Miyerkules Oct 22 2025 03:03

8 min

10 Best Crypto With Most Potential: Choosing cryptocurrencies for a portfolio requires clear criteria, awareness of technology and use cases, and an eye for project fundamentals.

Below is a concise review of ten widely discussed projects, what they aim to deliver, and factors to consider when deciding which may be most suitable for your goals and timeframe. This is educational in nature and not financial advice.

How to Judge Potential

Before reviewing individual projects, consider these evaluation points:

Purpose and use case: Is the token solving a real problem or enabling a new market?

Development activity: Are teams and communities actively building and updating code?

Security and decentralisation: How robust are the network’s security mechanisms and governance?

Ecosystem growth: Are applications, wallets, and third-party tools being adopted?

Tokenomics: Does the supply model and utility support the intended network behaviour?

Regulatory and legal context: Is the project exposed to regulatory friction in key jurisdictions?

Liquidity and market structure: How easy is it to trade and access the token?

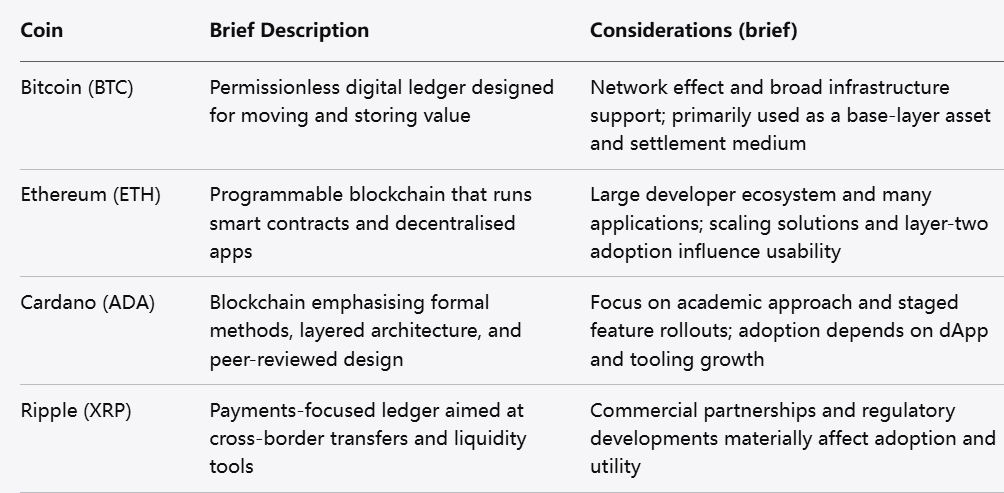

Quick Look at the Ten Picks

Bitcoin (BTC)

Overview: Designed as a permissionless digital ledger for moving and storing value, it has the largest network effect and broadest recognition.

Considerations: Look at adoption trends, infrastructure build-out for custody and settlement, and network security metrics. For many, it functions as a foundational layer in crypto allocation.

Ethereum (ETH)

Overview: A programmable blockchain that supports smart contracts and decentralised applications. It serves as the primary settlement and execution layer for many protocols.

Considerations: Track upgrades that affect throughput and fees, the growth of layer-two scaling solutions, and the diversity of applications built on the platform.

Cardano (ADA)

Overview: A blockchain that emphasises formal verification, academic peer review, and a layered architecture for settlement and computation.

Considerations: Evaluate the pace of development, real-world deployments, and the growth of decentralised applications and tooling in its ecosystem.

Ripple (XRP)

Overview: A payments-focused ledger intended to facilitate near-instant cross-border transfers and liquidity tools for payment providers.

Considerations: Regulatory developments and commercial partnerships play a major role in the network’s adoption profile. Examine how legal rulings and enterprise integrations evolve.

