Best currency pairs to trade: Understanding the world of Forex trading begins with knowing what currency pairs are and how to choose the right ones for your trading approach.

This guide introduces the basics of Forex pairs, practical steps to select suitable pairs, and insights into the most traded and volatile currency pairs. Additionally, it provides a list of the top 15 major Forex pairs commonly traded in the market.

Forex trading involves buying one currency while simultaneously selling another. These two currencies together form a currency pair. The value of a currency pair reflects how much one unit of the base currency is worth in terms of the quote currency. For example, in a pair like EUR/USD, the first currency (EUR) is the base, and the second (USD) is the quote.

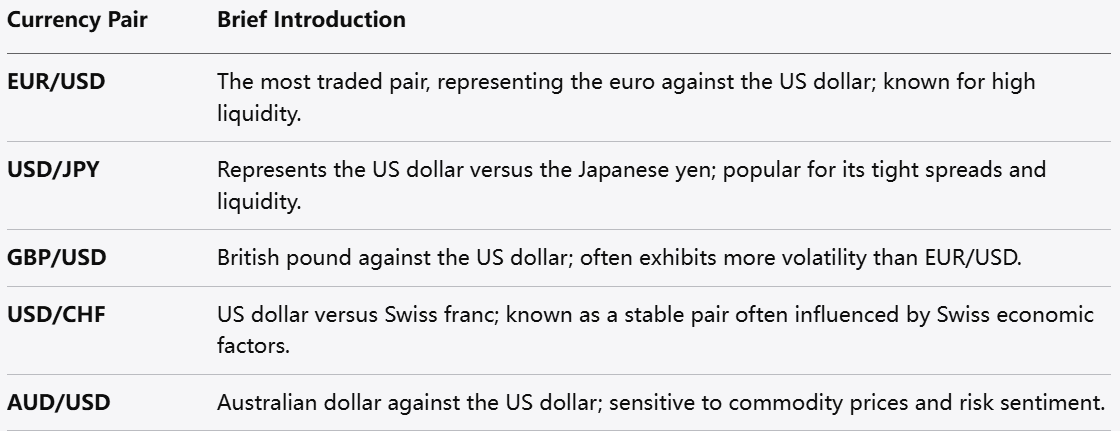

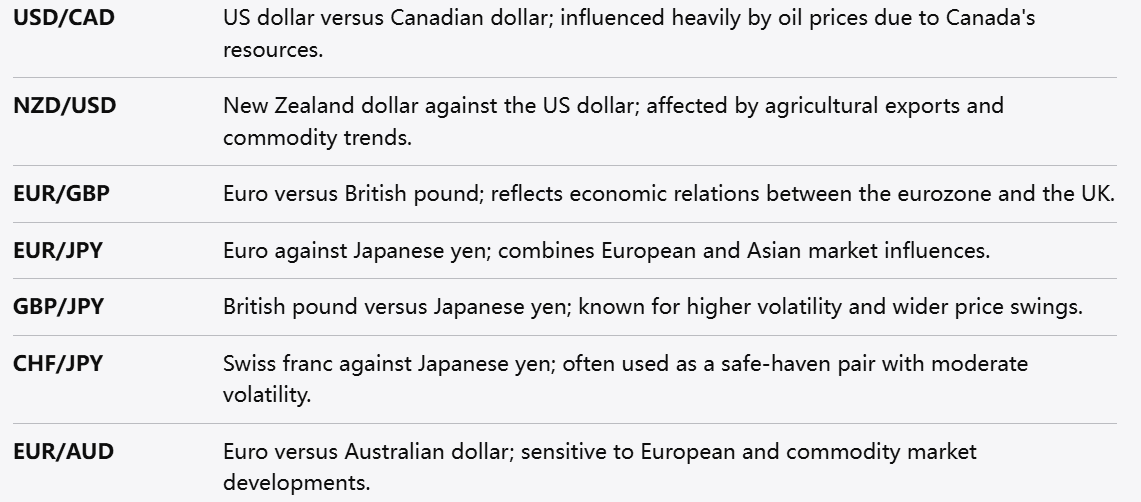

Currency pairs are categorized into majors, minors, and exotics based on their liquidity, trading volume, and the countries involved. The major pairs feature the most traded and liquid currencies worldwide, making them popular among traders due to their tight spreads and ample market activity.

Choosing the right currency pairs to trade depends on several factors related to your trading style, goals, and market conditions. Below are five steps to guide this selection process:

Step 1: Understand Your Trading Style

Are you a day trader, swing trader, or long-term trader? The choice of currency pairs may vary according to how quickly you want to enter and exit trades. For quick trades, pairs with high liquidity and tight spreads are preferable. For longer-term trades, pairs with clear trending behavior might be more suitable.

Step 2: Consider Market Volatility

Volatility refers to how much a currency pair’s price fluctuates within a specific period. Traders who prefer fast price movements may focus on more volatile pairs, while those who prefer steadier moves might opt for less volatile pairs.

Step 3: Examine Liquidity Levels

Liquidity impacts how easily a currency pair can be bought or sold without affecting its price. Major pairs typically have the highest liquidity, ensuring smooth trade execution. Lower liquidity pairs may experience slippage and wider spreads.

