I CFD sono strumenti complessi e presentano un alto rischio di perdere soldi rapidamente a causa della leva finanziaria. Il 72,3% dei conti di clienti al dettaglio perde denaro facendo trading con i CFD con questo fornitore. Devi verificare se comprendi pienamente come funzionano i CFD e se puoi permetterti di correre il rischio elevato di perdere i tuoi soldi.

Lunedì Oct 20 2025 07:50

5 min

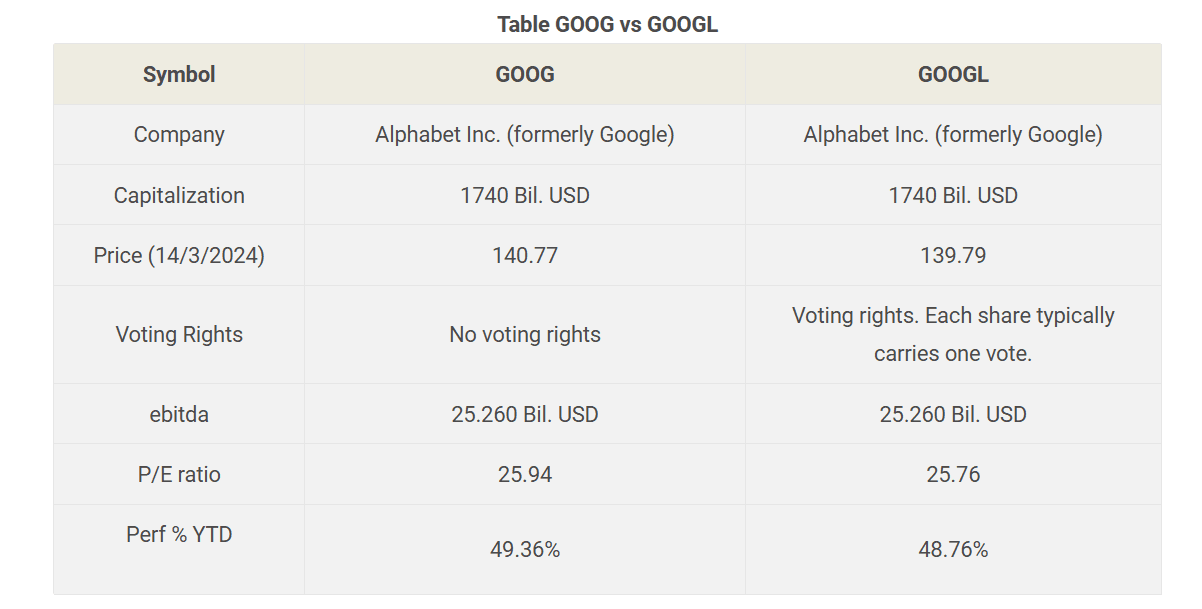

Stocks to Watch 2026: The core difference between GOOGL and GOOG lies in the rights granted to the shareholder, specifically voting rights.

While both provide an ownership stake in one of the world's largest technology companies, the class of stock determines the shareholder's ability to influence corporate decisions.

GOOG vs GOOGL: Overview

GOOG and GOOGL are the two stock ticker symbols for Alphabet Inc.

GOOGL represents the company's Class A shares. Holders of GOOGL stock are granted one vote per share on matters such as electing the board of directors and approving major corporate changes.

GOOG represents the company's Class C shares. These shares grant the holder no voting rights whatsoever.

