You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Senin Oct 27 2025 02:50

7 min

CFD Traidng Basics: Purchasing Bitcoin has become increasingly accessible through various platforms, but the cost of trading can vary widely depending on the broker or exchange used.

For those looking to trade Bitcoin with minimal fees, understanding the options available and how to navigate them is essential. This guide explores affordable ways to buy Bitcoin, highlights some of the cheapest exchanges, and focuses on trading Bitcoin CFDs through markets.com as an example of cost-effective trading.

When considering how to acquire Bitcoin while minimizing fees, there are several approaches:

Direct Purchase on Cryptocurrency Exchanges: Buying Bitcoin directly from an exchange often involves fees related to trading, deposits, and withdrawals. Choosing exchanges known for lower fee structures can reduce overall costs.

Trading Bitcoin CFDs (Contracts for Difference): CFDs allow trading price movements without owning the actual asset. This method usually involves spreads and overnight fees but can offer lower entry costs compared to buying Bitcoin outright.

Peer-to-Peer Platforms: These platforms sometimes offer competitive prices but may come with additional considerations such as transaction time and security.

Broker Platforms: Brokers that offer CFD trading or direct Bitcoin purchase can vary in fee structures. Some specialize in providing low-cost trading environments, including competitive spreads and minimal commissions.

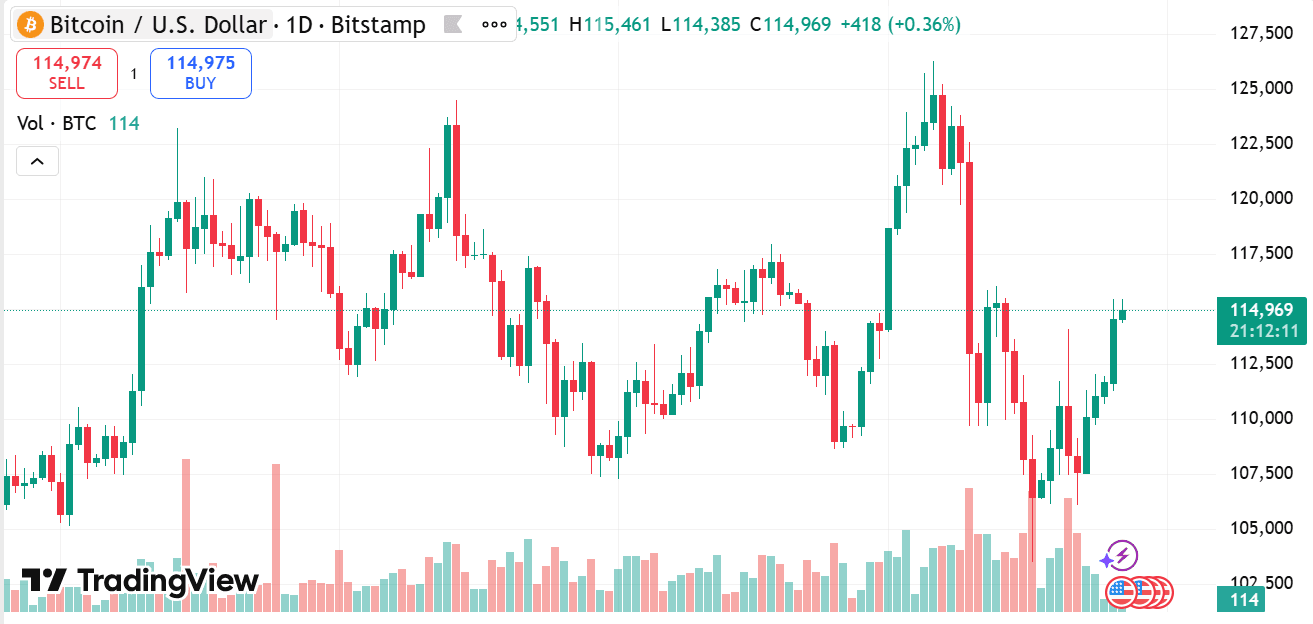

source: traidngview

Selecting the best option depends on individual trading preferences, frequency, and the desired level of control over the underlying asset.

Several exchanges are known for offering relatively low-cost Bitcoin trading. Here is an overview of four platforms commonly recognized for their affordable fee structures:

(1) Coinbase

Coinbase is one of the most popular cryptocurrency exchanges globally. While it provides a user-friendly interface and a secure environment, it also offers competitive fees especially on its Coinbase Pro platform. This version caters to more active traders looking to benefit from lower trading costs.

(2) Binance

Binance is known for its wide range of cryptocurrencies and one of the lowest fee schedules in the industry. It offers tiered fee reductions based on trading volume and the use of its native token. Binance’s extensive liquidity often results in tighter spreads, lowering the overall cost of trading Bitcoin.

(3) MEXC

MEXC is gaining recognition for offering low trading fees and a straightforward platform. It supports a variety of digital assets and provides incentives such as fee discounts for frequent traders or token holders, making it attractive for cost-conscious users.

(4) markets.com

Markets.com is a broker platform offering Bitcoin trading through CFDs. It focuses on providing a cost-efficient trading environment with competitive spreads and minimal commissions. Its regulation and user-friendly interface also appeal to those seeking a streamlined Bitcoin trading experience.

Cheap Bitcoin Trading Broker - Trade Bitcoin CFD with markets.com

Markets.com offers an accessible way to trade Bitcoin CFDs without owning the cryptocurrency directly. Trading CFDs means speculating on Bitcoin’s price movements, either up or down, using leverage to enhance potential gains or losses.

This platform is notable for its transparent fee structure, combining low spreads with no hidden commissions, making it suitable for traders aiming to reduce overall costs.

Trading Bitcoin CFDs on markets.com with minimal fees involves several practices:

While low fees are important, there are several other factors to consider when trading Bitcoin to ensure a smooth and controlled experience:

Market Volatility

Bitcoin’s price can be highly volatile, leading to rapid price swings. This volatility can affect trade execution, margin requirements, and risk management strategies.

Leverage Risks

Using leverage increases exposure but also magnifies losses. Understanding the implications and applying proper risk controls is essential.

Regulatory Environment

The regulatory landscape for cryptocurrency trading continues to evolve. Ensuring the broker or exchange complies with relevant regulations adds an extra layer of security.

Platform Reliability

Technical issues or downtime can impact the ability to execute trades effectively. Choosing platforms with strong reputations for stability and customer support is beneficial.

Spread and Slippage

Even with low spreads, slippage can occur during fast-moving markets. Being mindful of market conditions and order types helps mitigate this risk.

Fees Beyond Trading Costs

Watch for additional fees such as withdrawal charges, inactivity fees, or currency conversion costs that may affect overall expenses.

Buying and trading Bitcoin with minimal fees requires careful selection of platforms and an understanding of trading mechanics. Exchanges like Coinbase, Binance, and MEXC provide competitive fee structures for direct Bitcoin purchases. Meanwhile, brokers such as markets.com offer cost-efficient CFD trading options that can suit those looking to speculate on Bitcoin’s price movement without owning the asset directly.

Keeping an eye on spreads, leverage, and other trading costs, combined with awareness of market conditions and platform reliability, can help traders manage expenses effectively. By choosing the right broker or exchange and employing prudent trading strategies, it is possible to engage in Bitcoin trading while keeping fees as low as possible in 2025.

Risk Warning and Disclaimer: This article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform. Trading Contracts for Difference (CFDs) involves high leverage and significant risks. Before making any trading decisions, we recommend consulting a professional financial advisor to assess your financial situation and risk tolerance. Any trading decisions based on this article are at your own risk.