Terça-feira Oct 21 2025 03:52

6 mín

Forex trading basics: A lot in forex is the standardized quantity of currency units that defines the size of a trade.

1. What is a Lot?

In forex, a lot is the standardized quantity of the base currency that is traded in a single transaction. It defines the scale of a trade and provides a common unit for brokers, platforms, and traders to communicate position size. Using lots helps ensure consistency in order execution and in how margin and exposure are calculated across different currency pairs and accounts.

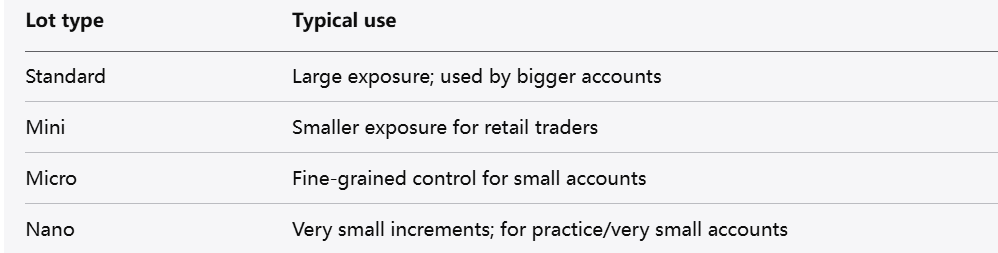

There are commonly accepted lot categories that scale exposures from large to very small. Each category represents a fixed multiple of the base currency amount used to measure the trade. Because lots are standardized, they make it simpler to compare positions across instruments and to understand the relationship between price movements and account exposure.

2. How do I calculate the profits and losses in trading?

Calculating gains and losses in forex involves a few steps: determining the position size in units of the base currency, measuring the price movement in pips, converting pip movement into the quote-currency value, and then translating that result into your account currency when needed.

Determine position size: Convert the number of lots held into the number of base-currency units represented by the trade. This establishes how many units are affected by each incremental price move.

Identify price movement: Measure the change in price from entry to exit in pips. A pip is the smallest commonly quoted price increment for the pair being traded; the pip definition can vary by currency pair and platform.

Convert pip value to monetary terms: Multiply the number of pips moved by the pip value per unit and then by the number of base-currency units represented by the position. This yields the monetary outcome in the quote currency for the pair.

