Les CFD sont des instruments complexes et sont accompagnés d’un risque élevé de pertes financières rapides en raison de l’effet de levier. 72,3 % des comptes d’investisseurs particuliers perdent de l’argent en tradant des CFD avec ce fournisseur. Vous devez déterminer si vous comprenez comment fonctionnent les CFD et si vous pouvez vous permettre de courir le risque élevé de perdre votre argent.

Vendredi Oct 24 2025 03:24

6 min

A beginner's guide to day trading crypto: Cryptocurrency day trading has gained popularity as digital assets continue to capture attention worldwide.

For newcomers, understanding what crypto day trading involves, how to approach it, and what strategies to use is essential to navigating this fast-paced market. This guide offers an overview of crypto day trading, a straightforward Bitcoin day trading strategy, key considerations, and answers common questions.

Crypto day trading involves buying and selling cryptocurrencies within a single day, aiming to capitalize on short-term price movements. Unlike holding digital coins for the long term, day traders enter and exit positions rapidly, sometimes within minutes or hours, to take advantage of volatility.

Cryptocurrencies, including Bitcoin, are known for their price fluctuations and 24/7 market availability, making them attractive for day trading. The continuous trading hours allow market participants to respond promptly to news, market sentiment, and global events without waiting for traditional market openings.

Day trading cryptos provides an active way to engage with the market, allowing traders to react quickly and adjust positions frequently throughout the day.

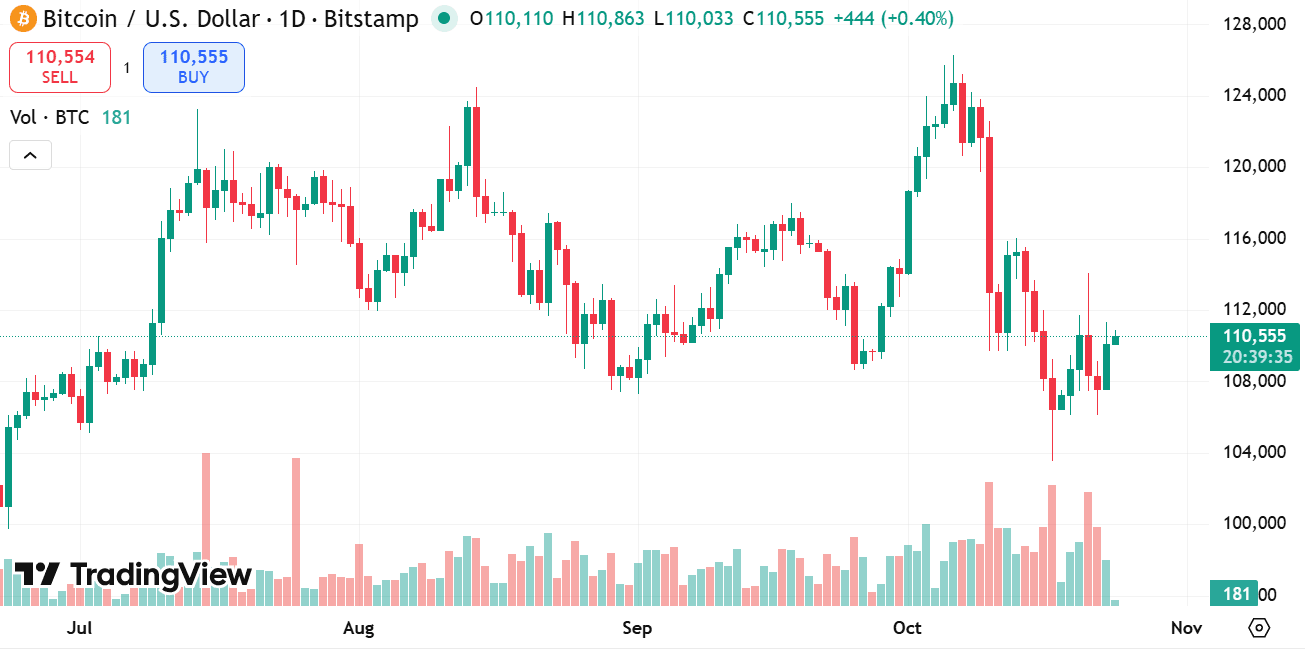

source: tradingview

Day trading crypto requires a blend of knowledge, discipline, and tools. Here are key steps to get started:

Choose a Trading Platform: Select a platform with reliable execution, low fees, and suitable trading pairs.

