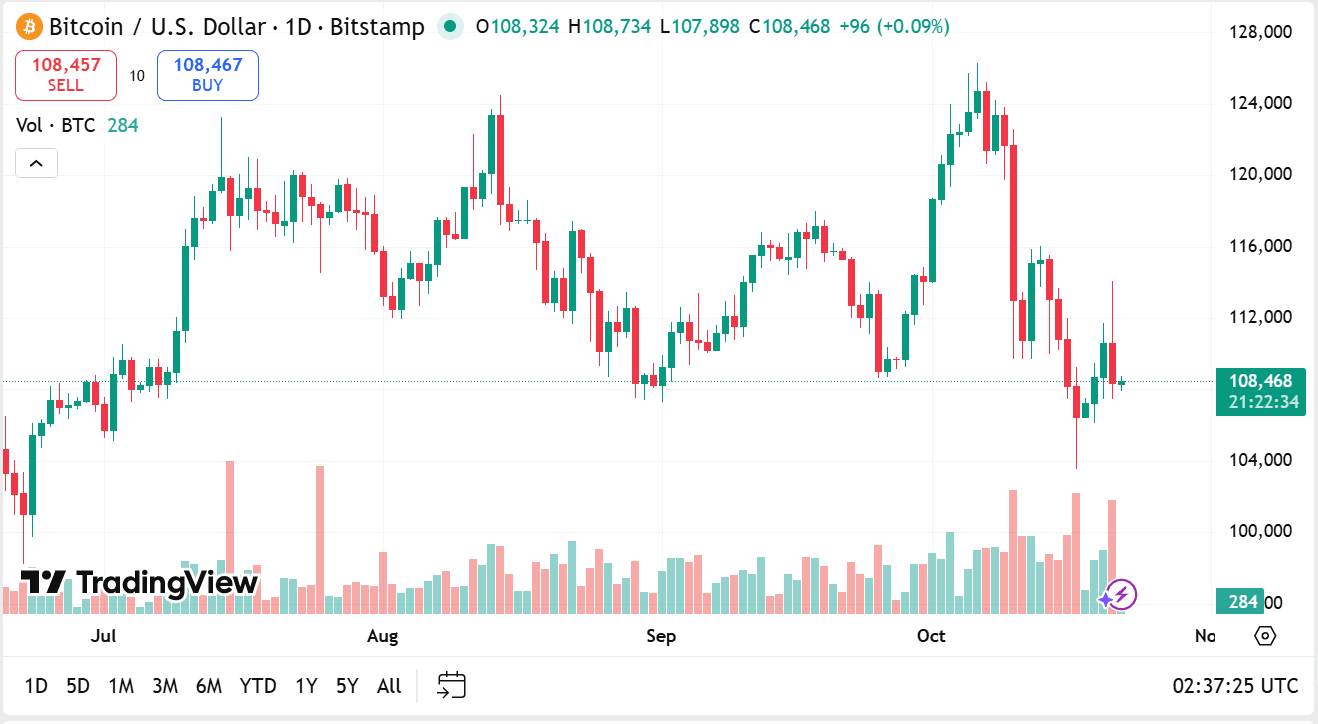

source: tradingview

2, Understand fee components

To judge cheapness accurately, consider all fee types rather than just headline trading fees.

Trading fees: The explicit fees charged per trade, often lower on large or maker orders. Some venues offer fee reductions for higher-volume accounts or for using the platform’s native token to pay fees.

Spreads: The difference between buy and sell prices can be a hidden cost, especially on apps that emphasise simplicity. Tight spreads on major exchanges reduce friction for frequent traders.

Deposit and withdrawal fees: Moving fiat into or out of a platform, or withdrawing crypto to an external wallet, can incur fees. Choosing payment methods and venues with low transfer costs reduces overall expense.

Network fees: Sending bitcoin across the blockchain incurs miner or network fees. These fluctuate with network congestion and are unavoidable when taking custody on-chain. Aggregating transfers or using batch withdrawals can reduce per-unit network cost.

Financing and overnight fees: For derivative positions, look at financing or overnight funding charges that accumulate while positions are held. Low headline trading fees can be offset by high financing costs for multi-day holds.

Conversion fees and spreads: If your fiat currency differs from the platform’s base currency, currency conversion fees may apply. Some platforms fold conversion into their quoted price, increasing apparent costs.

3, Cheap exchanges and trading models (what to look for)

When screening for low-cost exchanges, evaluate these practical attributes:

Maker/taker pricing: Platforms that reward makers (limit-order liquidity providers) can be very cheap if you are willing to place passive limit orders rather than take liquidity immediately.