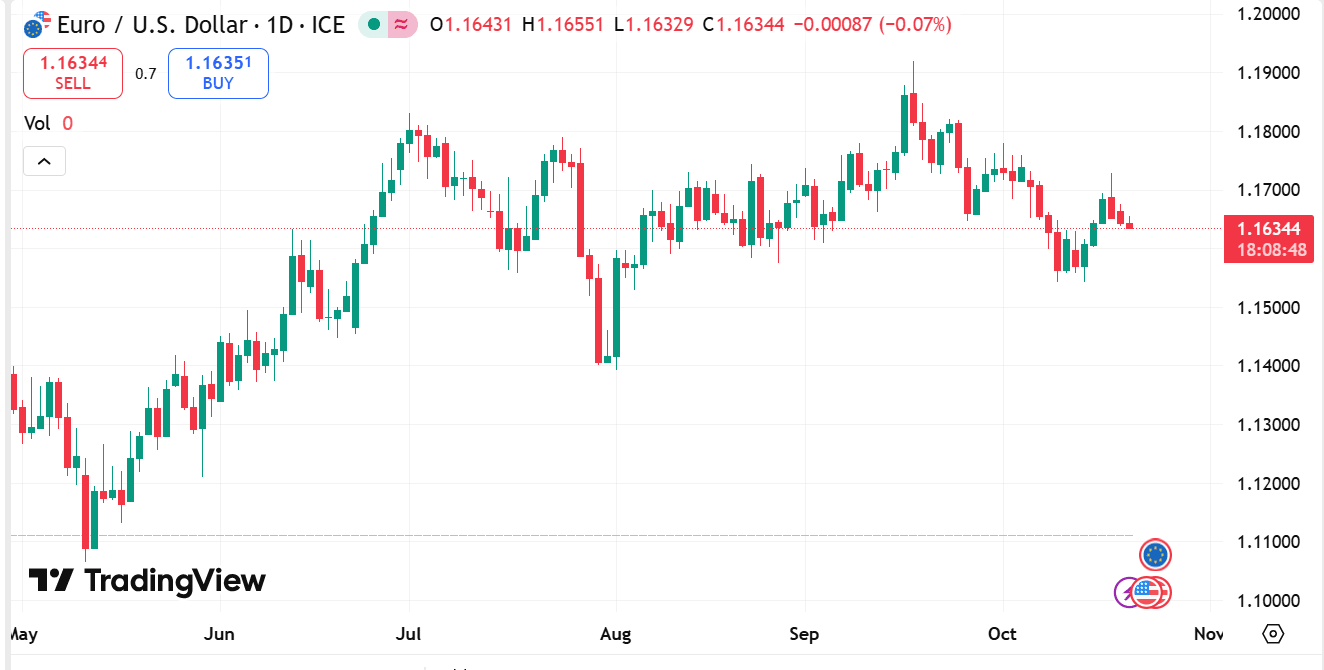

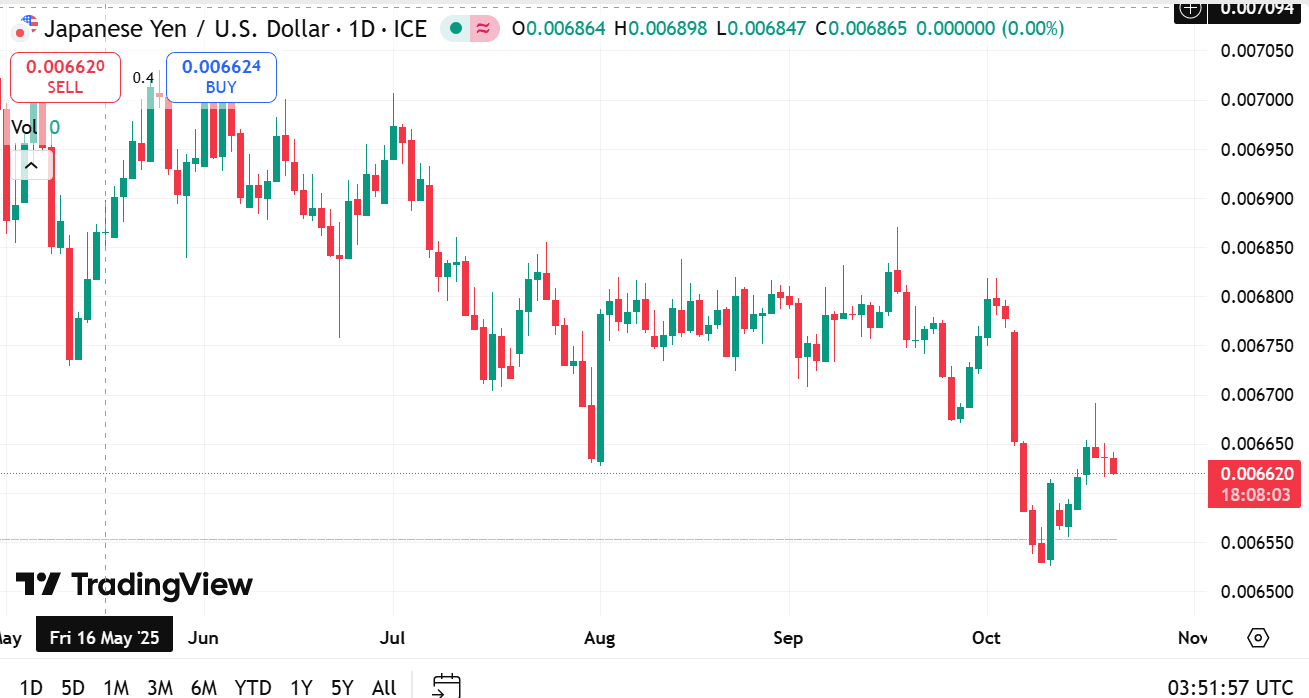

source: tradingview

Convert to account currency if needed: If your trading account uses a different currency than the quote currency, convert the result using the relevant exchange rate to express the outcome in account terms.