Step 4: Monitor Economic and Political Factors

Currency prices are influenced by economic reports, central bank decisions, geopolitical events, and trade relations. It is essential to choose pairs where you can stay informed about underlying factors affecting their movement.

Step 5: Test and Observe

Before committing significant resources, it is beneficial to test trading strategies on a few pairs using demo accounts or small positions. Observing how different pairs behave in various market conditions can help refine your choices.

The most traded currency pairs usually involve major global currencies such as the US dollar, euro, Japanese yen, British pound, Swiss franc, Canadian dollar, and Australian dollar. These pairs are favored because they combine high liquidity with relatively stable trading conditions.

Trading these pairs often means tighter spreads, which can reduce transaction costs. Their liquidity means that entering and exiting positions is generally easier, even for larger trades. Additionally, the availability of extensive market information and news coverage helps traders understand and anticipate price movements.

It is worth noting that while these pairs are widely traded, their behavior can differ due to the distinct economic profiles of the countries involved. Understanding these differences can aid in developing more effective trading plans.

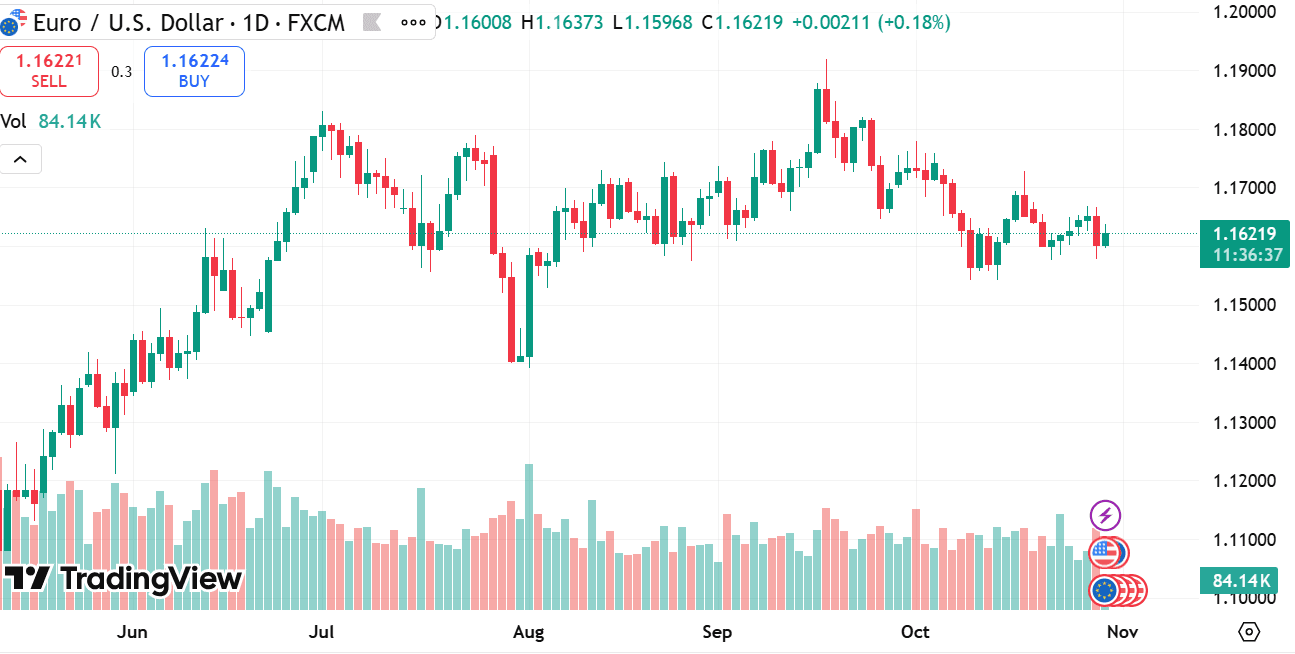

source: tradingview

Volatility varies greatly across currency pairs and over time, influenced by economic cycles, geopolitical developments, and market sentiment. Some pairs are known for sharper price swings, providing more trading activity but also higher unpredictability.

High volatility can offer more frequent price movements, which some traders may find advantageous for shorter-term strategies. However, it also requires careful risk management and awareness of potential price gaps during major news events.

Pairs with emerging market currencies or those influenced by commodity prices often show elevated volatility. It is important to balance volatility preferences with your ability to manage rapid price changes.

Below is a list of major and popular Forex pairs that are commonly traded due to their liquidity, trading volume, and market relevance:

Understanding Forex pairs and how to select the right ones is fundamental for anyone looking to participate in currency trading. By considering your trading style, volatility preferences, liquidity needs, and staying informed about economic factors, you can better navigate the Forex market.

Focusing on major currency pairs provides access to the most liquid and widely followed markets, while also offering varying levels of volatility to suit different approaches. Exploring and testing different pairs will further help tailor trading strategies to individual needs.

With a solid grasp of these basics, traders can engage more confidently in the dynamic world of Forex trading.

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.