Understand Market Conditions: Monitor market sentiment, news, volume, and price movements closely.

Develop a Trading Plan: Define entry and exit points, risk limits, and position sizes.

Use Stop-Loss Orders: Protect your capital by setting automatic exit points to limit losses.

Stay Disciplined: Follow your plan strictly and avoid emotional decisions.

Keep Records: Track trades and outcomes to learn and improve strategies over time.

Day trading requires constant attention and quick decision-making, so beginners should start with small positions and gradually build experience.

One straightforward approach to Bitcoin day trading focuses on momentum and trend confirmation. Here's a simplified outline:

This strategy emphasizes trading with the flow of the market rather than against it, reducing the risk of losses from sudden reversals. It allows for clear entry and exit signals while keeping the approach manageable for beginners.

Day trading is demanding and fast-paced. It requires discipline, emotional control, and the ability to act quickly under pressure. Not every day will produce ideal trading conditions, and losses are part of the learning process.

Successful day trading involves continuous learning, adapting to changing market dynamics, and maintaining realistic expectations. It is essential to treat trading as a structured activity rather than a gamble.

markets.com offers a platform designed to help traders approach trading with a business mindset. It provides tools for risk management, clear pricing, and access to a variety of cryptocurrencies and other assets. Treating trading as a business means planning carefully, managing risk, and continuously improving strategies.

By using a platform that supports educational resources and transparent conditions, traders can build confidence and maintain discipline, which are crucial for day trading.

6.1 What Can You Trade on markets.com?

markets.com offers access to a wide range of assets including popular cryptocurrencies, indices, commodities, and foreign exchange pairs. This variety allows traders to diversify and explore different markets according to their preferences.

6.2 What Is the Best Cryptocurrency for Day Trading?

Cryptocurrencies with higher liquidity and volume tend to be more suitable for day trading. Digital assets that experience regular price movements and have active trading pairs provide more chances to enter and exit trades efficiently.

6.3 What Are the Best Day Trading Strategies?

Common strategies include trend following, momentum trading, breakout trading, and range trading. Choosing the right strategy depends on the trader’s style, risk tolerance, and market conditions. The simplest strategy often involves identifying trends and trading pullbacks with clear stop-loss levels.

6.4 What Are the Risks of Day Trading Cryptocurrency?

Day trading cryptocurrencies involves risks such as high volatility, rapid price swings, and emotional stress. Additionally, market manipulation and technical issues can affect trading results. Managing risk with stop-loss orders and starting with smaller positions helps mitigate these challenges.

Day trading crypto can be an engaging way to participate in the digital asset markets, but it requires careful preparation and discipline. By understanding the basics, applying straightforward strategies, and using supportive platforms, beginners can build their skills and navigate the market thoughtfully.

Avertissement sur les risques : cet article ne reflète que les opinions de l'auteur et est fourni à titre indicatif uniquement. Il ne constitue en aucun cas un conseil en investissement ou une recommandation financière, ni ne représente la position de la plateforme Markets.com.Lorsque vous envisagez de négocier des actions, des indices, des devises et des matières premières ou de faire des prévisions de prix, n'oubliez pas que le trading CFD comporte un degré de risque important et peut entraîner une perte de capital.Les performances passées ne sont pas indicatives des résultats futurs. Ces informations sont fournies à titre informatif uniquement et ne doivent pas être interprétées comme servant de conseils d'investissement. Le trading de CFD et de spreads bets sur les crypto-monnaies est restreint au Royaume-Uni pour tous les clients particuliers.