Our company name has changed from Finalto International Ltd to Markets International Ltd.

What's staying the same?

There are no changes to your experience

If you have any questions, our support team is here to help via phone, Live Chat or email support@markets.com

Wednesday Oct 22 2025 03:36

8 min

What Is A Stock Dividend: This guide explains stock dividends, how to buy dividend-paying shares, timing and mechanics of distributions, how dividends affect price behaviour, methods to calculate payouts, and where to verify a company’s dividend history.

At the end is a brief note about compiling a list of high-yield names for a given year; the list itself is not included here so you can source current holdings that match your criteria.

What is a stock dividend?

A stock dividend is a distribution made by a corporation to holders of its shares, paid in the company’s own shares rather than cash. When a company issues a stock dividend, each shareholder receives additional shares proportional to their existing holding. The total ownership percentage of each shareholder remains broadly the same immediately after the distribution, though each share represents a slightly smaller claim on the company’s equity because the share count has increased.

Stock dividends are a way to return value without reducing the company’s cash reserves. They can be used when management wishes to reward shareholders but prefers to retain liquidity for operations, capital projects, or debt service. Some firms use stock dividends as part of a broader capital-allocation policy alongside cash dividends and share buyback programs.

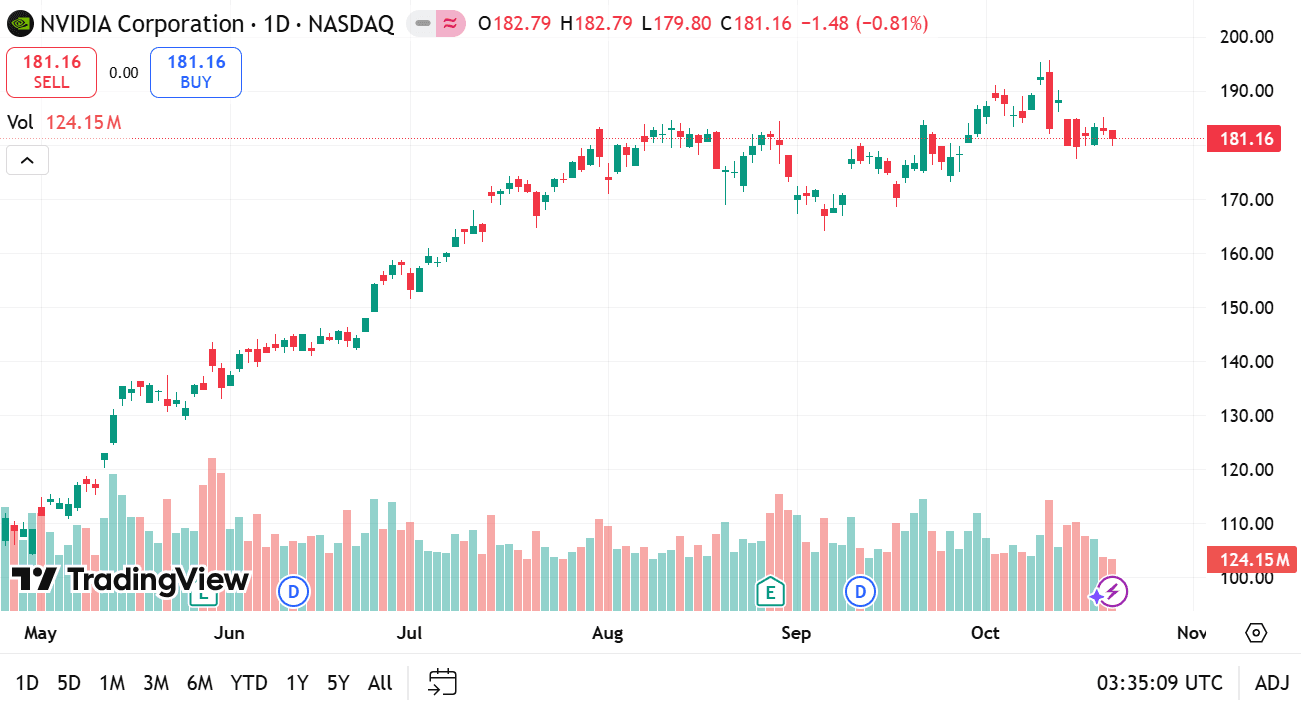

source: tradingview

How to invest in dividend stocks

Define your goals and time horizon: Decide whether you seek current distributions, longer-term total return, or a combination. This informs whether you prioritise yield level, dividend sustainability, or dividend growth.

