CFDs sind komplexe Instrumente und umfassen aufgrund der Hebelfinanzierung ein hohes Risiko, schnell Geld zu verlieren. 72,3% der Privatanlegerkonten verlieren Geld, wenn sie mit diesem Anbieter CFDs handeln. Sie sollten überlegen, ob Sie wirklich verstehen, wie CFDs funktionieren, und ob Sie es sich leisten können, das hohe Risiko von finanziellen Verlusten einzugehen.

Montag Oct 20 2025 08:09

5 min

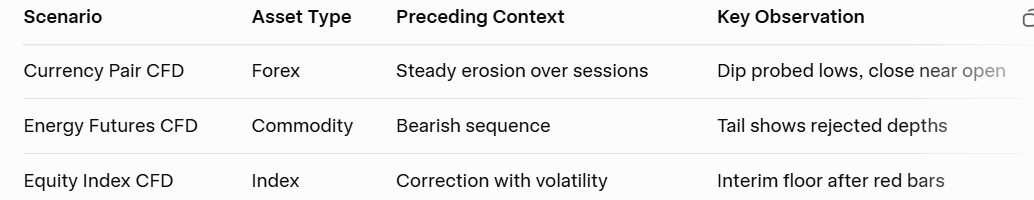

CFD Trading Basics: The hammer candlestick represents a specific formation in price charts used within contract for difference (CFD) trading.

1. What is a Hammer Candlestick?

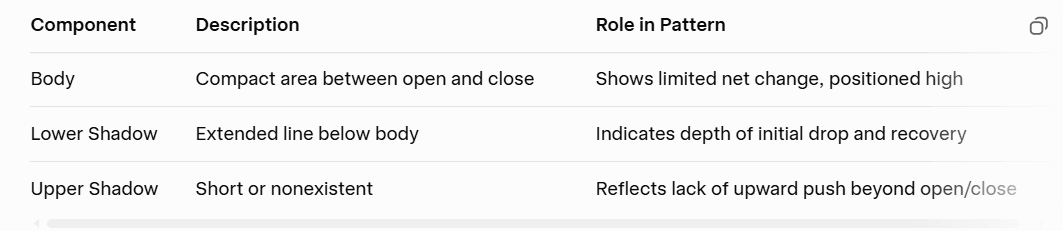

A Hammer Candlestick is a formation often seen on charts that suggests a potential change in market sentiment, usually after a downward movement. This single candle structure has a distinct appearance: a small body at the upper end of the trading range and a long lower shadow, with little or no upper shadow. The long lower shadow indicates that sellers drove prices down considerably during the period, but then buyers stepped in strongly to push the price back up toward the opening price.

The resulting small body represents the relatively close proximity of the opening and closing prices, while the long shadow shows the rejection of lower valuations. The color of the small body (whether it closes slightly higher or slightly lower than the open) isn't the primary factor, but a close above the open can lend a slightly stronger indication of buyer control.

2. Market Dynamics of the Hammer Candlestick

The structure of the Hammer Candlestick illustrates a clear battle between buying and selling forces. Following a decline in prices, the initial selling pressure pushes the market lower, forming the long shadow. This dip, however, is met with strong counter-demand. The subsequent buying activity is so powerful that it almost completely erases the loss, bringing the closing price near the opening price. This strong recovery from the lows is the key takeaway. It suggests that, at least for this period, the selling momentum may be exhausted, and a potential shift in market control from sellers to buyers could be underway. Observing this pattern after an extended downtrend can signal that the market is searching for a bottom.

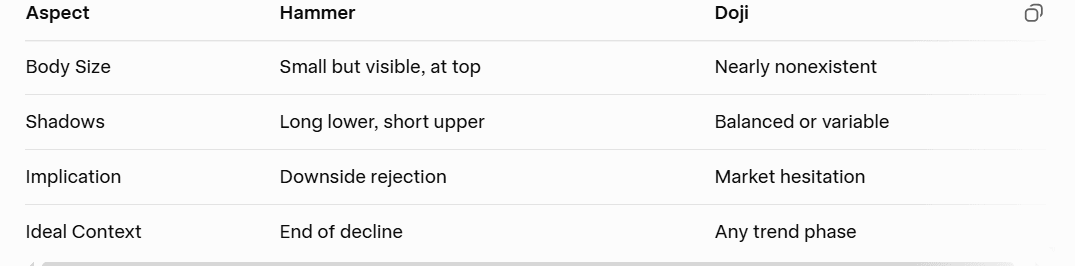

3. Difference Between Hammer Candlestick and Doji

The Hammer Candlestick and the Doji are both single-candle formations that can suggest market indecision or a turning point, but they differ fundamentally in their structure. The Hammer has a small, distinct body where the open and close are close but not identical, and a long lower shadow. This small body indicates a clear rejection of lower prices.