The core idea is that the monetary effect of a price move depends on three things: the magnitude of the move in pips, the pip value per unit for the specific pair, and the number of units (which is derived from the lot size). Larger lot sizes amplify the monetary impact of any given pip movement, while smaller lot sizes reduce it.

3. Do you need to calculate the lot size yourself?

Yes and no—there are practical nuances.

Manual calculation: Understanding how lot size maps to exposure is important for sound trade planning and risk control. Traders who prefer to set strict position-sizing rules often calculate lot sizes manually based on desired exposure, acceptable account-level risk, and stop-loss distance. This manual approach reinforces discipline and helps ensure consistent application of risk-management rules.

Tools and automation: Many trading platforms and brokers provide built-in calculators or position-sizing tools that compute lot sizes for you based on inputs such as account currency, risk per trade, stop-loss in pips, and desired percentage risk of the account. These tools remove the arithmetic burden and reduce the chance of entry errors. Portfolio or risk-management software can also automate lot sizing across multiple trades to enforce diversification or maximum aggregate exposure limits.

Best practice: Even when using automated tools, it is wise to understand the underlying calculations so you can verify outputs and adapt inputs when market conditions or personal objectives change. Blind reliance on automation without comprehension can produce unintended exposure, particularly in fast-moving markets or when leverage is applied.

4. Summary

A lot is the standard measure of trade size in forex, making position sizing and margin requirements consistent across platforms. The monetary effect of a trade depends on the lot size, the price change measured in pips, and the pip value for the currency pair being traded. Understanding how these elements interact enables clearer planning for position sizing and risk management.

While many platforms offer calculators that produce lot-size recommendations, familiarity with the manual calculation process remains valuable. It helps ensure that traders can check automated outputs, adapt to unusual conditions, and apply coherent risk controls. Whether you calculate lot sizes yourself or rely on tools, the key is to have a repeatable method that aligns position size with risk tolerance and account objectives.

5. FAQs about Lot sizes

What are the standard lot categories?

There are commonly used lot categories that scale exposure from large to small. Each category represents a fixed number of base-currency units. These categories are widely supported by brokers and trading platforms to accommodate different trader preferences and account sizes.

How does lot size affect my account exposure?

Lot size determines how many base-currency units are traded, and therefore how much the account’s balance changes for each pip of price movement. Larger lot sizes translate to larger monetary changes for the same pip movement; smaller lot sizes reduce that monetary impact.

Is lot sizing different for exotic pairs?

The mechanics are the same, but pip value and conversion to account currency can vary depending on the pair and the currencies involved. For pairs where the quote currency is not the same as the account currency, an extra conversion step is required to express outcomes in account terms.

Can I trade fractional lots?

Many brokers support fractional or micro-sized positions, allowing traders to take much smaller steps in exposure than full standard lots. This feature enables finer-grained position sizing and can aid practical risk management for smaller accounts.

Why should I use a position-sizing rule?

Position-sizing rules translate risk appetite into concrete trade sizes. By linking stop-loss distance with allowable account-level risk, traders can keep single-trade exposure consistent across different setups and market conditions.

What role does leverage play with lot sizes?

Leverage affects the margin required to open a position but does not change the number of base-currency units represented by a lot. It does, however, amplify the account’s sensitivity to price moves because margin allows larger nominal positions relative to posted collateral.

Where can I practice lot sizing calculations?

Many demo accounts and educational resources allow you to test manual calculations and risk rules without financial exposure. Practicing in a simulated environment is a recommended way to build familiarity before applying methods to a live account.

Understanding lots and how they interact with pip values and account currency is foundational to disciplined forex trading. Whether you calculate sizes by hand or use platform tools, a clear, repeatable approach to position sizing will support consistent decision-making and risk management.

Risk Warning and Disclaimer: This article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform. Trading Contracts for Difference (CFDs) involves high leverage and significant risks. Before making any trading decisions, we recommend consulting a professional financial advisor to assess your financial situation and risk tolerance. Any trading decisions based on this article are at your own risk.