Monday Sep 21 2020 08:32

7 min

September blues continue: European markets shot lower in early trade on Monday after US stocks fell for a third week in a row – the first such sustained decline in a year. The FTSE 100 headed under 5,900 and the DAX gave up the 13,000 handle as risk aversion spread across equity markets.

The FTSE 100 plunged more than 2.5% lower to test the big September lows – the weakest since May – at 5850. On Friday the S&P 500 broke down at the 50-day simple moving average and closed at its weakest since early August.

Rising infection rates (I discussed the inherent problem with comparing the number of cases today with April and May) in Europe and the prospect of fresh lockdowns in the UK and elsewhere are a worry for investors – how quickly do we recover from the pandemic? A fresh round of flash PMIs this week ought to help tell us whether the momentum has faded.

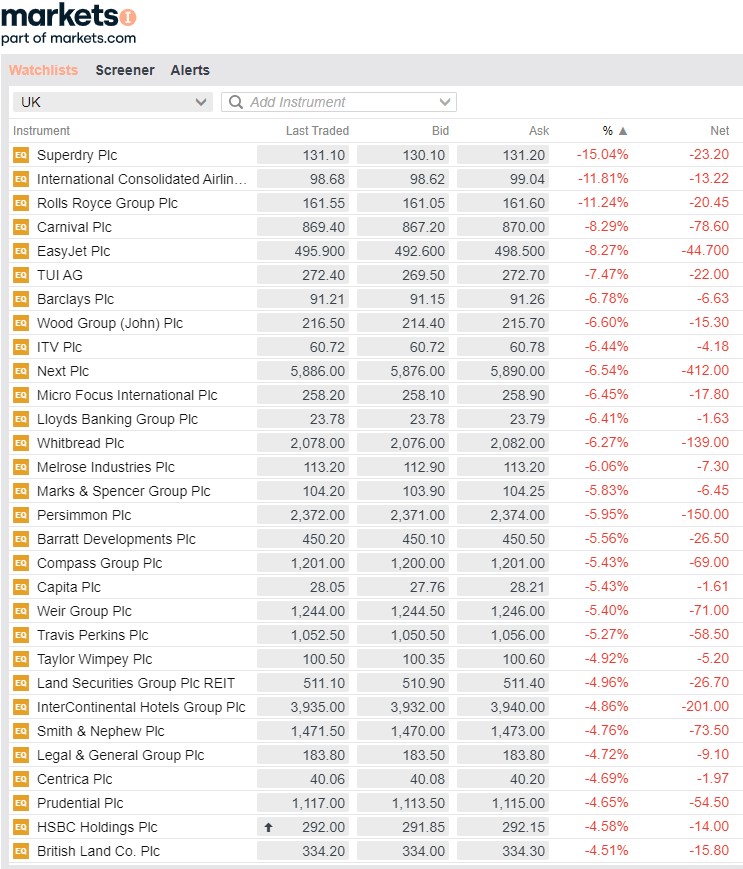

Tighter rules are almost certain as the authorities flounder and seem unable to get any kind of consistently clear approach to the pandemic. Travel and leisure was hit hard as new lockdowns and travel restrictions are an almost given heading into half term. Many stocks are now trading at multi-year lows– IAG and Rolls Royce both dropped 10% today, whilst Lloyds sank 6% to as low as 23p.

It’s a very nasty looking board this morning – as of 08.47 this morning.

Banks are being whacked: HSBC, Barclays and Standard Chartered shares fell after being named in a report on trillions of dollars of suspicious transfers being funnelled through the banks. JPMorgan, HSBC, Standard Chartered Bank, Barclays, Deutsche Bank and Bank of New York Mellon were all named in the so-called FinCEN files.

The report from the International Consortium of Investigative Journalists centres on more than 2,100 suspicious activity reports filed by banks and other financial firms with the U.S. Department of Treasury’s Financial Crimes Enforcement Network, which boasts Meryl Streep and Barbara Streisand among its supporters.

Whilst it is unclear to extent there will be a material impact on the banks in question, and whether the transactions are covered by existing DoJ deals and fines, it raises litigation and regulatory risk and we cannot rule out fines and charges being levied by various actors.

Either way, the stench of corruption and money laundering will linger over the largest banks for a long time. There were even reports HSBC may be added to China’s unreliable entity list.

As if it were even possible, the US presidential race just got a whole lot more interesting. The death of Ruth Bader Ginsburg raises the stakes of the election and should energise the respective bases into action.

Whilst Trump has said he wants to install a replacement before the election, there is not much time and moderate Republicans may prevent it. A special election in Arizona in Nov ought to cut the Republican lead in the current Congress in half.

Democrats are horrified at the potential for a 6-3 conservative split on the Supreme Court that could stymie liberal reforms for decades. As we saw last time, presidential and Senate elections can take on a different complexion when a Supreme Court seat is up for grabs. If there is one on offer this time, conservatives and liberals on either side will be fired up to vote.

This could tip the Senate vote in favour of the Republicans but could dent Donald Trump’s chances of swinging some of the Rust Belt seats. Either way, this will only exacerbate the split between the two parties and make agreeing another round of stimulus before the election almost impossible.

Last week the Fed appeared to hand the economic recovery baton over to Congress, but with more fiscal stimulus not on the cards, focus on the central bankers will be high. A slew of Fed speakers this week, including Jay Powell, will be closely watched as to what they are trying to achieve and how they see the new monetary policy framework shift.

Watch Dallas Fed president Robert Kaplan, who dissented somewhat from last week’s statement, saying that he prefers the FOMC to ‘retain greater policy rate flexibility beyond that point’ at which the Fed’s ‘maximum employment and price stability goals’ have been reached. Kaplan at least is worried about ZIRP ad infinitum.

Andrew Bailey, the Bank of England governor, also gets two speeches this week to explain what the MPC meant by signalling negative rates are coming – the pound may be volatile should he seek to distance himself from this and carve out some greater policy flexibility.

Sterling will also be watching the passing of the internal market bill in the Commons today and tomorrow – whilst Tories are on board, the Lords is less keen. Quite what the EU makes of it passing will come in the trade deal wash towards the end of the month. GBPUSD dropped in early trade on Monday to test the 1.29 round number.

Finally, Trevor Milton has stepped down as executive chairman at Nikola after the electric carmaker was done up like a kipper by Hindenburg. It follows a pretty devastating research report from the short seller which accused Nikola of a web of lies.

Nikola’s response was weak and failed to address the bulk of the concerns raised by Hindenburg, which dubbed it a ‘tacit admission of securities fraud’. Mr Milton clearly didn’t feel in a good place to defend against these attacks. Former GM vice chairman Stephen Girsky is taking the helm.