Forex market today: The forex market remains one of the largest and most liquid financial markets globally, with the euro and U.S. dollar pair (EUR/USD) often drawing the most attention.

For traders and market participants, understanding the strength of the euro, the performance of EUR/USD, and other euro pairs is essential to navigate this dynamic space. This article explores the recent trends and outlook for EUR/USD, discusses other euro currency pairs, and examines how to approach trading the euro effectively.

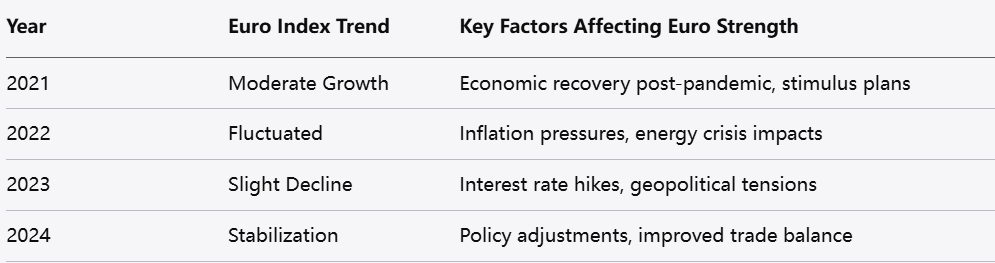

The euro has experienced various phases of strength and adjustment over recent years, influenced by economic developments within the Eurozone, monetary policy decisions, and global economic trends. Factors such as inflation trends, employment levels, and fiscal policies across member countries contribute to shaping the euro’s overall standing.

At the same time, external influences like trade relations, geopolitical events, and shifts in global demand have also impacted the euro’s relative value. Various euro-related indices that track the currency’s performance against a basket of other currencies reflect these dynamics, demonstrating periods of resilience and pressure.

Understanding the broader economic backdrop and factors influencing the euro helps provide context for EUR/USD movements and trading decisions.

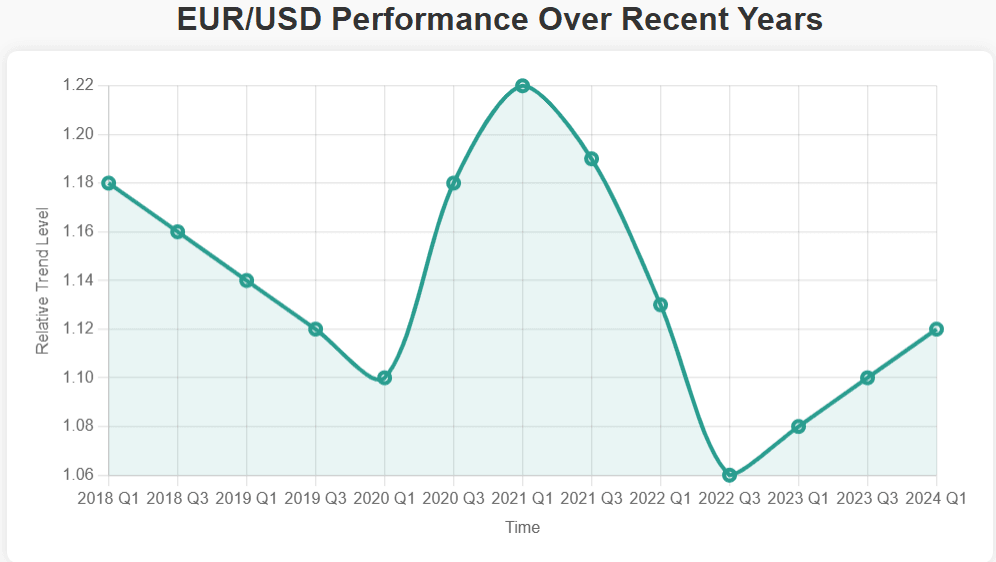

EUR/USD, representing the exchange rate between the euro and the U.S. dollar, is the most traded currency pair in the forex market. Its performance over the years mirrors the interplay between the two largest economies in the world.

Movements in this pair are influenced by differences in monetary policy between the European Central Bank and the U.S. Federal Reserve, economic growth rates, trade balances, and geopolitical developments. Currency flows related to trade, capital movements, and market sentiment also contribute to price changes.

The pair has experienced periods of volatility and stability, reflecting shifts in economic cycles and global risk sentiment. Traders closely watch this pair for clues about broader economic trends and cross-market linkages.