In contrast, a Doji has virtually no real body, meaning the opening price and the closing price are exactly the same or extremely close. This structure represents complete indecision or a stalemate in the market where neither buyers nor sellers could gain control to move the closing price away from the open. While both are used in context to spot changes, the Hammer shows a clear defeat of the sellers and a recovery by the buyers, whereas the Doji simply shows a pause or balance.

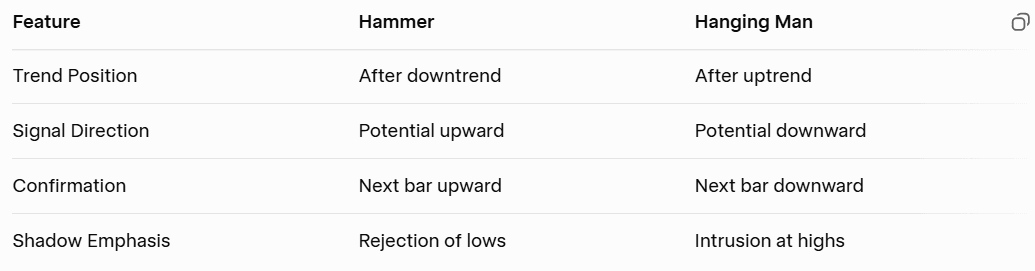

4. Difference Between Hammer Candlestick and Hanging Man

The Hammer Candlestick and the Hanging Man candlestick are structurally identical: both feature a small body near the top of the range and a long lower shadow with little upper shadow. The difference between them is purely contextual—where they appear in the market's movement.

The Hammer is considered when it appears after a downward movement in the market. Its formation suggests that sellers pushed the price low, but buyers overcame this pressure, pushing the close back up, hinting at a potential reversal to an upward movement.

The Hanging Man is considered when it appears after an upward movement in the market. In this context, the long lower shadow is interpreted as a warning. While buyers pushed the price back up by the close, the deep dip during the period shows that sellers were strong enough to cause a serious temporary decline. It suggests that selling pressure is entering the market at higher valuations, hinting at a potential reversal to a downward movement. The interpretation hinges entirely on the preceding market direction.

5. Integrating Other Market Indicators

While the Hammer Candlestick provides a valuable indication of a potential turning point, relying on this single pattern alone is generally not advisable. Its true predictive power is enhanced when it is integrated with other market gauges that help confirm the indication.

For instance, looking at volume can provide extra confirmation. A Hammer that forms on increased trading volume suggests that the battle between buyers and sellers at the low valuations was highly active and passionate, lending more weight to the buyer's successful defense and counter-attack.

Another useful integration is with support and resistance levels. When a Hammer forms right at a known support level (a price area where buying interest has historically overcome selling pressure), the pattern gains a much stronger foundation. The market is not only rejecting the low price but is doing so at a predetermined valuation point where buyers were expected to step in.

Momentum indicators can also be used. If an indicator shows that the downward momentum has been decreasing (or diverging) as the price has moved lower, and then a Hammer forms, it reinforces the view that the market is ready for a change in direction. The combined signals suggest a robust basis for the indicated shift in control. This method of confirming one gauge with another provides a more comprehensive perspective on market activity.

Risikowarnung: Dieser Artikel gibt nur die Meinung des Autors wieder und dient lediglich als Referenz. Er stellt keine Anlageberatung oder Finanzberatung dar, noch repräsentieren er die Haltung der Markets.com Plattform.Wenn Sie Aktien, Indizes, Devisen und Rohstoffe für den Handel und für Preisprognosen in Betracht ziehen, denken Sie daran, dass der Handel mit CFDs ein erhebliches Risiko birgt und zu einem Kapitalverlust führen kann.Die Wertentwicklung in der Vergangenheit ist kein Indikator für zukünftige Ergebnisse. Diese Informationen werden nur zu Informationszwecken bereitgestellt und sind nicht als Anlageberatung zu verstehen. Der Handel mit Kryptowährungs-CFDs und Spread-Wetten ist für alle britischen Privatkunden eingeschränkt.