Screen for candidates: Use filters such as dividend yield, payout ratio, dividend growth history, sector exposure, and financial health metrics. Consider whether you prefer established companies with steady distributions or higher-yielding firms that may carry greater variability.

Choose an execution method: Purchase shares through a brokerage account or use a fund that aggregates dividend-paying companies. Some brokerages offer dividend reinvestment plans that automatically use cash distributions to buy more shares.

Evaluate total return: Remember that dividend payments are one component of shareholder return; share-price movement and company fundamentals also matter.

Monitor holdings and rebalance: Periodically review payouts, company fundamentals, and market conditions, then rebalance the portfolio to maintain alignment with your goals.

Top 20 high‑dividend stocks list for a year

Preparing a current list of high-dividend names requires fresh market data and a set of selection criteria. A typical process to assemble such a list includes:

If you want a specific top‑twenty list for 2026, I can generate one using up-to-date market data if you would like me to do that; tell me whether you prefer global listings, a single market focus, or particular sectors to include or exclude.

When are stock dividends distributed? How are they distributed?

Timing and the sequence of key dates determine who receives a dividend and when payment occurs:

Declaration date: The company’s board announces the dividend amount, type (cash or stock), and the schedule for the dividend’s key dates.

Ex‑dividend date: Shares bought on or after this date do not qualify for the upcoming distribution. Buyers who hold shares before this date are entitled to receive the dividend.

Record date: The company identifies registered shareholders who are eligible to receive the distribution. This date is typically one business day after the ex‑dividend date, depending on market settlement conventions.

Payment date: The company transfers the dividend to eligible shareholders. For stock dividends, the additional shares are credited to holders on or shortly after this date.

Stock dividends are distributed in-kind: the company issues new shares or transfers existing treasury shares to shareholders in proportion to their holdings. The company specifies the ratio or percentage (for example, a certain fraction of a share per existing share).

How to calculate stock dividends (examples)

Calculating a stock dividend involves applying the distribution ratio to your current holding. The basic formula is:

New shares received = Current shares held × Dividend ratio

After the distribution, total shares owned = Current shares held + New shares received

Example scenario (conceptual): If a company declares a stock dividend expressed as a fraction of one share per existing share, multiply your shares by that fraction to determine how many additional shares you will receive. Fractional shares may be handled according to the company or broker’s policy—some brokers credit fractional shares, while others may pay cash in lieu of fractional entitlements.

For a percentage-based stock dividend, multiply the share count by the percentage to find the additional shares. For instance, a percentage equivalent to a certain share fraction will scale holdings accordingly. Afterward, the per-share accounting metrics—such as book value per share—will adjust to reflect the larger share count.

How do dividends impact stock prices?

Short term: On the ex‑dividend date, a share’s market price typically adjusts to reflect the dividend distribution. For cash dividends, the price tends to decrease roughly by the cash amount per share, reflecting that the company’s assets have been reduced. For stock dividends, the per-share price commonly adjusts to account for the larger outstanding share count; each share represents a slightly smaller proportional claim, so market price adjustments can occur to reflect dilution.

Medium to long term: Dividend policies influence shareholder expectations and can signal management’s view of cash flow stability. A consistent dividend policy—especially one backed by steady cash generation—can support market confidence in a firm’s payout reliability. Conversely, reductions or suspensions may prompt re-evaluation of financial health. Other corporate actions like buybacks can interact with dividends to affect share supply and the per-share metrics that market participants use to value companies.

How to check for stock dividends paid by a company

To verify past and upcoming distributions, follow a methodical approach:

Conclusion and practical note about a top‑twenty list

A stock dividend increases the number of outstanding shares and distributes additional shares to existing shareholders in proportion to their holdings. Investing in dividend-paying stocks requires defining objectives, screening for sustainable distributions, and matching the chosen security to your time horizon. Dividend timing is governed by declaration, ex‑dividend, record, and payment dates. Calculations are straightforward and depend on the declared ratio; market prices adjust to reflect changes in per‑share claims.

If you want a specific top‑twenty high-dividend list tailored for 2026, indicate whether you prefer global markets or a specific exchange, whether to filter by sector, and any constraints on payout coverage or balance-sheet metrics. I can then produce a current list that meets those parameters.

Risk Warning and Disclaimer: This article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform. Trading Contracts for Difference (CFDs) involves high leverage and significant risks. Before making any trading decisions, we recommend consulting a professional financial advisor to assess your financial situation and risk tolerance. Any trading decisions based on this article are at your own risk.