CFD's zijn complexe instrumenten en gaan gepaard met een hoog risico snel kapitaal te verliezen als gevolg van hefboommechanismen. 72.3% an de retailbeleggers lijdt verlies op de handel in CFD's met deze aanbieder. U dient zorgvuldig te overwegen of u begrijpt hoe CFD's werken en of u het zich kunt veroorloven om hoge risico's te nemen op het verliezen van uw kapitaal.

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Maandag Oct 14 2024 06:35

7 min.

Super Micro shares plummeted by 13% on Tuesday, 6 August 2024, following the release of their fiscal fourth-quarter earnings, which fell short of analysts’ predictions.

The company reported a decrease in gross margin to 11.2%, compared to 17% in the same quarter last year and 15.5% in the previous quarter. Supermicro announced a 10-for-1 stock split, with trading on a split-adjusted basis scheduled to commence on 1 October.

1. SMCI Declines Due to Concerns Over High Chip Production Costs

Supermicro's stock dropped by 12.3% in premarket trading on August 7, 2024, amid concerns about high AI server chip production costs affecting profit outlook, overshadowing positive sales projections.

In the fourth quarter, the company reported an adjusted gross margin of 11.3%, falling short of the 14.1% average analyst estimate, according to LSEG data. This shortfall resulted from rising supply chain costs and a shortage of key components.

Despite these challenges, CEO Charles Liang reassured investors that margins are expected to stabilize within the normal range by the end of fiscal 2025, reaffirming the company’s target gross margin of 14% to 17%.

2. Supermicro Announces First-Ever Stock Split

Supermicro has announced a 10-for-1 forward stock split, approved by its board of directors. This change will be implemented through an amendment to the company’s Amended and Restated Certificate of Incorporation, increasing the number of authorized common shares proportionally.

Shareholders will receive nine additional shares for each share they currently own, with the adjustment taking effect after the market closes on September 30. The stock is expected to begin trading on a split-adjusted basis on October 1.

3. Supermicro Indicates Delay of Nvidia’s Blackwell Until Early 2025

During the earnings call, CEO Charles Liang announced that significant quantities of Nvidia’s Blackwell GPUs are not expected until the quarter ending in March 2025, with only a limited number potentially arriving by December.

SMCI Stock Current Market Position

Super Micro has established itself as a leader in the server and storage solutions market. With a diverse product lineup that includes cloud, enterprise, and data center solutions, the company's focus on efficiency and sustainability has attracted attention from various industries. As businesses shift to cloud computing and AI-driven solutions, Super Micro is well-positioned to benefit from these trends.

SMCI Stock Growth Drivers

Rising Demand for High-Performance Computing

The increasing demand for high-performance computing, driven by the growth of artificial intelligence, machine learning, and big data analytics, bodes well for Super Micro. Organizations are investing heavily in advanced computing capabilities to gain a competitive edge. This trend is expected to continue, potentially boosting Super Micro's sales and market share.

Expansion into New Markets

Super Micro has been proactive in expanding its footprint in emerging markets and regions, increasing its global presence. As more enterprises, especially in developing countries, adopt modern IT infrastructure, Super Micro's products stand to gain traction.

Partnerships and Collaborations

Strategic partnerships with other technology giants and service providers can enhance Super Micro's offerings and reach. Collaborations aimed at developing innovative solutions and expanding customer bases can drive future revenue growth.

Super Micro Computer Inc's Financial Performance

Revenue Growth and Profitability

In recent years, Super Micro has demonstrated strong revenue growth, driven by robust demand for its server solutions. Maintaining or even accelerating this growth will be crucial for enhancing investor confidence. Additionally, profitability metrics such as margins and earnings per share will influence stock performance moving forward.

Investment in R&D

Super Micro's commitment to research and development is essential for sustaining its competitive advantage. By investing in next-generation technologies and innovative products, the company can enhance its market position and attract new customers.

Market Trends and Economic Factors on SMCI Stock Prices

Macro-Economic Conditions

Economic conditions, including inflation and interest rates, can impact Super Micro's business environment. Economic stability encourages IT spending, while downturns may lead to budget constraints for corporate customers. Monitoring these trends will be vital for predicting future stock performance.

Competitive Landscape

Understanding the competitive landscape is also crucial for forecasting Super Micro's future. As traditional and emerging players in the technology sector innovate and price their products, Super Micro will need to adapt and differentiate its offerings to maintain its market share.

Super Micro Stock Valuation and Future Outlook

Earnings Projections

Based on current growth rates, analysts may project earnings growth for Super Micro over the coming years. If the company maintains a strong trajectory, it could command a higher valuation multiple, positively influencing its stock price by 2026.