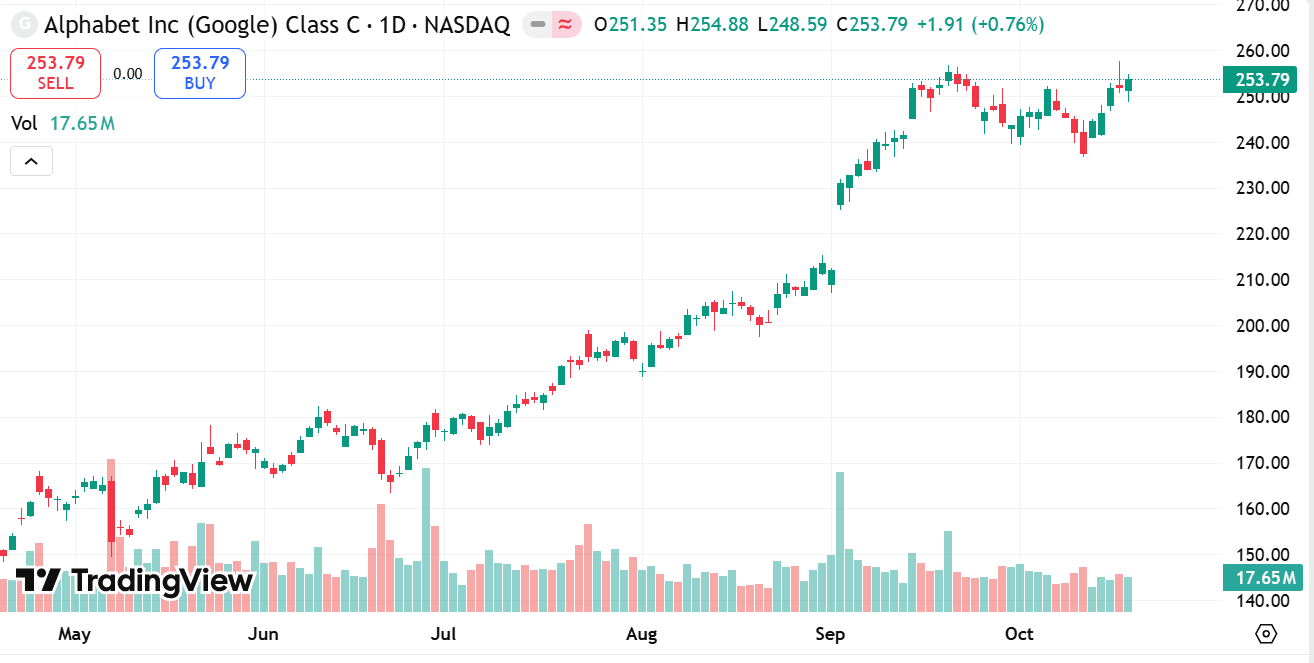

souce: tradingview

This dual-class structure was implemented to allow the company to issue new shares to raise capital or for employee compensation without diluting the voting control held by the founders and company insiders, who own a third class of stock, Class B shares, which are not publicly traded and carry ten votes per share.

Despite the difference in corporate influence, both GOOGL and GOOG shares represent the same economic interest in the company. This means they are equally affected by the company's financial performance and receive the same value per share in the event of a stock split or the issuance of dividends.

GOOG vs GOOGL: Price Change Trend

Historically, the stock prices of GOOGL (Class A, voting) and GOOG (Class C, non-voting) have tracked each other very closely. They share the same underlying business and are essentially two sides of the same coin in the public market.

However, there is a persistent, though usually small, difference in their price. Because voting rights hold some inherent value, the Class A shares (GOOGL) may sometimes trade at a slight premium compared to the Class C shares (GOOG). This is not a universal rule, and the price difference can fluctuate, occasionally even favoring the non-voting shares. Ultimately, both stock classes move in near-lockstep, reflecting the market's collective valuation of Alphabet's core business and future outlook.

How to Buy GOOG or GOOGL Shares?

Buying either GOOG or GOOGL shares involves a standard process through a brokerage platform:

Open a Brokerage Account: You'll need an account with an online brokerage firm that offers access to U.S. stocks, which trade on the NASDAQ stock market.

Fund Your Account: Transfer money into your new brokerage account from your bank.

Search for the Stock: Use the trading platform's search function and enter the desired ticker symbol, either GOOGL or GOOG.

Place an Order: Decide how many shares you wish to buy. You will then need to select your order type, such as a market order (to buy immediately at the current market price) or a limit order (to specify the maximum price you are willing to pay).

Execute the Trade: Review and confirm your order. Once executed, the shares will be held in your brokerage account. Some brokerage services also offer the option to purchase fractional shares, allowing you to allocate a specific amount of currency to the stock instead of buying whole shares.

GOOG vs GOOGL: Which one should you buy?

The choice between GOOG and GOOGL boils down to your personal preference regarding corporate governance participation and a slight difference in initial purchase cost.

If you place a value on having the ability to cast a vote on corporate matters, even though the influence of individual public shareholders is limited due to the superior voting rights held by the founders, then the GOOGL (Class A) shares would be the appropriate choice.

If your primary focus is solely on gaining economic exposure to Alphabet's future growth and you are indifferent to shareholder voting, then the GOOG (Class C) shares may be preferable, as they occasionally trade at a lower cost.

For the vast majority of retail stock buyers, the practical difference between the two classes is minimal. Both provide identical ownership and equal exposure to the company's business performance and long-term trajectory.

Looking to trade GOOG stock CFDs? Choose Markets.com for a user-friendly platform, competitive spreads, and a wide range of assets. Take control of your trading journey today! Sign up now and unlock the tools and resources you need to succeed in the exciting world of CFDs. Start trading!

Informativa sul rischio: questo articolo rappresenta solo l’opinione dell’autore ed è solo per riferimento. Non costituisce una consulenza di investimento o guida finanziaria e non rappresenta la posizione della piattaforma Markets.com.Nel valutare azioni, indici, forex e materie prime per il trading e per le previsioni di prezzo, ricorda che il trading di CFD comporta un livello significativo di rischio e può portare alla perdita del capitale.I rendimenti passati non sono indicativi dei risultati futuri. Queste informazioni sono fornite esclusivamente a scopo informativo e non devono essere interpretate come consulenza di investimento. Nota: il trading con CFD su criptovalute e lo spread betting è soggetto a restrizioni nel Regno Unito per tutti i clienti al dettaglio.