Terça-feira Oct 21 2025 10:31

6 mín

How To Buy Silver In Australia Online: Silver can be accessed through multiple channels in Australia, including physical bullion dealers, online marketplaces, CFD trading.

Each route has different operational requirements, cost profiles, custody implications, and tax treatments. The guidance below outlines common ways to obtain exposure, practical steps to get started online, and considerations specific to Australian market participants.

Should I Buy Silver in 2025?

Deciding whether to add silver to a portfolio depends on personal objectives, time horizon, and tolerance for price variability. Silver combines roles as an industrial input and as a tradable commodity, so demand drivers can be cyclical and tied to manufacturing trends as well as broader market sentiment. Those contemplating exposure should weigh how silver aligns with portfolio goals, how much volatility they are prepared to weather, and how long they intend to hold exposure. It is also useful to consider alternatives for access—physical holding versus paper exposure—and the differing cost and tax implications of each.

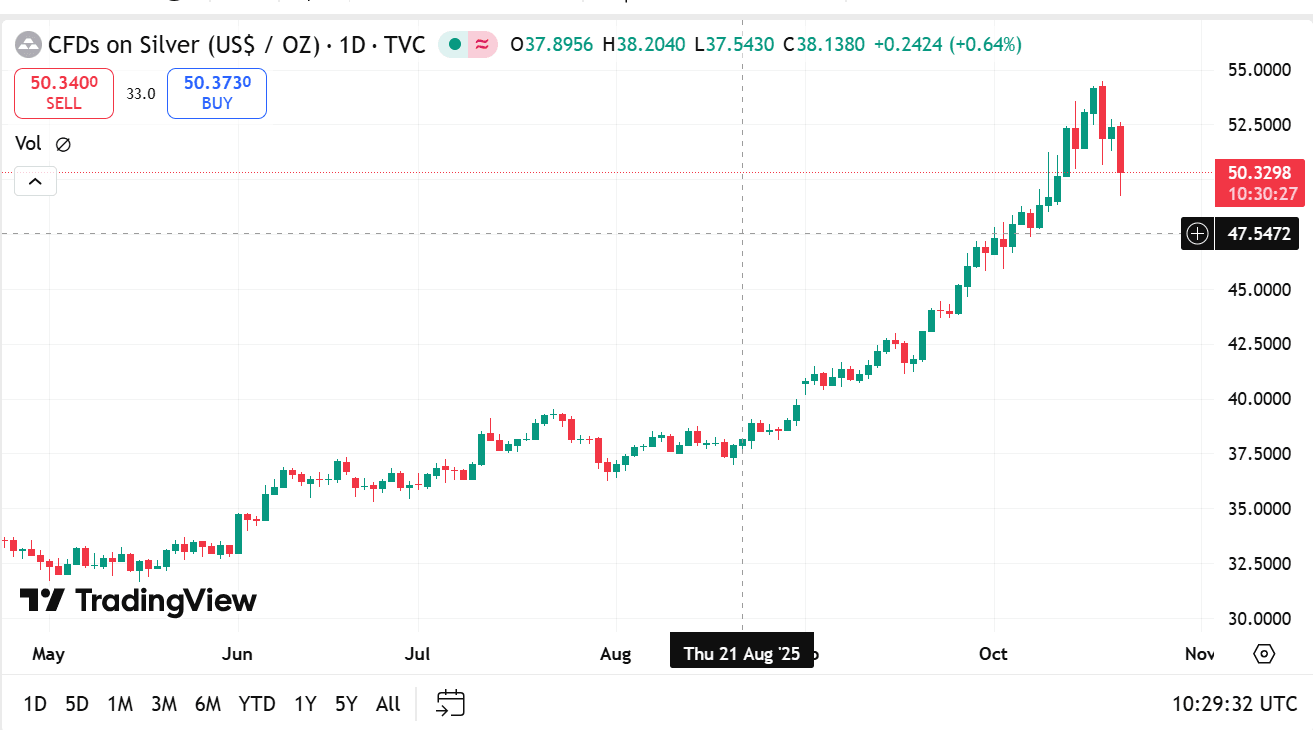

source: tradingview

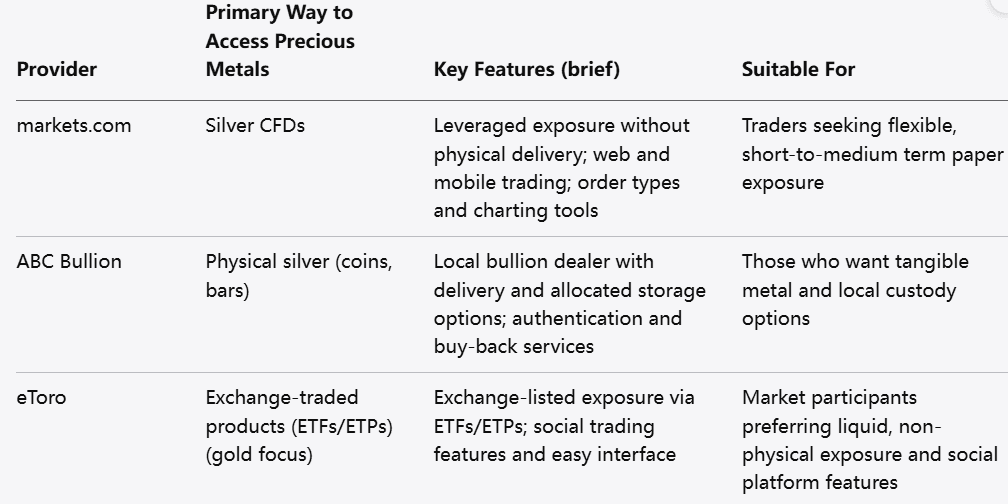

Where to Trade or Buy Silver in Australia

markets.com — Silver CFD trading: An online broker offering commodity CFDs that let traders gain leveraged exposure to silver price movements without taking physical delivery. CFDs provide convenient market access via web and mobile platforms, with trade execution, charting, and order types suited to active trading. Users should review margin requirements, overnight financing, spreads, and platform features before opening an account.