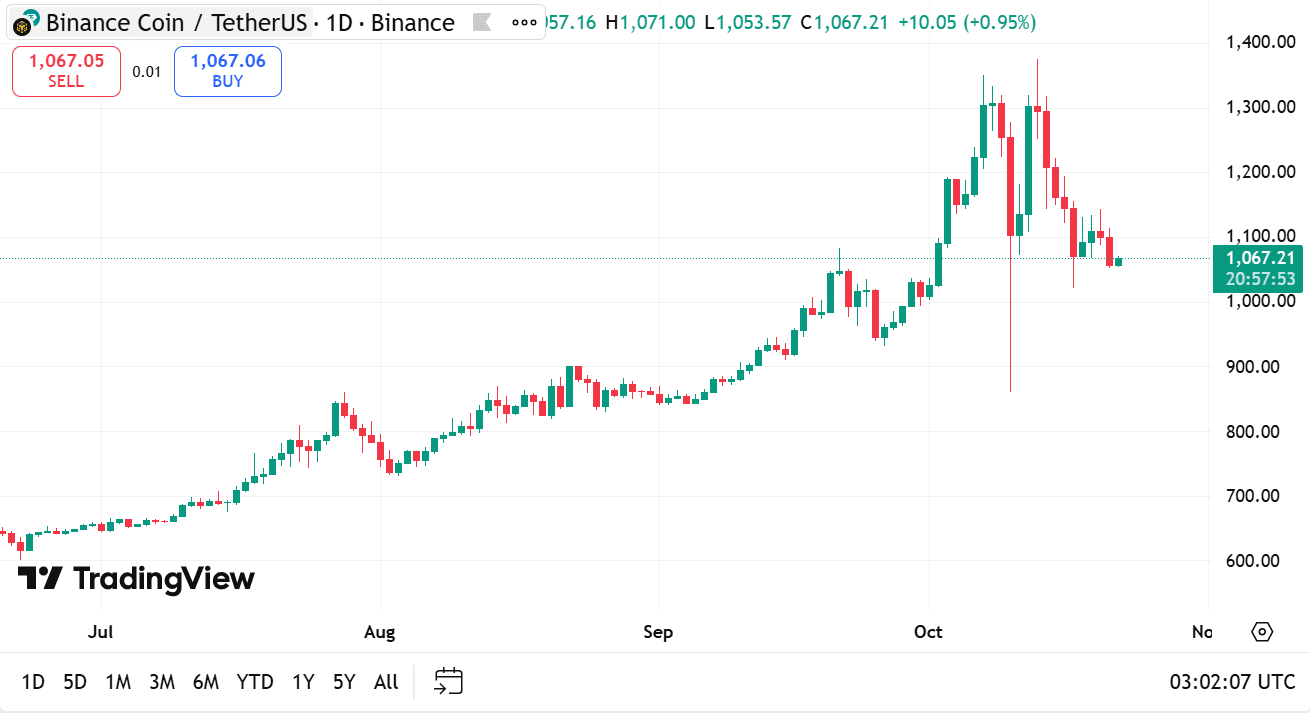

Binance Coin (BNB)

Overview: Originally created to support an exchange ecosystem, the token also powers a smart-chain environment with a broad set of decentralised applications.

Considerations: The token’s utility is tied to the health of the underlying exchange and its smart-chain ecosystem. Watch for shifts in fee models, burn mechanisms, and ecosystem expansion.

