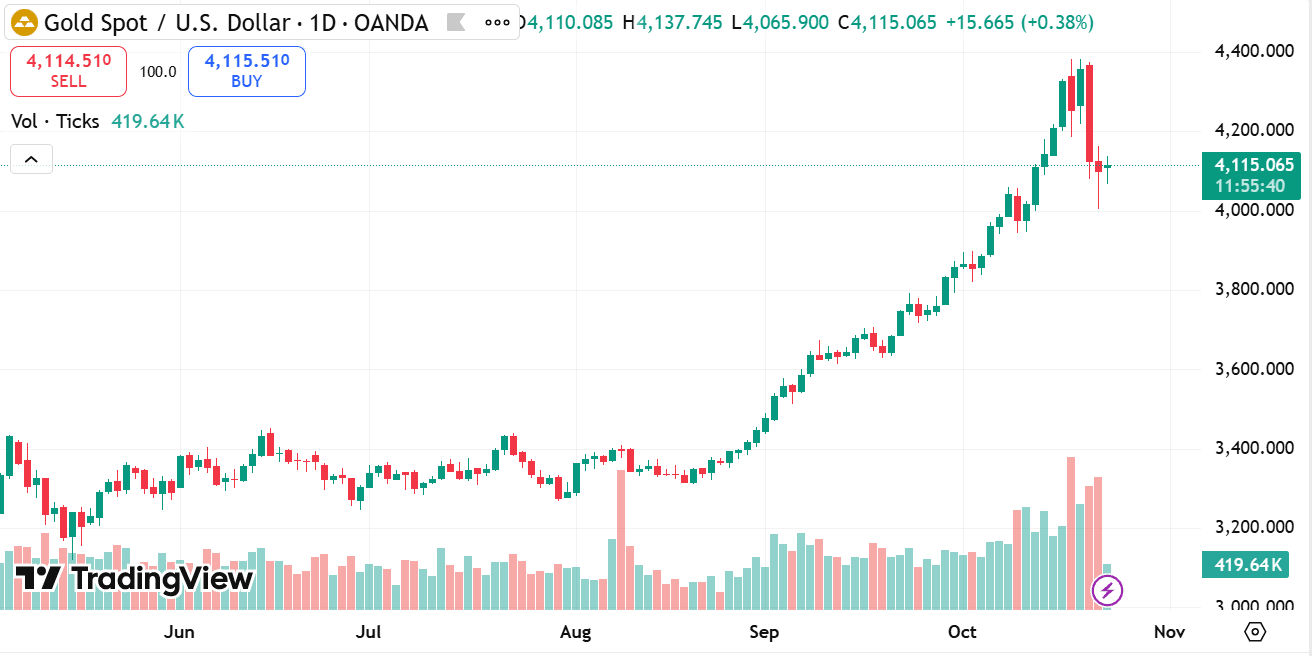

Gold price forecast: Gold has recently experienced a notable decline, shaking the market and prompting a reevaluation of its near-term trajectory.

This shift raises important questions about the factors influencing this movement and the potential direction gold prices may take moving forward. In this discussion, we will explore key drivers behind the recent drop, the broader economic backdrop, and the possible scenarios that could shape gold’s path in the coming months.

Understanding Gold Prices Downward Movement

The recent fall in gold prices reflects a complex interplay of global economic forces and market sentiment. Among the primary contributors is the evolving landscape of monetary policy. Central banks around the world have been adjusting their stances in response to inflation trends and economic growth indicators. Changes in interest rates and expectations around future monetary tightening have a profound impact on gold, as they influence the relative attractiveness of holding non-yielding assets like gold compared to interest-bearing instruments.

Additionally, shifts in currency valuations, particularly the strength of the US dollar, play a crucial role. When the dollar strengthens, gold often faces downward pressure because it becomes more expensive in other currencies, dampening demand. The recent strengthening trend has been a notable headwind for gold prices, adding to the downward momentum.