ABC Bullion — Buying physical silver: A well-known Australian bullion dealer that sells minted coins and cast bars with options for home delivery or allocated storage. Purchasing from established local dealers simplifies logistics, provides local customer service, and often comes with clear redemption policies and authenticity guarantees.

eToro — Trading ETFs and commodity exposure: A social trading platform that offers access to exchange-traded products (ETPs) and other securities. Through ETFs or ETPs that track precious metals, users obtain liquid exchange-listed exposure without handling physical metal. Platform features like copy trading and community discussions can appeal to those seeking a more social approach to market engagement.

How to Buy Silver in Australia Online

Trading Silver CFDs Online

Step 1: Find a Trusted CFD Platform

Choose a platform regulated in a reputable jurisdiction and check whether it offers commodity CFDs specific to silver. Review the broker’s fee structure, margin rules, execution model, available order types, and client protections. Platform reliability, customer support responsiveness, and educational resources are useful attributes to evaluate.

Step 2: Create a Trading Account

Complete the broker’s onboarding, which typically involves identity verification and linking a funding method. Select the account type that matches your trading objectives and read the client agreement carefully, with attention to leverage, negative-balance protection, and applicable fees.

Step 3: Analyze the Markets

Before placing trades, form a view on the drivers most likely to influence silver price direction over your intended horizon. For shorter-term trading, monitor liquidity, volatility, and timing around economic or industry releases. For longer-term exposure, consider industrial demand trends, mining supply dynamics, and macro conditions that influence currency and yield environments.

Step 4: Place Buying and Stop-Loss Orders

When entering a CFD position, set clear entry criteria and predefine a stop-loss level to manage downside exposure. Use order types that match your approach—market orders for immediate execution, limit orders for targeted entries, and stop orders for automated exits. Remember that leveraged products amplify exposure, so position sizing is critical.

Step 5: Pay Attention to Taxes

CFD trading may be treated differently for tax purposes than physical metal ownership or holdings in listed exchange products. Australian tax rules can vary by product type and by individual circumstances, so consult a tax professional to understand any capital gains or income tax implications and recordkeeping requirements.

Buying Physical Silver Online

Choose a reputable dealer: Look for established Australian dealers that disclose premiums, delivery and storage options, and authentication practices.

Delivery versus allocated storage: Decide whether you want home delivery or to use a vaulting service. Home delivery requires secure storage and insurance; allocated storage transfers custody responsibilities to a professional vault provider and may involve storage fees.

Verify authenticity and redemption policies: Confirm the dealer’s procedures for certifying metal, accepted payment methods, and the process for selling or redeeming holdings later.

Consider transaction costs: Dealer premiums, shipping fees, and potential buy-back spreads can affect total transaction cost; compare across dealers before purchasing.

Practical Tips for Effective Silver Exposure

Clarify your objective: Define whether you are seeking short-term speculative exposure, medium-term tactical allocation, or long-term portfolio diversification. The chosen vehicle should align with that objective.

Use position sizing discipline: Limit the proportion of account capital allocated to leveraged products and define clear loss tolerances. For physical holdings, consider how much liquidity you need and how quickly you may need to liquidate.

Understand product mechanics: CFDs, ETFs, and physical holdings each have different cost drivers—overnight financing for CFDs, management and tracking for ETFs, and premiums and storage for physical bullion. Match product choice to operational comfort and tax preferences.

Monitor industrial demand: Because silver has widespread industrial applications, shifts in technology adoption or manufacturing activity can affect medium-term demand dynamics. Keep an eye on sector trends relevant to silver consumption.

Keep records and seek tax advice: Accurate recordkeeping is essential for later reporting. Professional tax advice helps clarify deductibility, treatment of gains, and any product-specific considerations.

Check dealer and platform reviews: Reputation matters—look for customer feedback on execution quality, delivery timelines, storage integrity, and customer-service responsiveness.

Trial small and scale: If you are new to a product or platform, begin with a modest exposure to learn operational mechanics and to verify the platform’s user experience and customer service before increasing allocation.

Summary

Australia offers multiple practical avenues to gain exposure to silver: online CFD platforms like markets.com for leveraged trading, local dealers like ABC Bullion for physical holdings and storage options, and platforms offering ETFs for exchange-listed access. Each path has unique trade-offs involving custody, fees, operational complexity, and tax treatment. Whether buying physical metal or trading CFDs, clear objectives, disciplined position sizing, and awareness of product-specific mechanics are essential. For tax and regulatory nuances that may affect your choice, consult a qualified professional before committing capital.

Risk Warning and Disclaimer: This article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform. Trading Contracts for Difference (CFDs) involves high leverage and significant risks. Before making any trading decisions, we recommend consulting a professional financial advisor to assess your financial situation and risk tolerance. Any trading decisions based on this article are at your own risk.