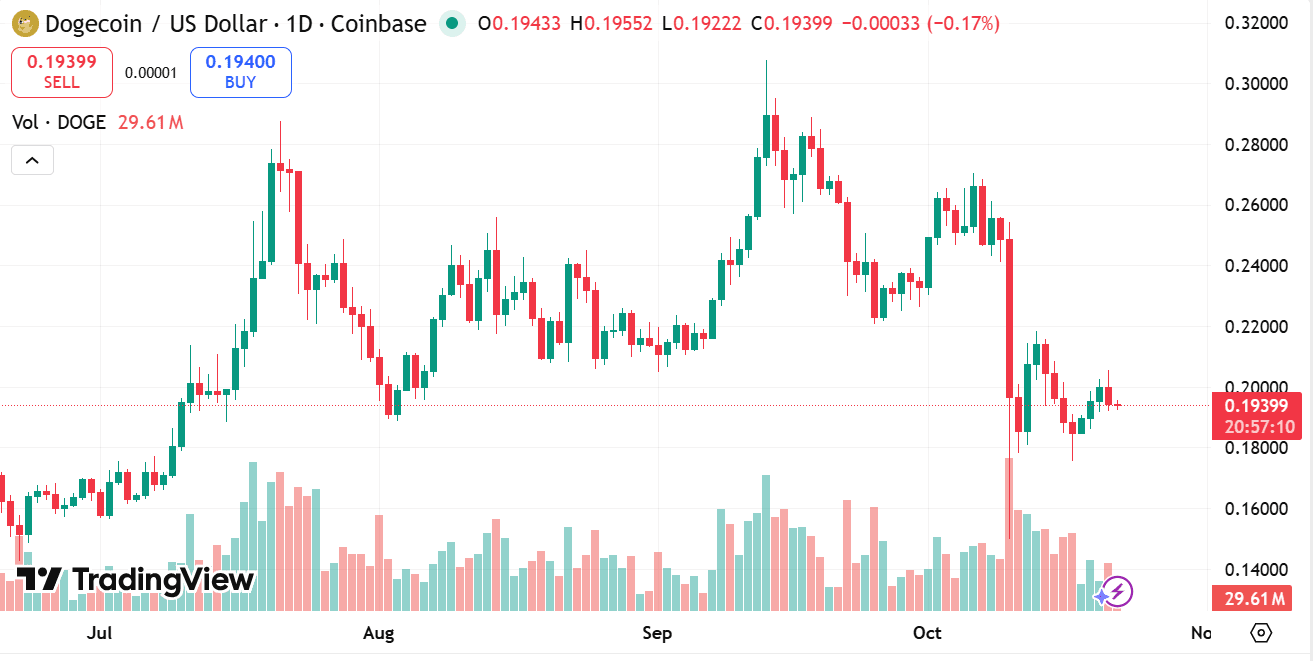

Dogecoin (DOGE)

Overview: Started with a community-driven ethos and widespread cultural recognition, it is used for tipping, micropayments, and community initiatives.

Considerations: Community engagement and network usage patterns are key. Its open-source codebase and broad awareness make it distinct from many newer memecoins.

Polkadot (DOT)

Overview: A multi-chain protocol enabling parachains to interoperate through a shared relay chain. It focuses on cross-chain communication and shared security.

Considerations: The success of the parachain auction model and the diversity of parachains securing real use cases are important indicators of ecosystem traction.

