Les CFD sont des instruments complexes et sont accompagnés d’un risque élevé de pertes financières rapides en raison de l’effet de levier. 72,3 % des comptes d’investisseurs particuliers perdent de l’argent en tradant des CFD avec ce fournisseur. Vous devez déterminer si vous comprenez comment fonctionnent les CFD et si vous pouvez vous permettre de courir le risque élevé de perdre votre argent.

You are attempting to access a website operated by an entity not regulated in the EU. Products and services on this website do not comply with EU laws or ESMA investor-protection standards.

As an EU resident, you cannot proceed to the offshore website.

Please continue on the EU-regulated website to ensure full regulatory protection.

Lundi Oct 27 2025 03:26

8 min

What is non-farm payroll (NFP): Non-Farm Payroll (NFP) is one of the most closely watched economic indicators in global financial markets.

It provides essential insight into the health of the labor market and the broader economy. This article explains what NFP is, when it is released, its statistical scope, and how it affects various financial markets, helping to clarify whether a higher NFP figure is beneficial or detrimental.

Non-Farm Payrolls refer to the total number of paid workers in the economy excluding farm workers, private household employees, and employees of nonprofit organizations. The data covers a wide range of sectors such as manufacturing, construction, services, and government employment.

NFP serves as a key indicator of employment trends and overall economic activity. Since employment is closely linked to consumer spending and economic growth, changes in NFP numbers often reflect shifts in economic momentum.

The NFP report also includes data on unemployment rates and average hourly earnings, providing a comprehensive picture of the labor market.

Non-Farm Payroll data is released monthly, typically on the first Friday of the month at a fixed time. This regular schedule makes it a predictable and highly anticipated event for market participants worldwide.

The release covers employment changes from the previous month, offering a timely snapshot of labor market conditions. Because of its regularity and importance, traders, economists, and policymakers closely monitor the report for clues about economic trends and policy directions.

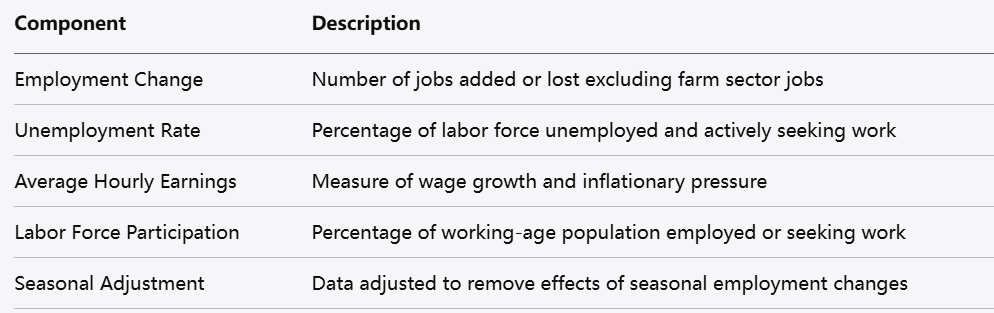

The NFP report is compiled by surveying thousands of businesses and government agencies, covering a broad spectrum of employment sectors. Key components of the report include:

Employment Change: The net number of jobs added or lost in the economy, excluding farm-related employment.

Unemployment Rate: The percentage of the labor force that is unemployed and actively seeking work.

Average Hourly Earnings: A measure of wage growth, indicating inflationary pressures in the labor market.

Labor Force Participation Rate: Percentage of the working-age population either employed or actively looking for work.

This data is seasonally adjusted to account for predictable fluctuations such as holiday hiring or weather-related changes, providing a clearer view of underlying employment trends.

The breadth of sectors covered and the various employment measures make the NFP report a comprehensive gauge of the labor market’s health.

The release of NFP data can cause immediate reactions across many financial markets. Understanding these impacts helps in interpreting the market’s response and managing trading strategies.

(1) Stock Market

(2) Foreign Exchange Market

(3) Cryptocurrency Market

Although cryptocurrencies are somewhat detached from traditional economic indicators, NFP data can still influence market sentiment. Strong employment data may encourage risk-on behavior, potentially drawing capital into conventional assets and away from cryptocurrencies.

(4) Index Market

Non-Farm Payroll (NFP) is a critical monthly report that provides insight into employment trends outside of the farming sector. It offers valuable information on job creation, unemployment, wage growth, and labor participation, all of which are crucial for understanding the health of the economy.

The report’s regular release schedule makes it a key event for financial markets worldwide, influencing stock prices, currency values, cryptocurrencies, and market indices. A higher NFP figure generally indicates a strengthening economy, which can boost market confidence. However, the interpretation depends on the broader economic context and expectations.

In summary, NFP data serves as a vital barometer for economic activity, and its impact on financial markets highlights the interconnectedness of employment trends and market dynamics. Understanding the nuances of NFP helps market participants navigate volatility and make more informed decisions.

Avertissement sur les risques : cet article ne reflète que les opinions de l'auteur et est fourni à titre indicatif uniquement. Il ne constitue en aucun cas un conseil en investissement ou une recommandation financière, ni ne représente la position de la plateforme Markets.com.Lorsque vous envisagez de négocier des actions, des indices, des devises et des matières premières ou de faire des prévisions de prix, n'oubliez pas que le trading CFD comporte un degré de risque important et peut entraîner une perte de capital.Les performances passées ne sont pas indicatives des résultats futurs. Ces informations sont fournies à titre informatif uniquement et ne doivent pas être interprétées comme servant de conseils d'investissement. Le trading de CFD et de spreads bets sur les crypto-monnaies est restreint au Royaume-Uni pour tous les clients particuliers.