Tuesday May 26 2020 11:09

3 min

The euro and Sterling were on the front foot on Tuesday, with cable stretching its advance to near a 2-week peak. Whilst the dollar was offered on a broad return of risk appetite, the euro also seemed to get some lift from the ECB, which is giving signals it’s ready to do even more.

Bank of France Governor Francois Villeroy de Galhau, a key member of the ECB’s Governing Council, told a conference on Monday that there is room for the central bank to act ‘rapidly and powerfully’.

Speaking to CNBC subsequently on Tuesday he said there is a need to be flexible with the current round of coronavirus asset purchases, suggesting that the ECB shouldn’t need to bound to capital keys that dictate how many government bonds it can purchase based on the size of each country’s economy.

The German Constitutional Court ruling earlier this month expressly stated that the capital key was essential to avoid distorting markets, so this could fuel further disquiet among those hawks who have been set against the ECB’s bond buying.

Meanwhile, we await to see whether the EU states can agree a fiscal response, with Denmark, Austria, Sweden and the Netherlands countering the Franc-German proposal for a €500bn bailout fund to be financed by the European Commission issuing bonds. The so-called ‘Frugal Four’ want only a short-term emergency scheme financed by loans.

Prices are in recovery mode following a rejection of the lows yesterday at 1.0870. EURUSD extended to 1.09730 – with this high formed we can look to recover the 1.1020, the May 1st peak which could open up a breakout from the two-month range.

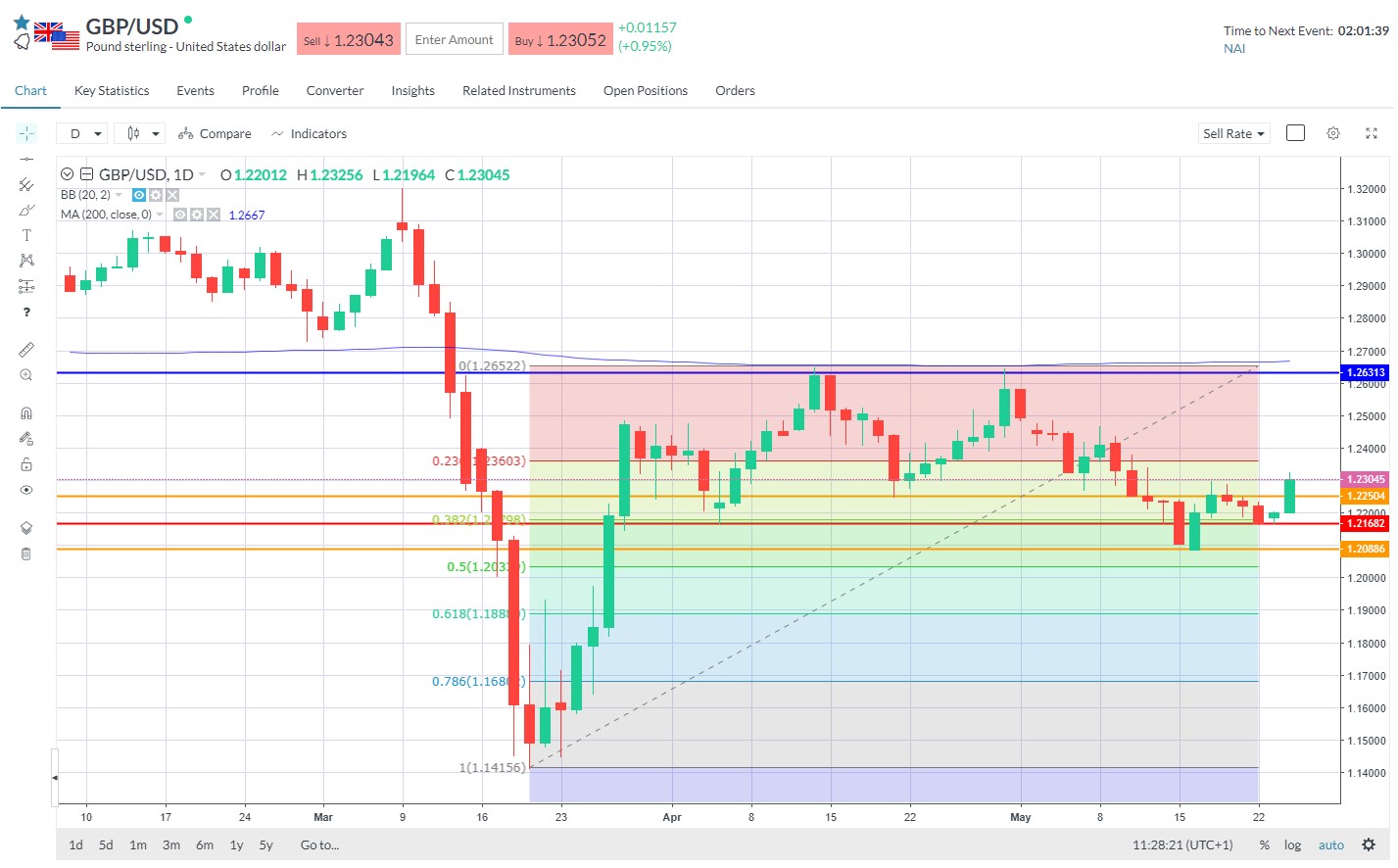

Meanwhile GBPUSD pushed up to a 2-week high at 1.23 after the 1.2160 support area held and we saw a push through the 1.2250 channel. A break to the upside calls for a return to 1.25/1.26 and the Apr double top highs. Failure to sustain the move beyond 1.23 calls for retest of the 1.2160 support and thence the swing low at 1.2080 comes back into focus.