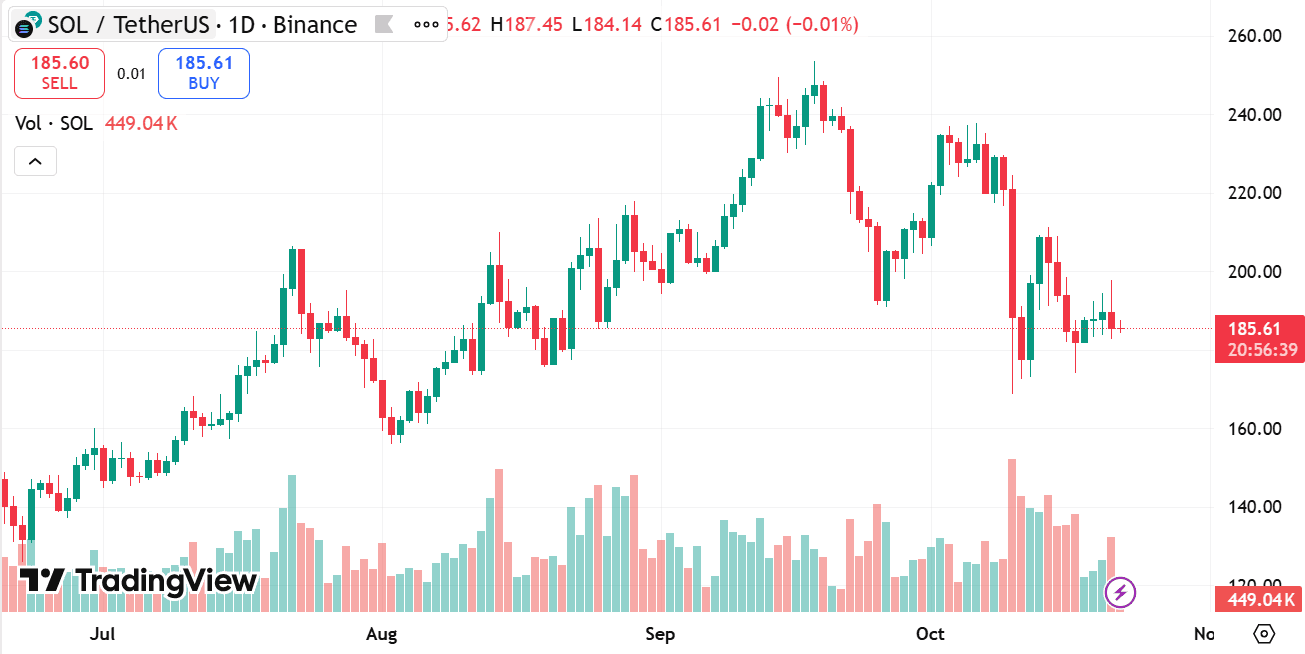

Solana (SOL)

source: tradingview

Overview: Designed for high throughput and low latency, it targets applications that demand fast confirmation and low transaction costs.

Considerations: Assess uptime history, developer momentum, and how well the network supports a range of decentralised applications without compromising security.

Chainlink (LINK)

Overview: A decentralised oracle network that supplies external data to blockchains, enabling smart contracts to connect to real-world information.

Considerations: The breadth of integrations and partnerships across chains and enterprise feeds strengthens its role as an infrastructure primitive.

Avalanche (AVAX)

Overview: A platform that offers multiple interoperable subnets and a consensus model designed for rapid finality and flexible customisation.

Considerations: Monitor subnet adoption, developer activity, and how the platform competes on performance, fees, and tooling.

Which Crypto Is Best to Buy Now?

Match the choice to your objectives and horizon. For those seeking established infrastructure, assets with wide developer ecosystems and infrastructure support may make sense for core exposure. For exposure to performance-oriented chains, assess how the network manages throughput and stability under load. If custody and access simplicity are priorities, choose assets widely supported by major platforms and wallets.

Which Coin May Rise in 2025?

Short- and medium-term performance will depend on adoption catalysts, regulatory clarity, macro conditions, and technical progress within each project. Projects that continue to build useful applications, expand developer communities, and address real-world needs are better placed to gain traction. Also consider how upgrades, partnerships, or ecosystem launches could influence interest in a given token.

Which Crypto Has the Highest Potential?

Potential is context-dependent. Some networks offer foundational infrastructure that other applications depend on, which can create persistent demand. Others provide niche capabilities—such as high-speed settlement, oracle services, or specialised interoperability—that become valuable if a corresponding market grows. Evaluate each project’s comparative advantage and whether that advantage addresses a large addressable market.

Risk Management and Practical Steps

Diversify exposures across a set of complementary projects to reduce single-project risk.

Use secure custody practices for long-term holdings, including hardware wallets or reputable custodial services that meet your security needs.

Keep position sizes aligned with risk tolerance and time horizon. Avoid overconcentration in highly speculative proposals.

Stay informed of protocol upgrades, governance votes, and major partnerships that can materially change a project’s trajectory.

Factor regulatory developments into planning, especially for projects with strong ties to payment rails or centralised entities.

Final Thoughts

Selecting the “best” cryptocurrencies depends on personal goals, risk tolerance, and time horizon. The ten projects above span foundational store-of-value, smart-contract platforms, interoperability solutions, oracle infrastructure, and widely recognised community tokens. A systematic approach—focusing on real-world use case fit, developer and ecosystem momentum, security posture, and regulatory considerations—helps in forming a reasoned view on which tokens to include in a portfolio. Regularly revisit these criteria as technology and market conditions evolve.

Risk Warning and Disclaimer: This article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform. Trading Contracts for Difference (CFDs) involves high leverage and significant risks. Before making any trading decisions, we recommend consulting a professional financial advisor to assess your financial situation and risk tolerance. Any trading decisions based on this article are at your own risk.