Les CFD sont des instruments complexes et sont accompagnés d’un risque élevé de pertes financières rapides en raison de l’effet de levier. 72,3 % des comptes d’investisseurs particuliers perdent de l’argent en tradant des CFD avec ce fournisseur. Vous devez déterminer si vous comprenez comment fonctionnent les CFD et si vous pouvez vous permettre de courir le risque élevé de perdre votre argent.

Jeudi Oct 23 2025 03:54

8 min

What is financial trading: Financial trading is the activity of buying and selling financial instruments with the aim of capitalizing on price changes, managing exposure, or reallocating capital among assets.

Four main styles:

Trading takes place across many markets — equities, bonds, currencies, commodities, derivatives, and more — and each market has its own rhythm, participants, and practical rules. This guide explains the four primary approaches to trading, highlights their defining features, and outlines practical considerations for each style.

Overview of the four types

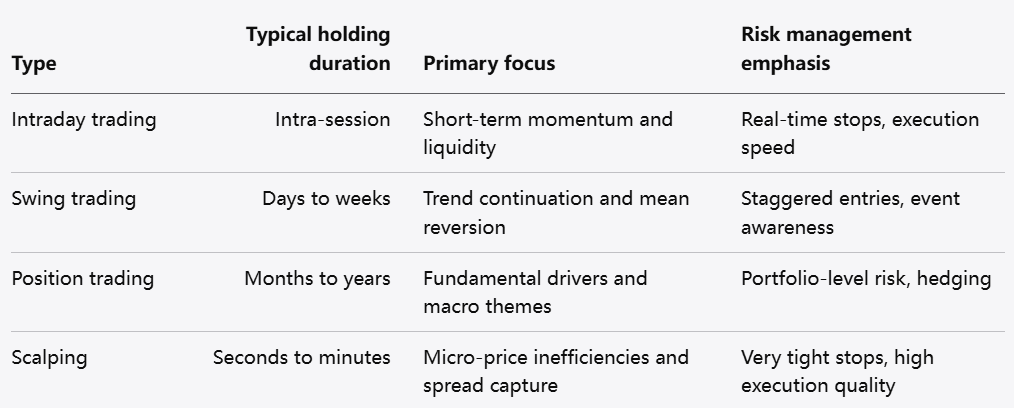

Type Typical holding duration Primary focus Risk management emphasis

Intraday trading Intra-session Short-term momentum and liquidity Real-time stops, execution speed

Swing trading Days to weeks Trend continuation and mean reversion Staggered entries, event awareness

Position trading Months to years Fundamental drivers and macro themes Portfolio-level risk, hedging

Scalping Seconds to minutes Micro-price inefficiencies and spread capture Very tight stops, high execution quality

Intraday trading

Definition and approach

Intraday trading, often called day trading, involves taking positions that are opened and closed within the same market day. Traders use short-term patterns, market microstructure, and news flow to take advantage of price moves while avoiding the risks that can occur overnight between sessions.

Tools and techniques

Real-time data feeds, charting platforms with short timeframes, and fast order execution are central. Order types like limit, stop, and immediate-or-cancel are commonly used to manage entry and exit. Market-depth information and tape reading can help gauge where liquidity sits.

Risk and capital management

Because leverage is often used and moves are rapid, strict rules for position size and stop placement are essential. Traders typically define a maximum loss per trade and per day to avoid catastrophic drawdowns. Keeping a clear end-of-day ritual — closing positions and reviewing performance — helps reset discipline.

Swing trading

Definition and approach

Swing trading captures medium-duration moves that persist beyond a single session but are not intended as long-term holds. Swing traders identify trends or reversals and seek to hold through a meaningful portion of a move while cutting losses when the trade thesis fails.

Tools and techniques

Swing traders use timeframes that smooth intraday noise and focus on broader price patterns, momentum indicators, and event calendars. They may scale into positions across several price points and use trailing stops to protect accrued gains while allowing the main trend to run.

Risk and capital management

Position sizing often accounts for larger stop distances than intraday trading. Swing traders must monitor looming events such as corporate releases or macro announcements that can produce abrupt moves, and decide whether to reduce exposure beforehand.

Position trading

Definition and approach

Position trading is oriented toward long-term trends and structural themes. Traders who adopt this style base their decisions on macroeconomic trends, sector rotation, company fundamentals, and other durable drivers. Trades can last many months or years.

Tools and techniques

Fundamental research, macro analysis, and thematic studies are core inputs. Position traders often allocate capital across multiple holdings as part of a strategic portfolio, applying rebalancing rules and periodic review processes rather than frequent trade adjustments.

Risk and capital management

Because positions are large and held through cycles, hedging tools such as options or correlation trades can be used to manage market risk. Position traders pay close attention to allocation limits, drawdown tolerance, and the correlation structure within a broader portfolio.

Scalping

Definition and approach

Scalping targets very small price increments and relies on speed, discipline, and an edge in execution. Scalpers enter and exit numerous times within a session, aiming for consistent tiny gains that compound over repeated trades.

Tools and techniques

Low-latency platforms, direct market access, and detailed order-book information are typical requirements. Scalpers rely on stringent routines, automated order execution, and precise risk controls to prevent one losing trade from wiping out multiple winners.

Risk and capital management

Because each trade captures limited movement, winning-rate expectations and low transaction costs are crucial. Position sizing is conservative per trade, but cumulative exposure can be meaningful given the high trade count. Rapid stop execution and robust monitoring are necessary.

Choosing a style

Personal factors

Select a style that fits temperament, time availability, capital base, and market access. Short-duration styles require intense screen time and rapid decision-making, while longer-duration styles suit those who prefer research and less frequent rebalancing.

Capital and costs

Trading costs, including commissions, spreads, and financing for leveraged positions, shape feasible strategies. Higher-frequency styles magnify the impact of transaction costs, while longer-term styles must factor in holding costs and potential margin financing if applied.

Skill development and education

Each style requires its own skill set. Intraday and scalp trading emphasize execution, speed, and market microstructure. Swing and position trading emphasize pattern recognition, macro understanding, and patience. Simulated practice, journaling trades, and iterative refinement of rules improve outcomes over time.

Common pitfalls and how to avoid them

Conclusion

Financial trading encompasses a range of approaches from multi-year position holds to split-second scalps. Each of the four main types — intraday, swing, position, and scalping — has distinct tools, time commitments, and risk profiles. Choosing the right style depends on personal temperament, capital, and access to appropriate markets and technology. Regardless of the approach, disciplined risk management, continuous learning, and clear rules are universal requirements for navigating market activity effectively.

Avertissement sur les risques : cet article ne reflète que les opinions de l'auteur et est fourni à titre indicatif uniquement. Il ne constitue en aucun cas un conseil en investissement ou une recommandation financière, ni ne représente la position de la plateforme Markets.com.Lorsque vous envisagez de négocier des actions, des indices, des devises et des matières premières ou de faire des prévisions de prix, n'oubliez pas que le trading CFD comporte un degré de risque important et peut entraîner une perte de capital.Les performances passées ne sont pas indicatives des résultats futurs. Ces informations sont fournies à titre informatif uniquement et ne doivent pas être interprétées comme servant de conseils d'investissement. Le trading de CFD et de spreads bets sur les crypto-monnaies est restreint au Royaume-Uni pour tous les clients particuliers.