Risk Factors

Investors should also consider potential risks, including supply chain disruptions, regulatory challenges, and changes in technological preferences. Any negative market sentiment or unforeseen challenges could impact stock prices significantly.

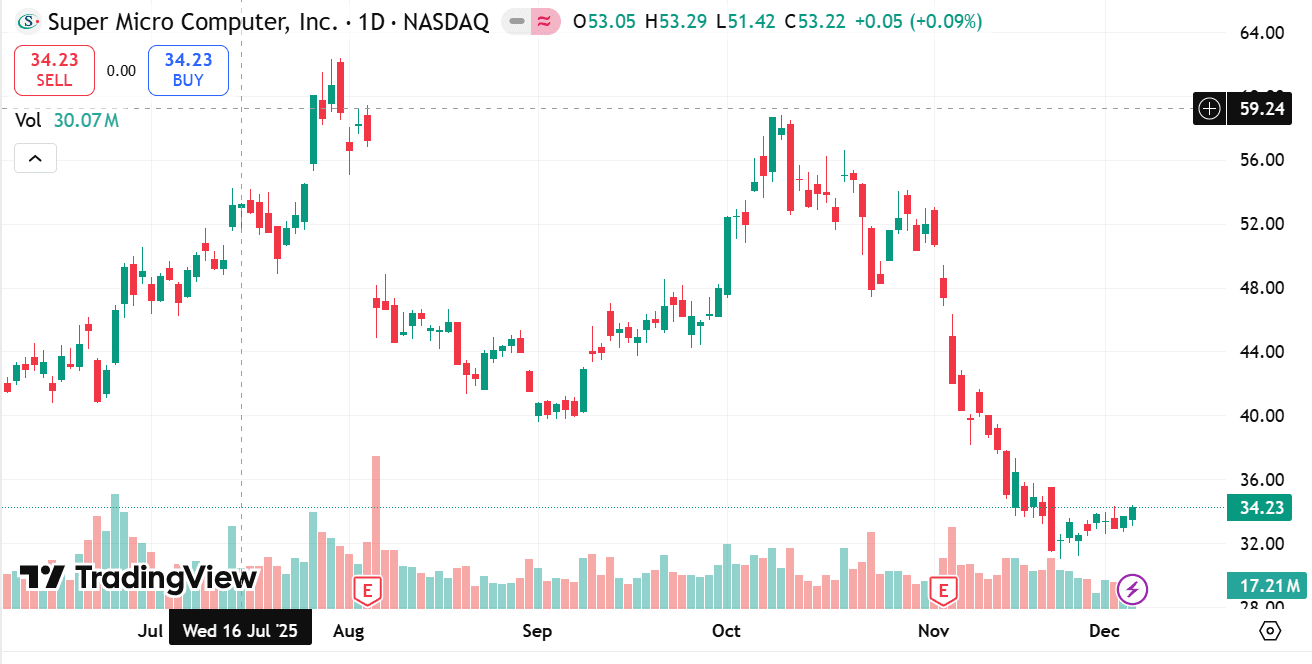

source: tradingview

This week, SMCI climbed on positive reports from the AI server maker. Super Micro surged 16% Monday after the company released numbers showing strong demand for its products. The stock was up 12% on Thursday from the prior week.

Super Micro makes servers using Nvidia's (NVDA) AI chips for data centers that power artificial intelligence software. The company said it’s shipping servers containing over 100,000 Nvidia GPUs per quarter “for some of the largest AI factories ever built.”

Then on Tuesday, shares of SMCI fell 5% after a promising premarket rally that saw the stock jump as much as 7%. Daniel Newman, CEO of the Futurum Group, said investors’ euphoria over the company’s shipment data faded against the backdrop of Super Micro’s regulatory risk.

Super Micro CEO Charles Liang said the Hindenburg report contained “false or inaccurate statements” and “misleading presentations of information that we have previously shared publicly.” Liang said the company’s delayed 10-K filing would not affect the company’s fourth quarter financial results, adding that Super Micro would address Hindenburg’s allegations “in due course.”

Looking to trade SMCI stock CFDs? Choose Markets.com for a user-friendly platform, competitive spreads, and a wide range of assets. Take control of your trading journey today! Sign up now and unlock the tools and resources you need to succeed in the exciting world of CFDs. Start trading!

Risk Warning and Disclaimer: This article represents only the author’s views and is for reference only. It does not constitute investment advice or financial guidance, nor does it represent the stance of the Markets.com platform. Trading Contracts for Difference (CFDs) involves high leverage and significant risks. Before making any trading decisions, we recommend consulting a professional financial advisor to assess your financial situation and risk tolerance. Any trading decisions based on this article are at your own risk.