Fee discounts and loyalty programs: Some exchanges offer discounts for using native tokens or meeting staking/volume thresholds. These mechanisms can lower fees for regular users, though they require committing to the platform’s ecosystem.

Competitive spreads: Low spreads are especially important for smaller accounts and for users on apps that route market orders. Look for venues with consistent order-book depth and narrow bid-ask differentials.

Low withdrawal costs: An exchange with low crypto withdrawal fees reduces the out-of-platform transfer cost. For beginners who eventually want on-chain custody, this matters.

Transparent fee schedule: The clearest fee comparisons come from platforms that publish explicit, itemised fee tables and explain conditions for discounts.

4, Cheap bitcoin trading brokers and CFD platforms

Brokers offering CFD exposure to bitcoin can be economical for traders who prioritise short-term exposure without the need to hold the underlying asset on-chain. Benefits that reduce costs include no network fees for on-chain transfers and simple fiat funding via bank transfer or card. However, be mindful of overnight financing charges and the potential for wider spreads during volatile conditions. For traders focused on low-fee short-term activity, a CFD platform with competitive spreads and low financing rates can be attractive.

How to trade bitcoin with low fees on markets.com

markets.com is one of several online brokers that provide derivatives trading on crypto assets. If you choose a platform like markets.com and aim to keep costs low, follow these steps:

(1) Understand the fee structure: Review how markets.com charges for spreads, overnight financing, and whether it offers preferential pricing for larger accounts or certain order types. Avoid surprises by reading the fee and margin documentation.

(2) Use limit orders when appropriate: Where the platform supports different order types, using limit orders can help secure better execution prices and may qualify you as a maker, attracting lower effective trading costs.

(3) Manage holding duration: If you use CFD or leveraged products, be aware that holding positions overnight or across multiple days can incur financing charges. Keep exposure durations aligned with the strategy to avoid unnecessary fees.

(4) Consolidate transfers and avoid frequent withdrawals: If you plan to move funds or crypto infrequently, batch transactions to reduce per-transfer charges. For fiat funding, choose low-cost deposit methods and confirm any intermediary bank fees.

(5) Take advantage of educational tools: Platforms often provide simulated accounts or practice modes; using these can reduce costly mistakes while you learn order entry and execution mechanics.

5, Practical tips to minimise overall cost

Prefer passive execution: Where possible, place limit orders that provide liquidity rather than taking liquidity at market. Over time, this reduces explicit fees and tightens realised trading costs.

Avoid high-cost payment routes: Card payments and instant third-party services can carry higher fees than fiat bank transfers. Select deposit methods that minimise up-front charges.

Combine trades and transfers: Aggregating small trades or withdrawals can reduce per-unit fees, particularly for network and withdrawal charges.

Monitor network conditions: When planning on-chain withdrawals, avoid periods of high network congestion, as miner fees rise. Use fee-estimation tools to select economical timings.

Compare total cost, not just fees: Evaluate the full economic impact of using a venue—spreads, slippage, withdrawal costs, and financing can outweigh a low headline trading fee.

Trade-offs and safety considerations

Lower fees often come with trade-offs that affect usability, custody, and regulatory protections:

Custody risk: Cheaper fiat-to-crypto routes may require trusting a custodial platform. If you plan to hold crypto long-term, consider whether on-chain withdrawal and independent custody are priorities.

Liquidity and execution quality: Very low-cost venues with thin order books can produce higher slippage during volatility. Prioritise venues with consistent depth for smoother execution.

Regulatory coverage: Fee savings are valuable, but ensure the chosen platform complies with local rules and provides the level of consumer protection appropriate for your jurisdiction.

Conclusion

Minimising the cost of acquiring bitcoin involves more than picking the lowest headline trading fee. Consider spreads, withdrawal and network fees, deposit costs, and financing charges when comparing venues. For many beginners, a centralised exchange that combines tight spreads, maker/taker pricing, and transparent withdrawal fees represents a practical balance of low cost and ease of use. Derivative platforms can reduce on-chain costs for short-term traders, while direct peer-to-peer routes may cut platform fees but require additional diligence. On brokers like markets.com, focus on order types, position duration, and transfer consolidation to keep expenses down. Above all, weigh fee minimisation against custody preferences and regulatory comfort to choose a route that fits both budget and peace of mind.

Risk Warning and Disclaimer: This article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform. Trading Contracts for Difference (CFDs) involves high leverage and significant risks. Before making any trading decisions, we recommend consulting a professional financial advisor to assess your financial situation and risk tolerance. Any trading decisions based on this article are at your own risk.