Economic Environment and Inflation Are Influencing Gold Prices

Gold traditionally acts as a hedge during periods of economic uncertainty and inflationary pressure. However, the current inflation landscape is showing signs of moderation in several key economies. This easing reduces one of the critical catalysts that typically bolster gold demand.

Moreover, the pace of economic recovery and growth prospects worldwide influence market confidence. As economic conditions improve, appetite for riskier assets tends to increase, sometimes at the expense of gold. The balance between growth optimism and inflation worries is delicate, and it is this equilibrium that will largely dictate gold’s direction.

source: tradingview

Geopolitical and Global Events

Geopolitical tensions and global events have historically affected gold’s appeal. In times of turmoil, gold often gains attention as a store of value. Recently, while there have been some geopolitical developments, they have not escalated to levels that traditionally drive gold prices higher. The relative calm in major conflict zones and diplomatic progress in some areas have contributed to a subdued response from the gold market.

That said, the landscape can change rapidly. Emerging risks or renewed tensions could quickly alter sentiment, potentially providing a lift to gold prices if market participants seek to mitigate uncertainty.

Market Sentiment and Behavioral Factors

Market psychology and sentiment are influential in commodity pricing. Following the recent decline, some market participants may be reassessing their exposure to gold, leading to short-term volatility. The interplay between speculative positioning and longer-term strategic holdings creates fluctuations that may not always align with fundamental factors.

Sentiment tends to swing as new information becomes available, and gold’s performance can be highly reactive to news, economic releases, and shifts in monetary policy communication. The current phase suggests a cautious stance prevailing, with participants waiting for clearer signals about the global economic trajectory.

Potential Scenarios for Gold Price (XAU/USD) Future Path

Looking ahead, several scenarios may unfold for gold prices:

Continued Pressure and Consolidation

Gold could experience a period of consolidation, with prices fluctuating within a defined range as markets digest recent changes and await new drivers. This scenario implies caution and a wait-and-see approach, with limited directional moves until more decisive economic or geopolitical developments emerge.

Rebound on Economic or Geopolitical Shifts

Should inflationary pressures re-emerge or geopolitical risks intensify, gold could regain some traction. Renewed concerns about economic stability or heightened uncertainty often rekindle interest in gold, leading to price stabilization or modest recovery.

Impact of Monetary Policy Changes

Central bank actions will remain a critical influence. If monetary tightening slows or is reversed due to weakening economic growth, gold might benefit from improved demand. Conversely, continued or accelerated tightening could keep downward pressure on prices.

Influence of Currency Movements

The trajectory of major currencies, especially the US dollar, will remain a key factor. A weakening dollar would typically support gold prices by making it more accessible globally, while further dollar strength could prolong challenges.

Strategic Considerations in a Changing Landscape

In navigating this environment, it is important to consider the broader context rather than focusing solely on short-term price movements. Gold’s role within a diversified portfolio and its relationship with global economic trends should guide decision-making.

Monitoring developments in inflation, monetary policy, currency trends, and geopolitical events will be essential. Additionally, understanding market sentiment and behavioral shifts can provide insights into potential turning points.

Conclusion

The recent decline in gold prices highlights the dynamic and multifaceted nature of the market. While several headwinds have contributed to the drop, the landscape remains fluid, with multiple factors capable of influencing the metal’s trajectory.

As global economic conditions evolve, the path for gold will be shaped by the interplay of monetary policy, inflation expectations, geopolitical developments, and market sentiment. Staying informed and adaptable will be key in understanding what comes next for gold prices.

Risk Warning: this article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform.When considering shares, indices, forex (foreign exchange) and commodities for trading and price predictions, remember that trading CFDs involves a significant degree of risk and could result in capital loss.Past performance is not indicative of any future results. This information is provided for informative purposes only and should not be construed to be investment advice. Trading cryptocurrency CFDs and spread bets is restricted for all UK retail clients.