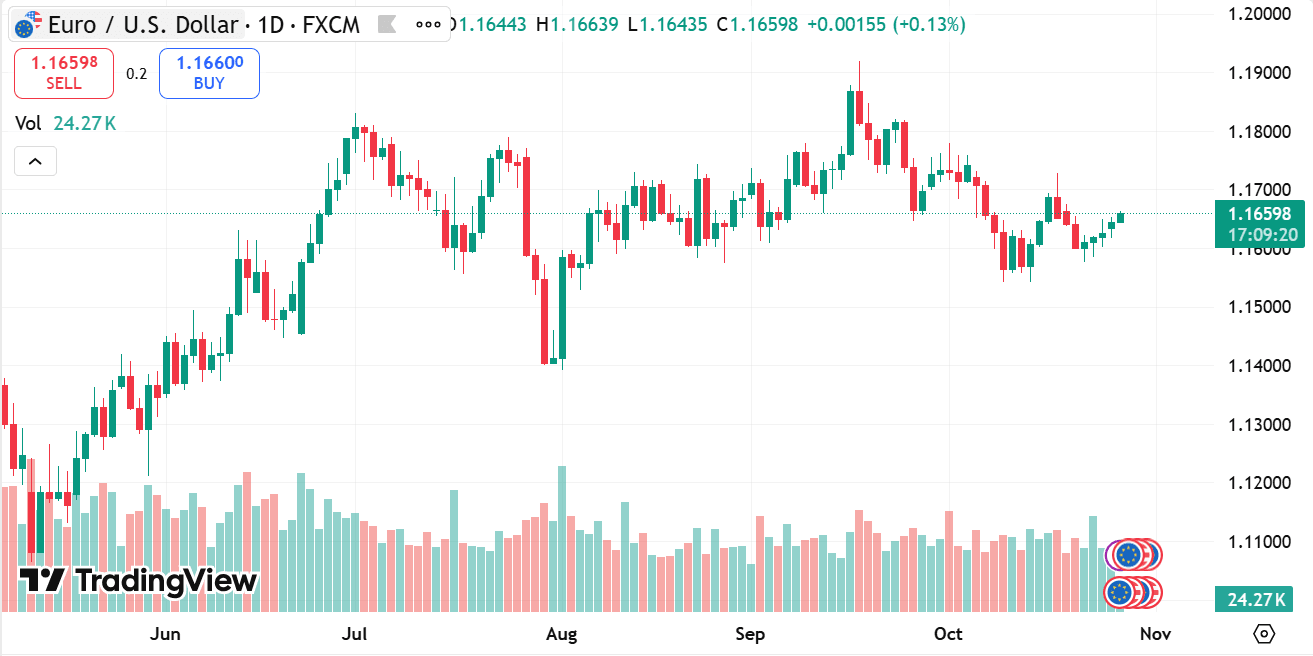

Looking at recent years, EUR/USD has navigated through various global events and economic shifts. These periods have included phases of tightening and loosening monetary policies, changes in inflationary pressures, and responses to geopolitical tensions.

source: tradingview

The pair’s movement reflects how market participants interpret economic data releases, central bank communications, and global financial conditions. Understanding these factors helps frame expectations for the pair’s behavior and informs trading strategies.

While past performance is not predictive of future results, examining historical trends provides valuable insights into how the pair reacts under different circumstances.

Deciding whether to buy EUR/USD depends on multiple considerations, including economic outlooks, monetary policy expectations, and geopolitical developments. Traders should assess current market conditions, personal risk tolerance, and trading goals before entering positions.

markets.com offers various platforms that provide access to EUR/USD through spot forex, futures contracts, or contracts for difference (CFDs). Each method has its characteristics in terms of leverage, cost, and flexibility.

Successful trading involves developing a clear plan, managing risk effectively, and staying informed about relevant news and economic releases. Utilizing demo accounts and educational resources can also help develop familiarity with the pair’s behavior.

Forecasting EUR/USD involves considering a range of economic and geopolitical factors that will influence the euro and dollar over time. Expectations for inflation, employment, fiscal policies, and central bank actions play a crucial role.

Global economic conditions, trade relationships, and political developments will continue to shape currency flows and market sentiment. Over the coming years, shifts in these areas can lead to changes in the exchange rate.

While it is impossible to predict exact price levels, understanding key drivers and monitoring evolving conditions can help form a view on the pair’s likely direction and volatility.

Beyond EUR/USD, several euro pairs attract attention in the forex market. These include EUR/GBP, EUR/JPY, EUR/CHF, and EUR/AUD among others. Each pair reflects the relationship between the euro and a different major currency, influenced by unique economic and political factors in their respective regions.

For example, EUR/GBP is sensitive to developments in both the Eurozone and the United Kingdom, including trade agreements and monetary policies. EUR/JPY involves dynamics between European and Japanese economies, with considerations for risk appetite and global financial conditions.

Trading other euro pairs offers diversification and exposure to different market drivers but also requires understanding the specifics of each currency’s economic landscape.

The EUR/USD pair remains central to forex market activity, shaped by broad economic forces and policy decisions in both the Eurozone and the United States. The euro’s strength and related indices provide important context for understanding the pair’s movement.

Traders considering EUR/USD should evaluate historical trends, current economic conditions, and future outlooks while employing effective risk management and trading discipline. Additionally, exploring other euro pairs can offer further trading possibilities with different characteristics.

Staying informed and adaptable is key to navigating the evolving forex market and making the most of trading euro currency pairs.

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.